Climate Disclosure

Leapfrogging toward Climate Mitigation and Minimizing Risk through Disclosure

-

Emerging Markets and Climate Disclosure

Policy makers and companies in emerging markets have two main reasons to focus on emerging markets and climate disclosure.

First, jurisdictions in developing economies are at a relatively earlier stage in developing their policy frameworks for climate disclosure, so there is flexibility to leapfrog and implement policy good practices from other jurisdictions to drive high-quality reporting practices.

Second, developing economies’ appetite to attract investment is an opportunity to act on the ambitions of the 2030 Sustainable Development Agenda and the Paris Agreement. Requiring climate disclosure allows for managing long-term risks and impacts of individual enterprises and the economy.

-

Drivers of Climate Disclosure

Standard-setters growingly introduce more stringent climate-related disclosure requirements. Regulators focus on developing new regulations to improve the quality and comparability of climate disclosure. Investors are increasingly requiring disclosure of climate-related risks and opportunities, so the practice of doing so is becoming mainstream.

Climate disclosure needs to support risk management within companies and help decision-makers and investors understand the impact that companies may have on the climate. Disclosure requirements help direct capital toward sustainable companies and activities and support risk analysis within companies, and help investors shift capital toward mitigation and adaptation solutions.

-

IFC and CDP Partner to Drive Climate Disclosure

IFC joined forces with CDP, an international nonprofit organization focused on climate disclosure, to help emerging market policy makers understand best practices for climate disclosure available to regulators in developing economies, drawing on the experience and work of regulators around the world.

On this page, you can learn more about the latest developments in climate disclosure and the role IFC and CDP are playing to improve disclosure.

Learn More:

-

The Business Case for Climate Disclosure

Rapid action is needed to meet the 1.5°C warming limit set out by the Paris Agreement. For credible action to happen, decision-makers and investors need comparable, reliable, and decision-useful information.

Climate disclosure provides this information. It allows stakeholders to understand what a company is doing to mitigate its impact on the climate and what risks and opportunities may lie ahead for the company in a changing climate.

Climate disclosure can also be a vehicle toward enhancing a transparent and accountable transition to a net zero economy over time.

For the sixth year in a row, the World Economic Forum has identified environmental risks—including failure to mitigate climate change, extreme weather, and natural disasters—as the top global risks for the short-term (two years) and long-term (10 years). Read the World Economic Forum 2023 Insight Report

The private sector has a fundamental role in mitigating climate risks because it is exposed to different physical and transition risks as a result of climate change, and therefore it must embrace the climate agenda by strengthening its sustainability and climate practices and disclosure.

Investor interest in companies engaged in sustainable business activities is growing. Investors want to understand how companies tackle issues such as climate change, gender diversity, or supply chain risks that may have a material impact on their businesses. Standard-setting is now producing new disclosure standards for climate-related financial information.

Read about the latest developments of the Sustainability and Climate Disclosure Standards.

Stock exchanges and regulators are interested in preparing climate disclosure regulations and training for issuers, integrating broader sustainability practices. Reporting climate-related risks and opportunities provides investors with the data they require and offers external and internal benefits for listed and non-listed companies.

Learn More:

- Stock Exchanges and Market Regulators;

- Analysis of Best Practices in Environmental Disclosure Policies: A Review of 101 Policies Worldwide Based on Five Criteria for High-Quality Disclosure (CDP and IFC);

- UN Sustainable Stock Exchanges Initiative (UN SSE);

- World Federation of Exchanges (WFE);

- CDP;

- IFC's Work in Climate Business;

- Sustainable Banking and Finance Network (SBFN);

- Central Banks and Supervisors Network for Greening the Financial System (NGFS);

- Glasgow Financial Alliance for Net Zero (GFANZ);

- Task Force on Climate-Related Financial Disclosure (TCFD);

- International Sustainability Standards Board Climate-Related Disclosures (ISSB);

- European Sustainability Reporting Standards.

