Protecting minority shareholders from concentrated ownership or conflicts of interest with controlling shareholders is a requirement of well-functioning markets. This includes equal voting rights and access to information for the same class of shares, and policies and practices to deal with minority shareholder interests in material transactions that may affect their rights.

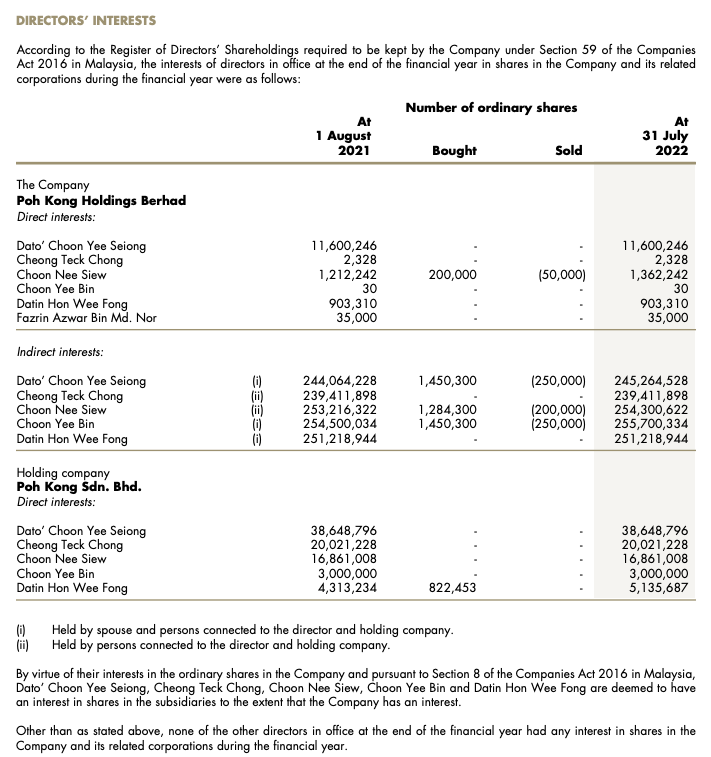

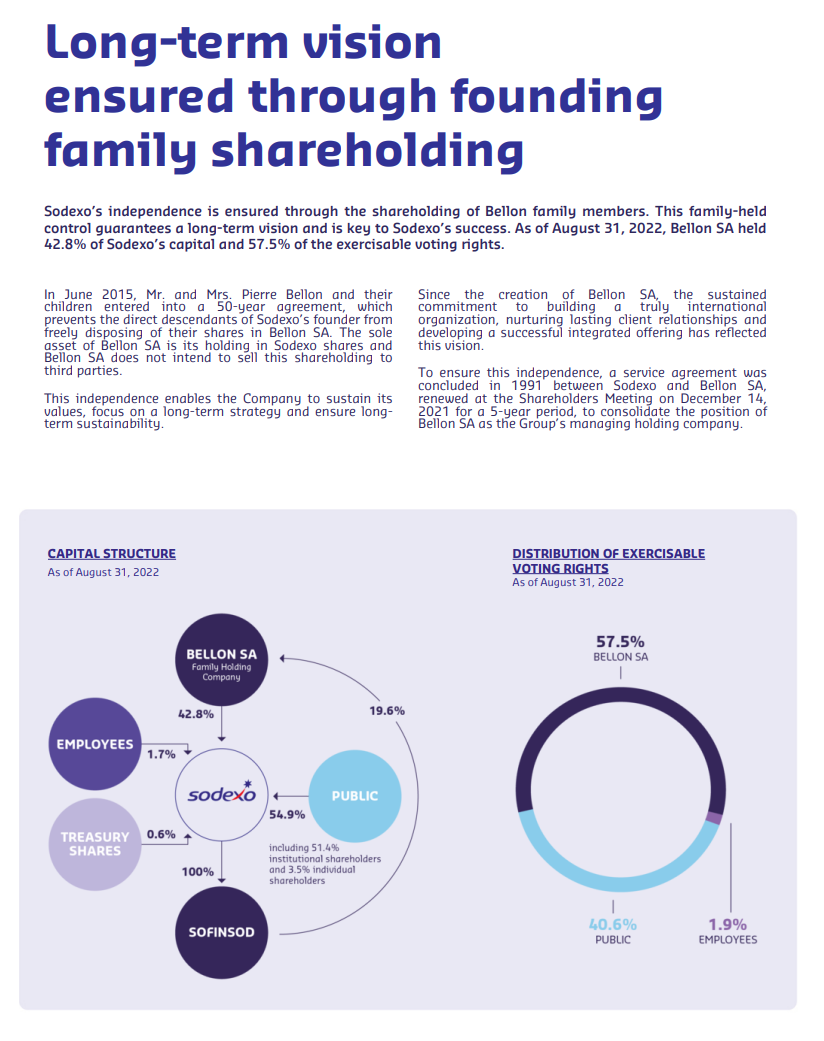

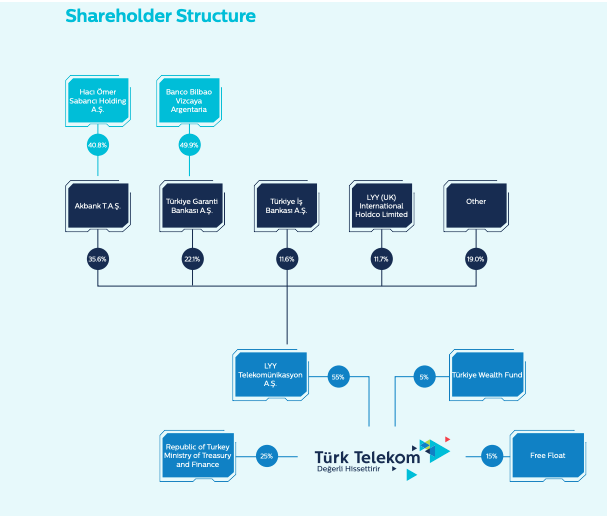

Ownership and Control: provide details on who owns the company, controlling shareholders, who can exert influence directly or indirectly, and where relevant, the ultimate beneficial owners.

Compensation: describe the company policy on compensation, actual compensation for key executives, and shareholders’ role in approving compensation, pay-for-performance plan and links to sustainability.

Rights of Minority Shareholders: describe voting, board nomination, and other rights of minority shareholders, including for change of control and related-party transactions (RPTs).

Related-Party Transactions: describe management systems for RPTs. Provide details on RPTs (party, amount, and type) and additional details for significant transactions (terms and third-party opinion).

The report should give a clear view of who owns the company, including those who own or can exert influence directly or indirectly.

Significant Direct Shareholders (or Ultimate Beneficial Owners)

The report should list significant shareholders (or ultimate beneficial owners, typically more than 5 percent of shares held directly or indirectly), the percentage held, and the percent of voting rights. This should also include share options, pledged shares, and other securities arrangements. It should also note when significant shareholders are management or board members.

Indirect or Deemed Ownership

Disclosure on ownership and control should also include arrangements that provide indirect control or deemed ownership, including:

- Shareholder agreements to vote shares in line with those of a substantial shareholder;

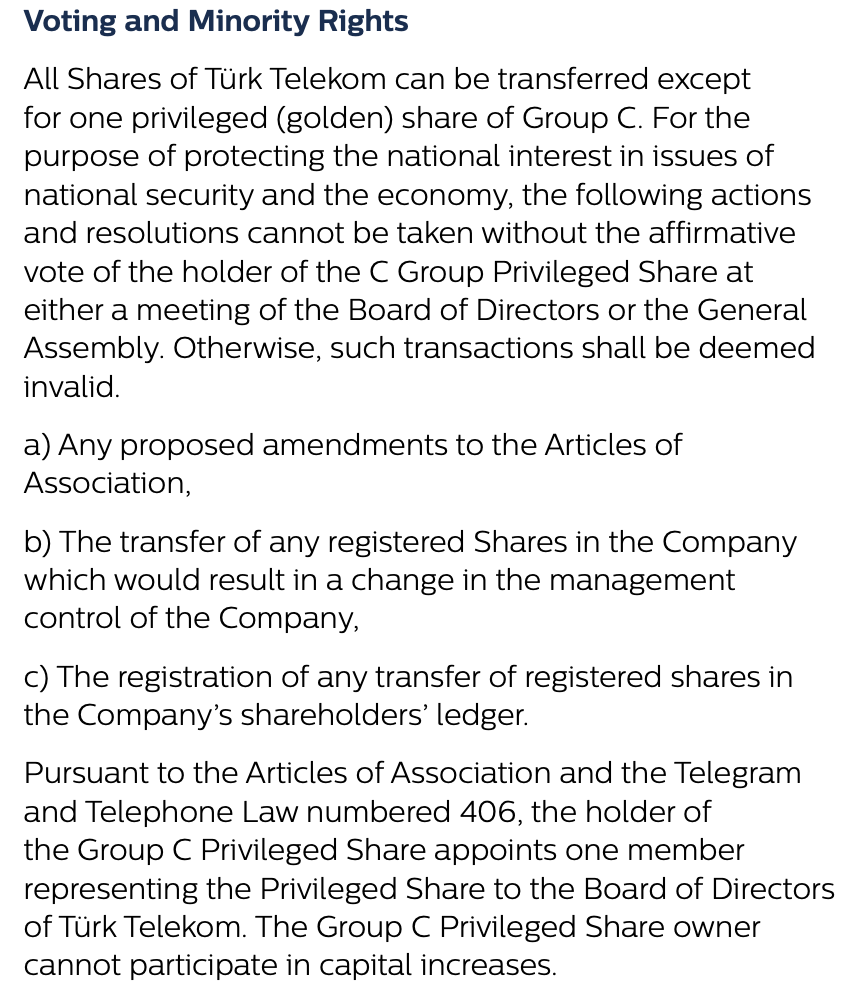

- Special voting rights;

- Multi-voting shares and the voting rights they grant to major shareholders;

- Control-enhancing or antitakeover mechanisms, such as voting caps and poison pills;

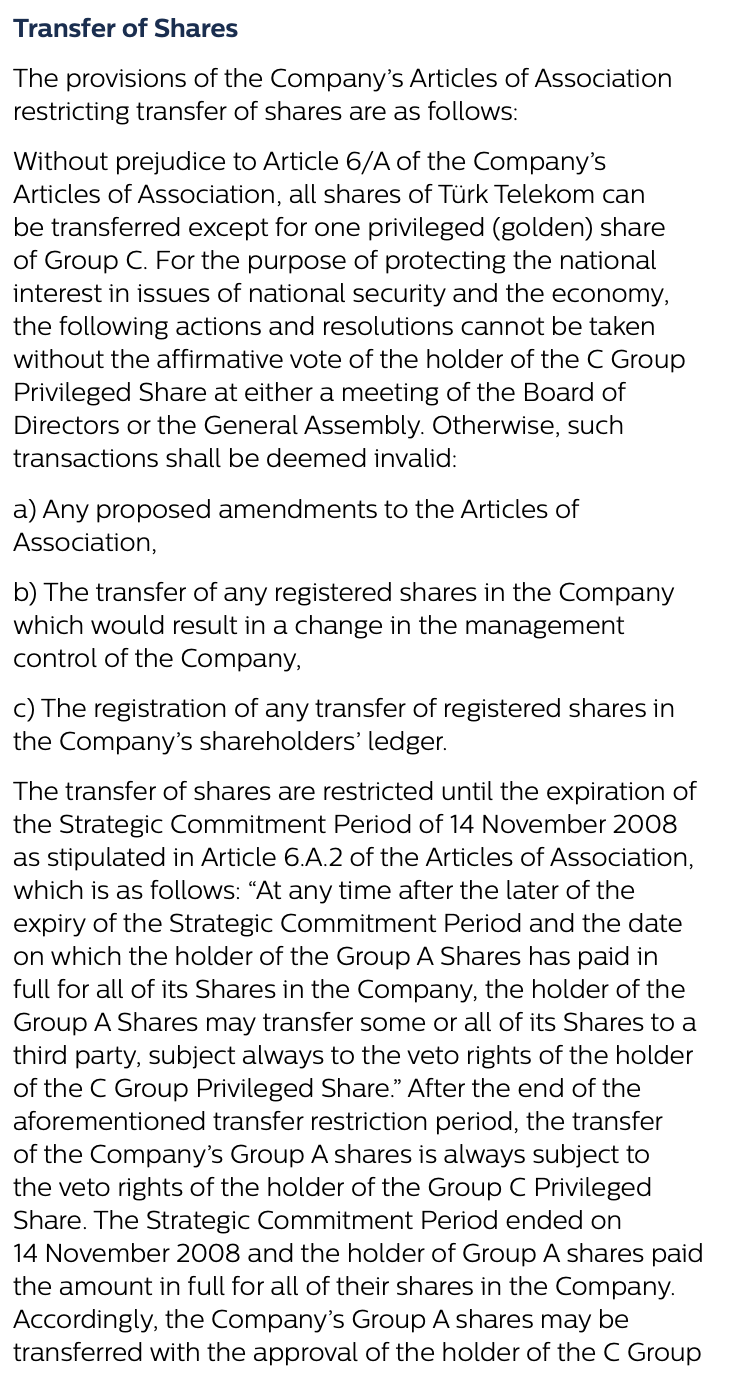

- Special shareholder rights (golden shares) to block certain major decisions or to appoint one or more board members directly (common in state-owned enterprises).