-

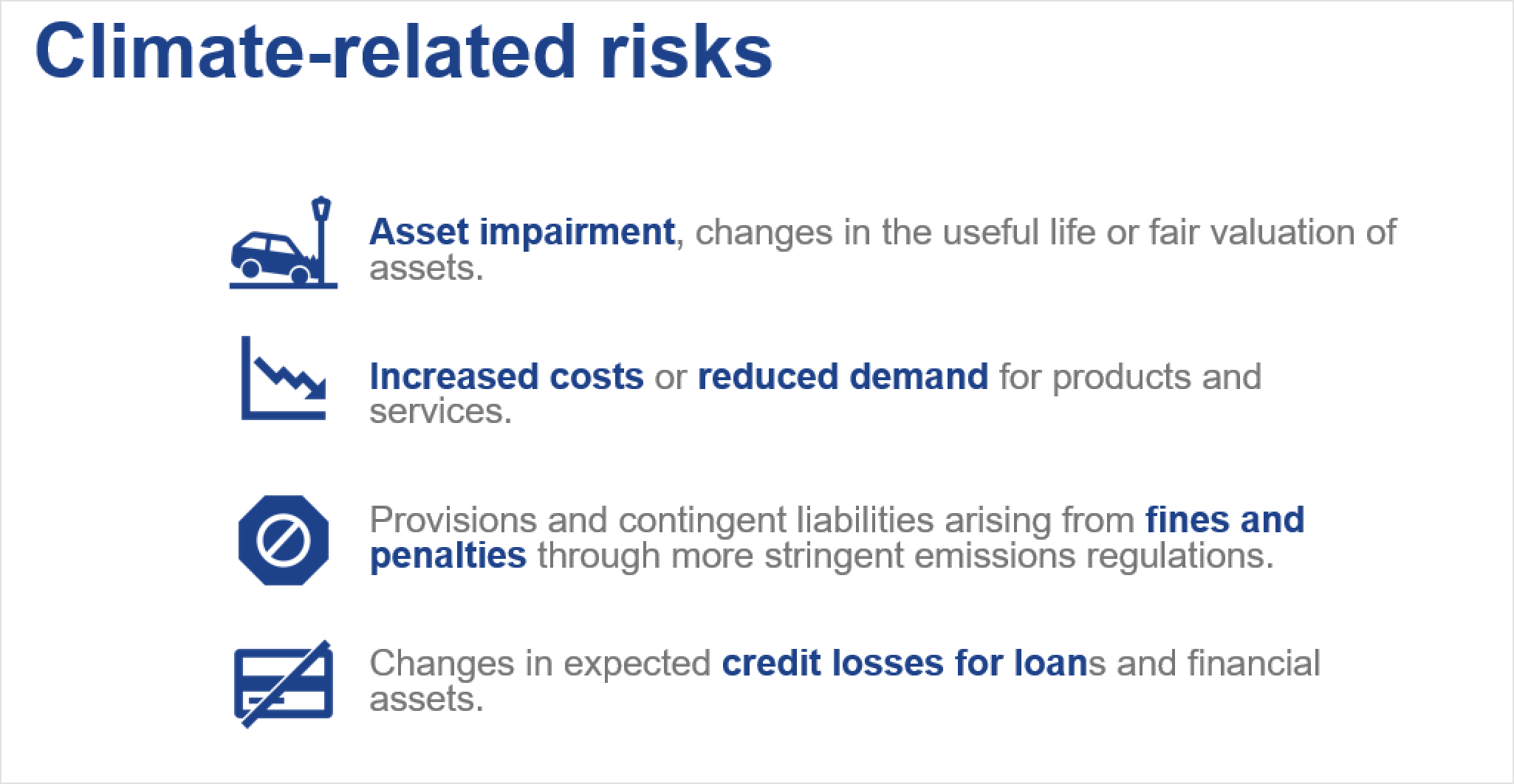

Climate-Related Risks

Climate risk has recently emerged as a key aspect of disclosure. Stakeholders and shareholders are increasingly aware that the effects of climate change—such as extreme weather events, poverty and displacement, rising sea levels, and increased droughts—may pose a risk to companies’ short-term operations and long-term financial viability. A CDP analysis of 500 of the world’s biggest companies by market capitalization found that nearly US$1 trillion dollars is at risk of loss. For this reason, stakeholders and shareholders alike are interested in getting a better understanding of what risks companies face.

Climate risks can be divided into physical and transition risks:

- Physical risks include the acute or chronic physical impacts of climate change, such as wildfires, storms, or droughts;

- Transition risks involve any type of risk resulting from policy, legal, reputational, and technology changes needed to transition the global economy to net zero.

See examples of climate-related risks:

Source: United Nations Sustainable Stock Exchanges Initiative, International Finance Corporation, and CDP Worldwide TCFD—Climate Disclosure Training. -

Climate-Related Opportunities

Companies can identify climate-related opportunities by assessing climate-related risks. Shifts in production and consumption patterns open up new opportunities for various industries. Economies that have climate disclosure requirements in place and in effect have a good understanding of what risks major players face can also identify and prepare for opportunities in the process.

Delivering on the Paris Agreement requires an economic transition of unforeseen scale, but it will open up new industries and supply chains with a multitude of opportunities for early adopters and innovators. According to the CDP analysis, 225 of the world’s 500 biggest companies reported climate-related opportunities representing potential financial impacts of more than US$2.1 trillion dollars. This shows that although both the risks and opportunities are significant, the opportunities outweigh the risks.

See examples of climate-related opportunities:

Source: United Nations Sustainable Stock Exchanges Initiative, International Finance Corporation, and CDP Worldwide TCFD—Climate Disclosure Training. -

Climate-Related Financial Disclosures

Sustainability information also has financial implications. There is focus on the financial consequences of any climate-related disclosure. To this end exploring the financial implications of emissions as well as transitions is gaining traction.

-

Task Force for Climate-Related Financial Disclosure

The recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD) were launched in 2017 “to help identify the information needed by investors, lenders, and insurance underwriters to appropriately assess and price climate-related risks and opportunities.”

The recommendations were intended for voluntary implementation, but they are becoming mandatory in markets such as Brazil, Japan, Singapore, Switzerland, the United Kingdom, and others. According to the TCFD 2022 Status Report, more than 3,800 companies provided TCFD reports as of October 2022.

The new ISSB Standards – IFRS S1 (sustainability-related risks and opportunities) and IFRS S2 (climate-related disclosures to be used with IFRS S1) – fully incorporated the recommendations of the TCFD and would take over responsibility for it from 2024.

For additional resources on TCFD, visit the TCFD Knowledge Hub and the TCFD publications web page.

-

International Sustainability Standards Board

The International Sustainability Standards Board (ISSB) launched the first two global baseline corporate sustainability disclosure standards (International Financial Reporting Standards IFRS S1 General Requirements for Disclosure of Sustainability-Related Financial Information and IFRS S2 Climate-Related Disclosures), to be applied as of January 1, 2024.

ISSB standards will follow the single materiality approach, with a focus on financial information that is relevant for investors and largely based on the TCFD framework.

Individual jurisdictions will decide the approach to adopting the ISSB standards. A few major jurisdictions are expected to adopt the standards, and they will gradually replace the TCFD reporting. Until then, ISSB encourages companies to disclose using TCFD recommendations as preparation for the new standards. -

European Sustainability Reporting Standards

On January 5, 2023, the European Union Corporate Sustainability Reporting Directive (CSRD) entered into force, affecting more than 50,000 companies in Europe and more than 10,000 outside of Europe. Companies subject to the CSRD must report according to the European Sustainability Reporting Standards (ESRS), including two cross-cutting standards on the general principles and requirements for reporting and detailed requirements on 10 topics across environment (five), social (four), and governance (one), to be applied to companies as of January 1, 2024. The first set of the European Sustainability Reporting Standards contains topic-specific standards on climate change (ESRS E1 Climate Change), which companies should implement together with the general disclosures required in the cross-cutting ESRS 2 General Disclosures.

Corporate Sustainability Reporting Directive

European Sustainability Reporting Standards—First Set June 2023.

-

US Securities and Exchange Commission Climate-Related Disclosures

In March 2022, the US Securities and Exchange Commission (US SEC) proposed climate-related disclosure requirements that would require public companies to provide climate-related financial data and greenhouse gas emissions insights in public disclosure filings. As part of the draft rule, companies have to disclose emissions for which they are directly responsible (Scope 1 and 2 emissions) and emissions from their supply chains and products (Scope 3 emissions). This aligns the US SEC approach more closely with the ISSB. Additionally, in May 2022, as part of the US SEC’s investor rule, US SEC proposed two new rules aiming to decrease unfounded claims by funds about their environmental, social, and governance (ESG) credentials and create more standardization regarding ESG disclosures by certain investment advisors and investment companies.

US SEC press release regarding the draft Climate-Related Disclosure by the US SEC.

-

Global Reporting Initiative

Global Reporting Initiative (GRI) is the independent international organization that helps businesses, governments, and other organizations understand and communicate their impacts on issues such as climate change, human rights, and corruption. Used by more than 10,000 organizations in more than 100 countries, the standards are advancing the practice of sustainability reporting and enabling organizations and their stakeholders to take action that creates economic, environmental, and social benefits for everyone.

-

CDP Worldwide

CDP Worldwide, created in 2000, is a nonprofit organization that runs the global disclosure system for investors, companies, cities, states, and regions to manage their environmental impacts. More than 20,000 companies worldwide complete CDP’s questionnaire on climate, water, and forests. The CDP questionnaire is aligned with TCFD. CDP will incorporate ISSB climate-related disclosure standards into the global environmental disclosure platform.