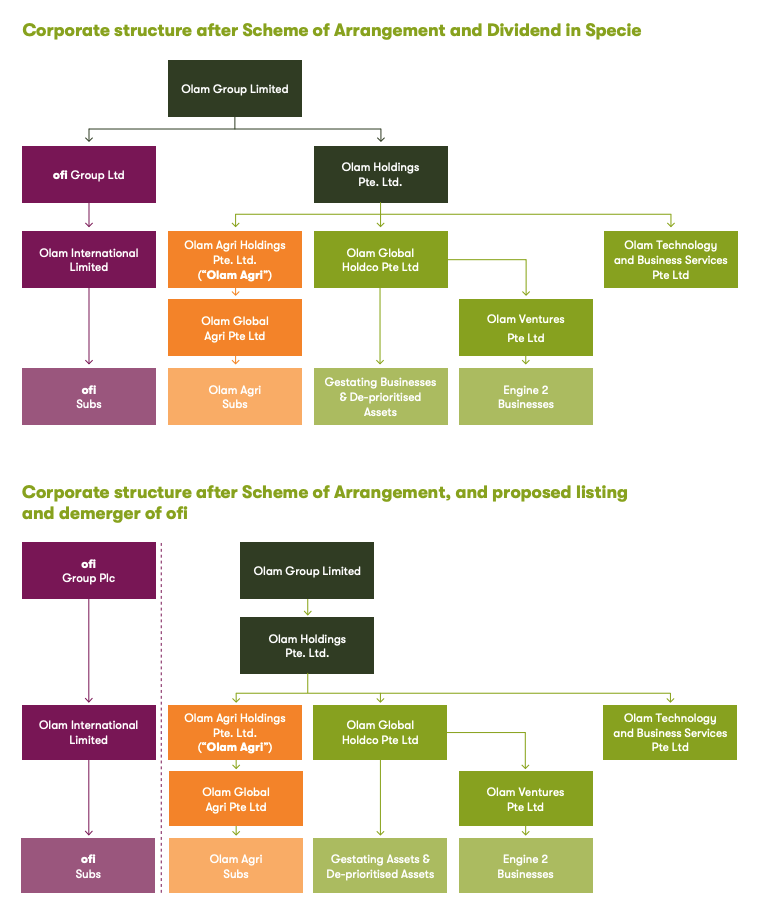

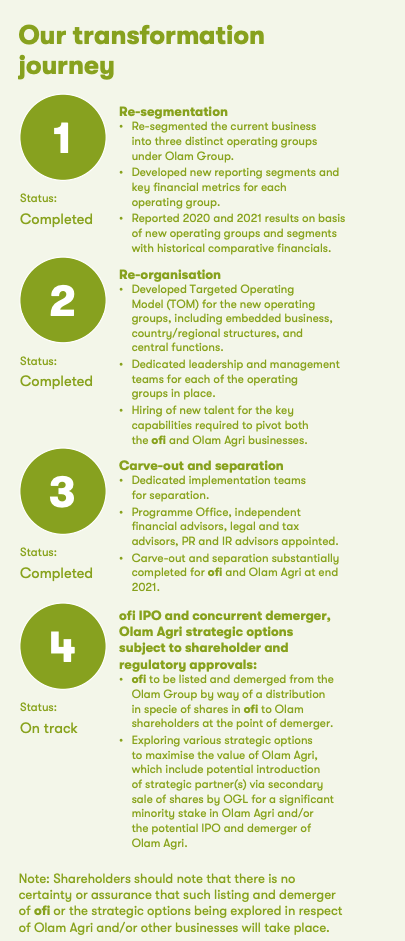

Groups and Control Chains

The report should indicate whether the company is part of a group and if so, how it fits into the group structure. It should also disclose the various intermediaries, if any, through which a controlling shareholder holds control.