-

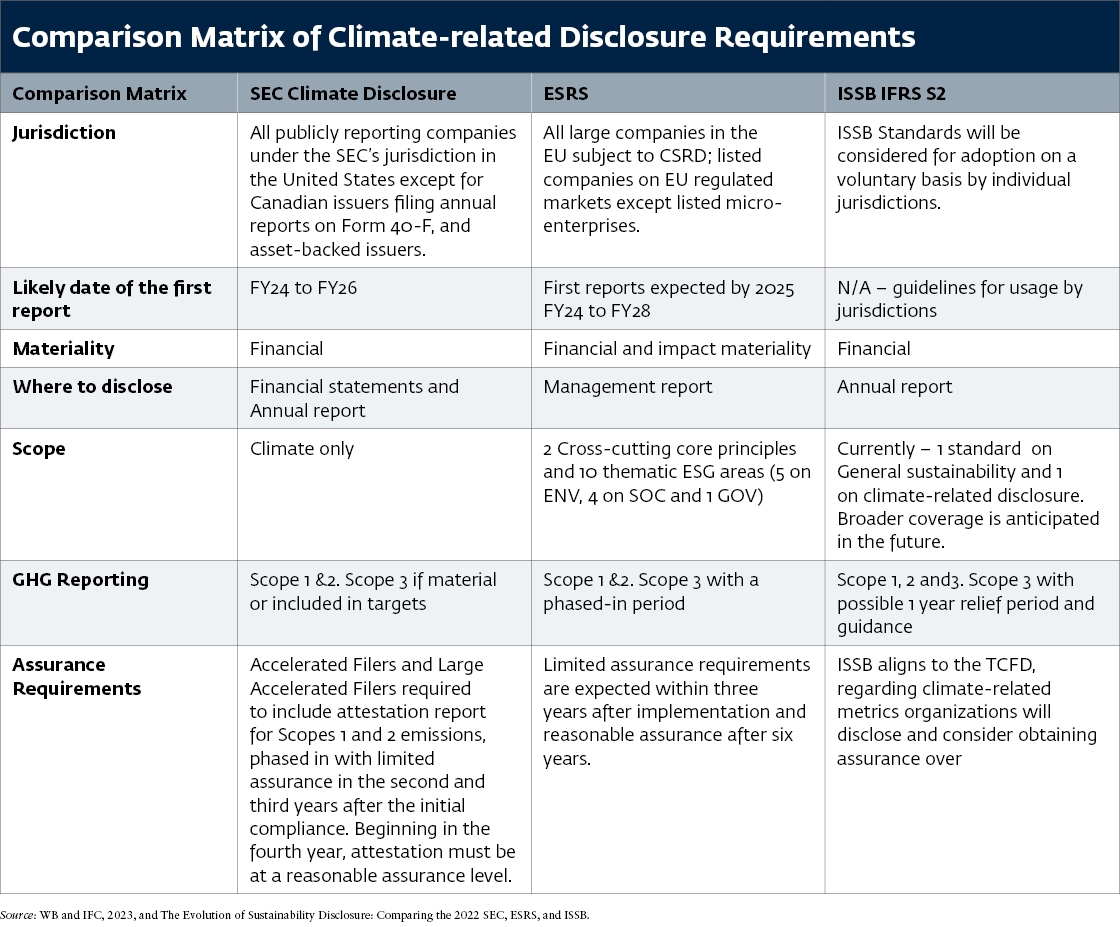

Comparing US SEC, ESRS, and ISSB Climate Disclosures

Sources: Adapted from The Evolution of Sustainability Disclosure: Comparing the 2022 SEC, ESRS, and ISSB Proposals and World Bank; International Finance Corporation 2023.

Note: CSRD = Corporate Sustainability Reporting Directive; EFRAG = European Financial Reporting Advisory Group; ESG = environmental, social, and governance; ESRS = European Sustainability Reporting Standards; EU = European Union; FY = Fiscal Year; ISSB = International Sustainability Standards Board; SEC = Security and Exchange Commission.

Comparison studies:

- The Evolution of Sustainability Disclosure: Comparing the 2022 SEC, ESRS, and ISSB Proposals;

- Draft European Sustainability Reporting Standards, Appendix V: IFRS Sustainability Standards and ESRS Reconciliation Table (ESRS E1 versus IFRS S2, pages 54–73;

- Comparison IFRS S2 Climate-Related Disclosures with the TCFD Recommendations;

- GRI and the European Sustainability Reporting Standards (ESRS): Q&A.

The evolution of corporate reporting toward integrating sustainability-related risks and opportunities in companies’ core strategy, governance, risk management, and performance brings new concepts of materiality to guide companies.

The recommendations of the TCFD and the new IFRS S2 Climate-Related Disclosures global baseline are intended to be used to integrate financial disclosures related to climate risks and opportunities into a company’s mainstream financial filings or annual report.

The concept of double materiality has gained prominence in climate disclosure, primarily in the European Union’s legislative landscape. This concept aims at addressing sustainability-related financial disclosures and the impact on people and the planet with a holistic environmental approach. Any given policy should be designed to advance the environmental agenda and to lead to real change that affects people and the planet positively.

It is not possible to tackle climate change without a holistic approach to the environment. Investor-focused frameworks and standards provide a good starting point for evaluating climate-related financial risks, but the low-carbon transition requires a broader focus. More data are needed on a much wider range of environmental topics and with the aim of incorporating impacts on people and impacts on the planet. This information can support evidence-based decisions from a broad range of stakeholders.

The IFRS’General Sustainability Disclosures and Climate-related Disclosures standards focus on financial-focused materiality (risks and opportunities for the company), while the European Sustainability Reporting Standards (which comply with the European Union’s Corporate Sustainability Reporting Directive) focus on double materiality (financial plus impact materiality).

The major upcoming standards will arguably incorporate double materiality in relation to climate disclosure for the coming decades.

Explore more:

- IFC’s Beyond the Balance Sheet Toolkit - Management of Material Sustainability Issues;

- How CDP is Aligned to the TCFD;

- Comparison IFRS S2 Climate-Related Disclosures with the TCFD Recommendations;

- The Evolution of Sustainability Disclosure: Comparing the 2022 SEC, ESRS, and ISSB Proposals;

- Draft European Sustainability Reporting Standards, Appendix V: IFRS Sustainability Standards and ESRS Reconciliation Table (ESRS E1 versus IFRS S2, pages 54–73);

- Practical Guidance on Preparing for the ISSB’s Sustainability Disclosure Standards, Chartered Accountants, Australia and New Zealand, May 31, 2023;

- United Nations Environment Programme Finance Initiative’s 2023 Climate Risk Landscape report.

Embedding Climate Disclosure in Wider Reporting

Several established frameworks can be used for climate disclosure that satisfy the information needs of various stakeholders. Most frameworks work with the Greenhouse Gas Protocol as a widely accepted carbon accounting methodology (which differentiates among Scope 1, Scope 2, and Scope 3 emissions) and the Partnership for Carbon Accounting Financials (PCAF).

The most common reporting standards and frameworks include the GRI Standards, TCFD recommendations, and the new IFRS Sustainability Disclosure Standards and European Sustainability Reporting Standards.

CDP implements and scales these frameworks and standards. The organization aligned its disclosure mechanism with the TCFD in 2017 and has partnered with the ISSB to adopt its final climate standard.

Climate change is one of the most pressing issues of our time, but it is not a stand-alone issue. Climate change interrelates with other issues that affect society, the economy, and the environment.

-

Climate and Gender

The impacts of climate change affects strongly women and girls. They experience the greatest impacts because of their higher dependency on natural resources and less access to them. Women around the world bear the responsibility of securing water and food. This in effect amplifies the impact of climate change and creates different threats to their livelihoods and health. The examples of gender-differentiated impacts of climate change are mostly context-specific, highlighting gendered experiences and behaviours governed by differing social norms.

-

Climate and Social Issues

Climate change is also a social crisis interlinked with inequality. The poorest and most vulnerable people face the harshest impacts of a changing climate, which exacerbates their conditions. Different social groups, such as children, people with disabilities, indigenous communities, ethnic minorities, displaced people, the elderly, and sexual and gender minorities similarly face harsher impacts. Poor and marginalized communities are asking for more ambition with regards to inclusion in climate action.

-

Climate and Production

Many production processes rely on stable environmental conditions, but a changing climate is gradually threatening the stable supply of goods and services, particularly agricultural production, which is threatened by growing periods of drought and flooding. Supply chain vulnerabilities are becoming evident, particularly because extreme weather events disrupt the stable availability of produce on certain shipment routes.

-

Climate and Other Environmental Topics

Climate change also interrelates with other environmental issues, particularly water security (including oceans and plastics), biodiversity loss, and the overall planetary boundaries, which entail physical resource use boundaries of the planet. A changing climate affects natural processes such as the water cycle, resulting in drought, glacial melting, and flooding in many parts of the world. These effects also have a tremendous impact on wildlife habitat and exacerbate biodiversity loss.