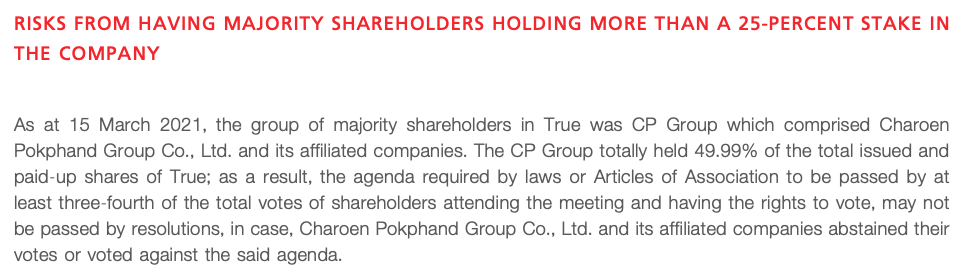

Controlling Shareholders

The report describes the identity of controlling shareholders (individual, family, or group), how many shares they control, and how control is held. It also addresses the controlling shareholders’ role or roles (for example, founders, providers of capital, and management).

Succession: controlled companies should disclose their succession policy as it relates to controlling shareholders (through inheritance or a family governance body, or through policies of corporate group or state-owned companies).

The report should include information on mechanisms that allow minority shareholders to nominate members of the board and vote on certain matters, including:

- Cumulative voting: a shareholder can cast all its votes for a single board nominee;

- Block voting: a large number of shareholders vote their shares in a single block;

- Super majority: certain transactions require approval by a large majority of shareholders;

- Majority of minority: certain transactions require approval from the majority of minority shareholders.

The report should also clarify the rights attached to various types of shares and whether the rights were exercised.

The report should describe company policy on the treatment of minority shareholders in case of a change of control. This includes tag-along rights, which require the buyer to offer to purchase the shares of minority shareholders or meet other requirements.

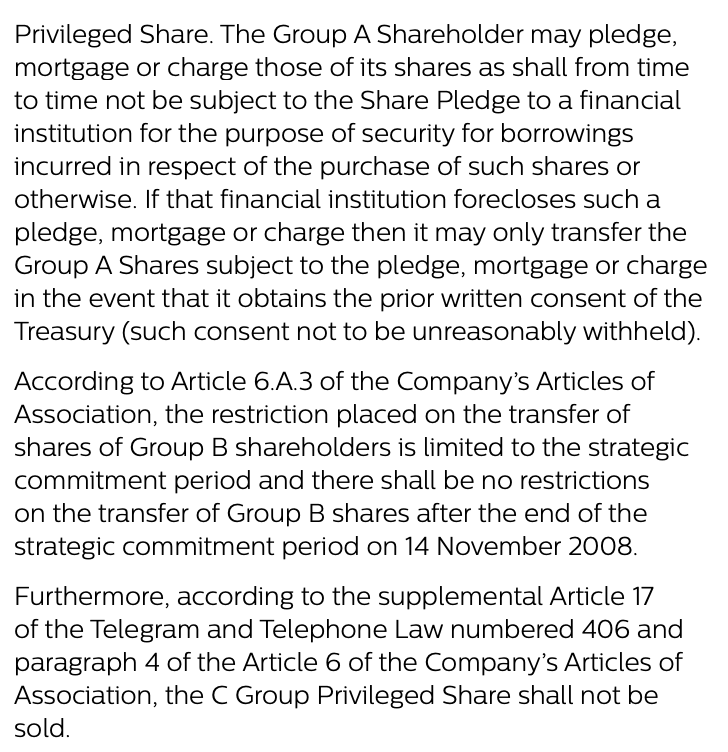

The report should describe the company’s oversight and management systems for RPTs, including:

- Policy on RPTs;

- How potential RPTs are identified and vetted;

- How RPTs are approved, including the role of the board (and committees) and shareholders and whether different transactions have different approval procedures;

- How to manage a situation in which a board member is conflicted or has conflicts of interest resulting from RPTs;

- Third-party evaluations.