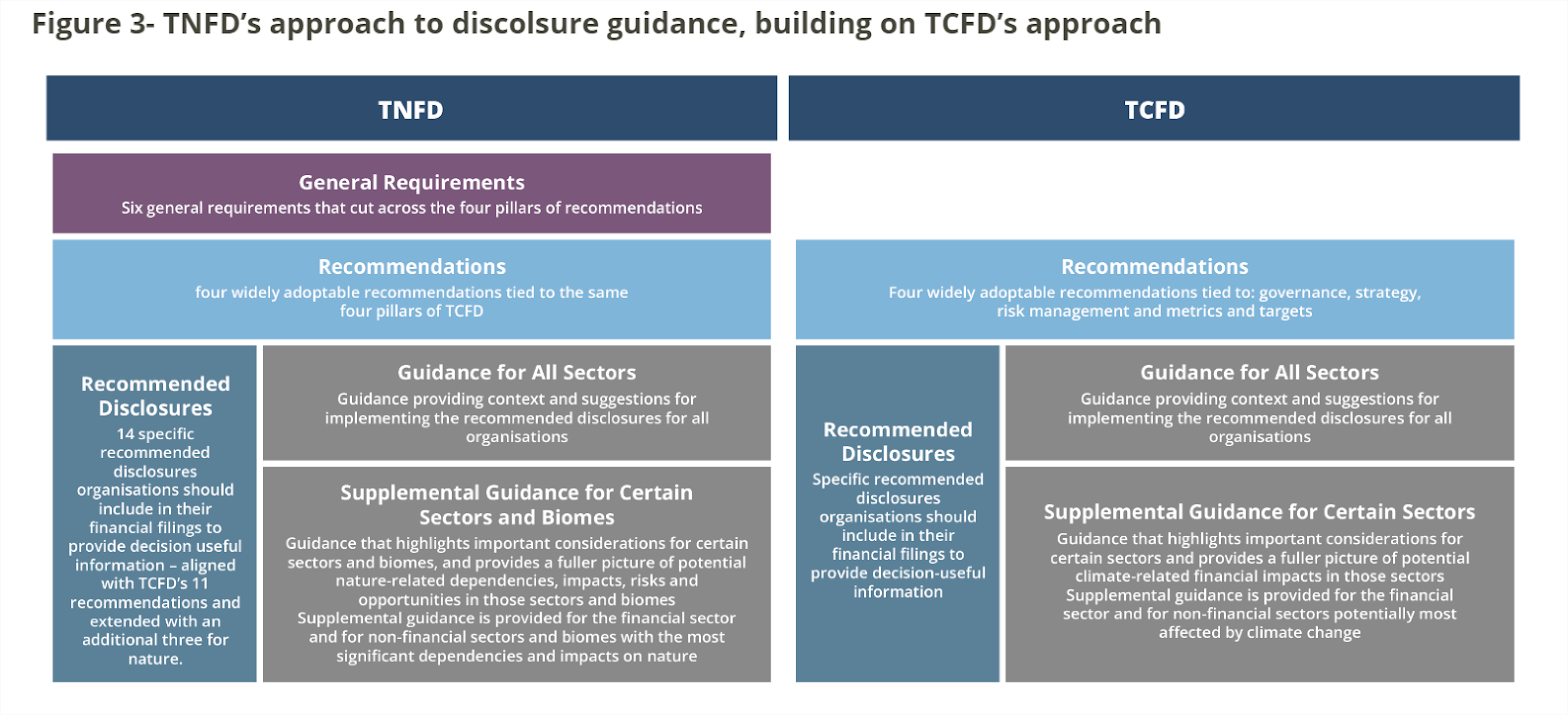

Target 15 of the Kunming-Montreal Global Biodiversity Framework of the UN Biodiversity Conference (COP15) in December 2022 commits governments to require nature-related disclosure from large companies and financial institutions. Companies should prepare to assess and disclose their risks, impacts, and dependencies on biodiversity.

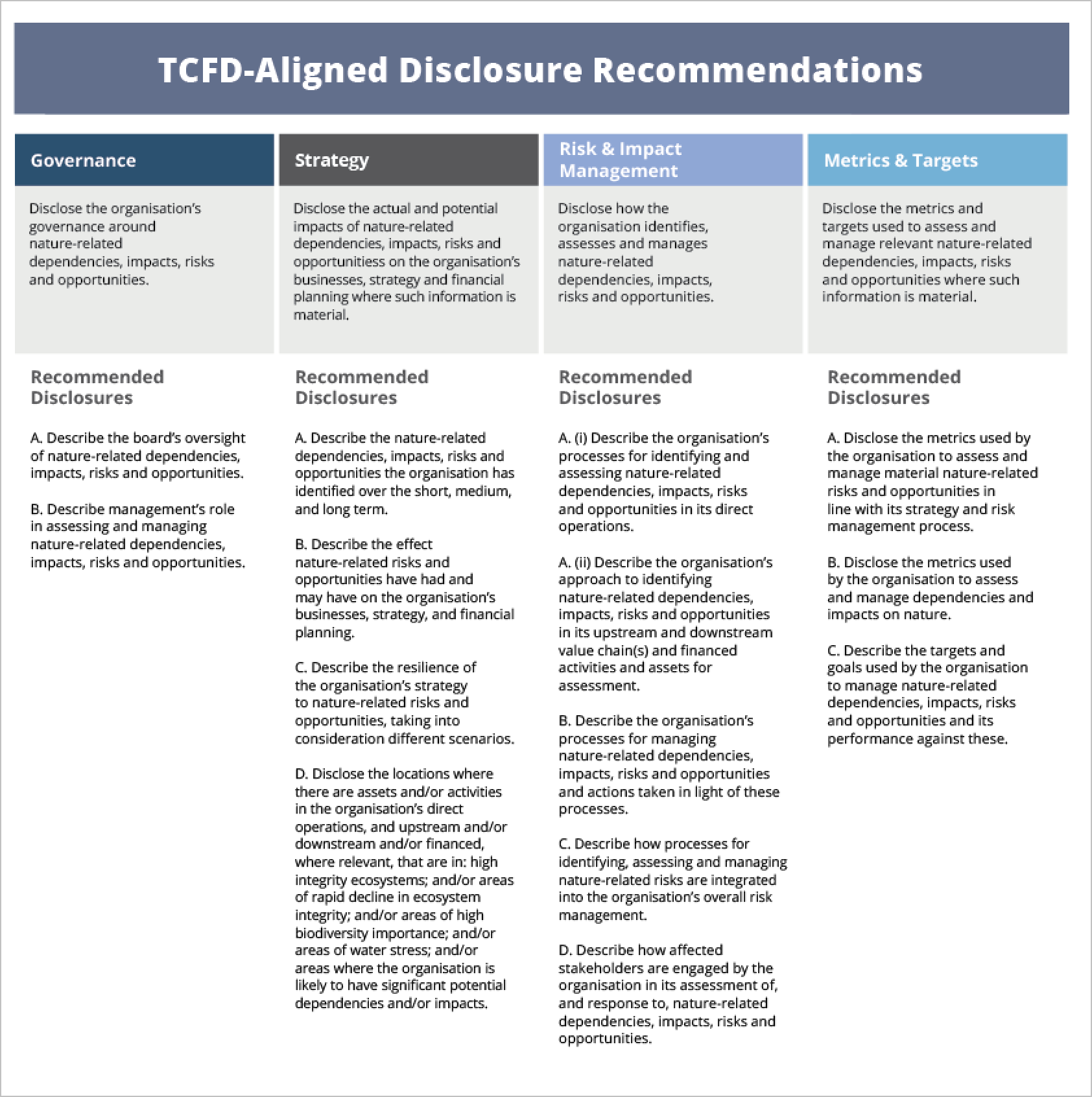

Nature loss poses both risks and opportunities for business now and in the future. More than half of the world’s economic output—US$44 trillion of economic value generation - depends on nature moderately or highly. The Taskforce on Nature-Related Financial Disclosures (TNFD) was announced in July 2020 to develop and deliver a risk management and disclosure framework for organizations to report and act on evolving nature-related risks, with the aim of supporting a shift in global financial flows away from nature-negative outcomes and toward nature-positive outcomes. In March 2023, TNFD released the fourth version of its beta framework for market consultation, aligned with the TCFD’s four pillar structure.