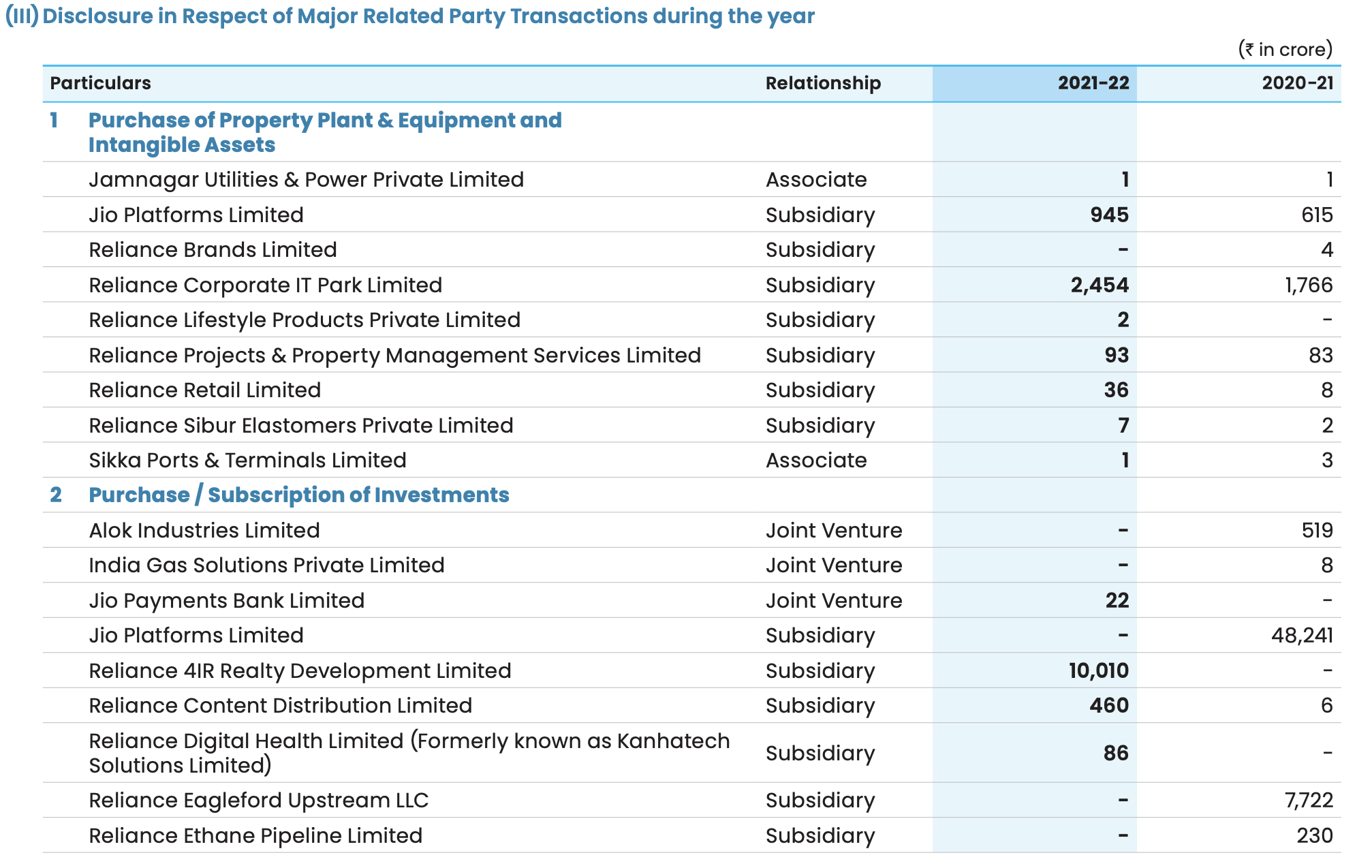

For all material RPTs concluded or contemplated during the past year, the report should disclose the following information:

- Name of the party and how it is related (parent, subsidiary, associate, joint venture, management);

- Amount and type of the transaction (sale of goods, services, loan);

- Any outstanding balances, contingencies, or bad debts related to the transaction.

For significant transactions, it might be useful to include additional details:

- Terms of the transaction (interest rate, cost, length of services);

- Reasonableness (market benchmarks, transaction process such as competitive tender);

- Third-party evaluation of the transaction.

-

What are RPTs?

According to International Accounting Standard 24, a related-party transaction is “a transfer of resources, services, or obligations between a reporting entity and a related party, regardless of whether a price is charged”.

Examples include the following:

- Sale, purchase of goods or materials

- Sale or purchase of property or assets

- Lease of property or assets

- Provision or receipt of services

- Transfer of intangible items (research and development, trademarks, license)

- Provision, receipt, or guarantee of financial services (loans, deposit)

-

Who are related parties?

A related party is a person or an entity that is related to the reporting entity.

Examples include the following:

- A board member, senior executive, controlling shareholder, or their immediate family members (parents, siblings, uncles, aunts, in-laws, cousins, and stepchildren)

- Another company linked by ownership or investment, including joint venture

- A company pension plan or entity linked to the company pension plan

- A company where a board member or senior executive has joint control or significant influence.