Latest (v0.4) TNFD draft recommended disclosures

Learn more:

- Analysis of Best Practices in Environmental Disclosure Policies: A Review of 101 Policies Worldwide Based on Five Criteria for High-Quality Disclosure (CDP and IFC);

- Shaping High-Quality Mandatory Disclosure: Taking Stock and Building upon the TCFD Recommendations (CDP);

- TCFD – Climate Disclosure Training (UN Sustainable Stock Exchanges Initiative-CDP-IFC);

- Model Guidance on Climate Disclosure: A Template for Stock Exchanges to Guide Issuers on TCFD Implementation (UN Sustainable Stock Exchanges Initiative);

- TCFD Knowledge Hub;

- CDP’s partnership with ISSB;

- UN Environment Programme Finance Initiative;

- TCFD 2022 Status Report;

- How CDP is aligned to the TCFD;

- CDP Technical Note on the TCFD: Disclosing in Line with the TCFD’s Recommendations;

- Major Risk or Rosy Opportunity: Are Companies Ready for Climate Change? (CDP);

- The Building Blocks: Connecting CDP Data with the CDSB Framework to Successfully Fulfil the TCFD Recommendations (Climate Disclosure Standards Board and CDP).

Developed in collaboration with the UN Sustainable Stock Exchanges Initiative.

-

1. To what extent are TCFD-related metrics aligned with the indicators required in the various other regulations on sustainable finance?

Most frameworks and standards are already mapped to the TCFD. Annex 2 of the Sustainable Stock Exchanges’ Model Guidance on Climate Disclosure includes a mapping exercise. However, the TCFD metrics are generally less prescriptive than other frameworks, so it’s important to remember the TCFD’s recommendations and ensure that the metrics you use align with the risks and opportunities that your organization identified as having a financial impact.

The 2021 TCFD Guidance on Metrics, Targets, and Transition Plans identifies seven metrics that all organizations should disclose and provides a list of metrics for each of those from other frameworks or standards that align with the TCFD’s recommended metric. This list is in appendix 2 (page 61).

-

2. How do you recommend implementing climate risks assesments along with other existing due diligence checks (for example, financial, legal, and so on)?

TCFD is not prescriptive on how information is reported but rather helps ensure that you’re not missing any important information. This is to help improve your organization’s resilience and preparation for changes and to communicate your strategies with your stakeholders. There’s no need to duplicate reporting. You can use TCFD as a checklist to ensure that you’re providing information that will be useful to investors. The Sustainable Stock Exchanges provides a TCFD checklist in annex 1 of its Model Guidance on Climate Disclosure to identify the gaps in your organization’s current disclosure practices and risk management processes.

-

3. Is there a prescribed way, process, tool, or system a company can use to measure the financial impact of the climate-related risks and opportunities?

The TCFD recommendations walk you through steps to measure the financial risks and opportunities related to climate change. Investors need to understand the actual and potential impacts of climate-related risks and opportunities on an organization’s financial performance and financial position, and how those impacts may affect the organization’s enterprise value over the long term so they can make informed financial decisions on capital allocation. A financial impact analysis should focus on the exposure and potential financial impact if the organization takes no action and the financial implications of managing risks and maximizing opportunities in the context of an organization's overall business strategy and environment.

Organizations should evaluate impacts to their financial performance (such as to changes in revenue, costs or operating cash flow, impairment charges from assets exposed to transition risks, and changes to total expected losses because of physical risks) and their financial position (changes to the carrying amount of assets, expected portfolio value or liability, and equity). More information on this and examples are in the 2021 TCFD Guidance on Metrics, Targets, and Transition Plans (section F: Financial Impacts) or the 2021 Implementing the Recommendations of the TCFD (annex 1).

-

4. Should TCFD-aligned disclosures be reported in a stand-alone climate report?

TCFD-related information should be linked to the financial information as much as possible, so a stand-alone report isn’t needed. You could include a sustainability section in your report, but most disclosures should be interspersed throughout the audited report in their corresponding sections (for example, material climate risks in the risks section, governance of climate risk in the governance section, and so on). Additional supporting information could be in a separate report, such as your sustainability report, and then cross-reference or possibly use a reference table to help readers find the information.

-

5. Is there a recommendation about external assurance and verification?

Disclosures should be defined, collected, recorded, and analyzed such that the information reported is verifiable and high quality. For future-oriented information, assumptions used should be traceable to their sources. This doesn’t imply a requirement for independent external assurance, but disclosures should be subject to internal governance processes that are the same or substantially similar to those used for financial reporting.

-

6. What are the differences between climate metrics and targets? Please provide some examples.

Metrics are what you decide to measure based on financially material risks and opportunities you identified—for example, water use, energy use, or land use based on your company’s sector and geography—in addition to the seven cross-industry climate-related metric categories recommended by the TCFD. These should be quantifiable measures that are decision-useful, clear and understandable, consistent over time, reliable, verifiable, and objective. Targets are forward-looking metrics for how the organization aims to perform in the future, and interim metrics indicate the path to that goal. For examples of metrics and targets, see the 2021 TCFD Guidance on Metrics, Targets, and Transition Plans.

-

7. Can the company do TCFD reporting on its own, or does it need to hire consultants to make these calculations and disclosures?

External expertise can provide support and an expert view, but it isn’t necessary. Some companies choose to use an external advisor, especially for their first attempt at evaluating impact and risks. However, a company can use existing processes. For example, a company likely analyzes inputs and costs in the value chain, and this process can be used in a scenario analysis but with additional scientific inputs that help identify how climate change will alter those costs.

-

8. How can a company appropriately claim to be TCFD compliant?

Compliance will depend on your organization’s regulatory context, but broadly, you should aim to address all the recommended disclosures, which includes either disclosing the information recommended or explaining why the recommendation isn’t relevant to your organization. It can often take three to five years to have all the necessary processes in place to provide all the information recommended by the TCFD. Also, maintaining sufficient governance and risk management requires continuous evaluation, so there’s no “finish line” but rather a new business as usual, in which climate-related risks and opportunities are sufficiently integrated into governance, strategy, risk management, and metrics and targets.

-

9. Is a set of scenarios and metrics and targets available by industry sector?

The TCFD provides specific guidance to four financial sector groups and four high-risk nonfinancial sector groups, but the TCFD recommendations apply to all sectors. Climate change is material to all organizations in some way. For sector-specific guidance on metrics, see the 2021 Implementing the Recommendations of the TCFD (section D: Supplemental Guidance for the Financial Sector, and Section E: Supplemental Guidance for Nonfinancial Groups). For more specific guidance on scenario analysis, see the TCFD’s 2020 Guidance on Scenario Analysis for Nonfinancial Companies), which builds on TCFD’s 2017 The Use of Scenario Analysis in Disclosure of Climate-Related Risks and Opportunities.

The Sustainable Stock Exchanges’ Model Guidance on Climate Disclosure also provides a good overview of the scenarios available (section 2.5).

-

10. Which and how many scenarios are companies expected to conduct and report?

A scenario analysis helps companies make strategic and risk management decisions under complex and uncertain conditions such as climate change. It allows a company to understand the risks and uncertainties it may face under different hypothetical futures and how those conditions may affect its performance, thus contributing to the development of greater strategy and resilience. Scenarios describe the plausible but hypothetical path of development leading to a particular future outcome. They are not forecasts or predictions and are not intended to represent a full description of the future but rather highlight central elements of possible futures.

More than one scenario should be used to properly evaluate your strategy’s resilience. A critical aspect of scenario analysis is selecting a set of scenarios that covers a reasonable variety of future outcomes, both favorable and unfavorable. TCFD recommends that organizations use a two degree or lower scenario in line with the UNFCCC’s Paris Agreement in addition to two or three additional scenarios deemed most relevant to their particular circumstances. Companies may want to start with existing scenarios and adapt or combine if needed. Commonly used scenarios include those by the Intergovernmental Panel on Climate Change, the International Energy Agency, and the Network for Greening the Financial System. For more information, see section 2.5 (pages 16–19) of Model Guidance on Climate Disclosure.

-

11. Where can I find additional guidance on setting internal carbon prices?

Implementing internal carbon pricing can be a useful tool to strengthen climate risk management. The TCFD provides guidance on setting an effective carbon price in appendix 1 (page 59) of its 2021 TCFD Guidance on Metrics, Targets, and Transition Plans. Another useful starting point is CDP’s 2021 report Putting a Price on Carbon: The State of Internal Carbon Pricing by Corporates Globally.

-

12. What is the value in reporting according to TCFD?

The benefits associated with implementing TCFD’s recommendations include access to capital, enhancing organizational resilience, proactively addressing investor demands, and addressing or preempting regulatory requirements. The important benefit is the impact on your organization’s resilience, so implementing TCFD’s recommendations makes the exercise meaningful and not just symbolic.

-

13. Where can we check which companies worldwide are already implementing TCFD recommendations?

The TCFD Knowledge Hub has a database of TCFD-aligned reporting. You can consider contributing your own reports to the database by emailing tcfdhub@cdp.net.

-

14. Is there a recommended methodology or tool for calculating scope 3 greenhouse gas emissions?

The TCFD recommends using the Greenhouse Gas Protocol for all emissions calculations to ensure consistency across reports. The Greenhouse Gas Protocol’s Technical Guidance for Calculating Scope 3 Emissions can help organizations understand how to get started on identifying and calculating these emissions. Financial sector companies should use the 2020 Financed Emissions: The Global GHG Accounting and Reporting Standard Part A that was launched by the Partnership for Carbon Accounting Financials. This standard builds on the Greenhouse Gas Protocol Scope 3 accounting rules. The Carbon Footprinting Methodology for Underwriting Portfolios, published in 2020 by the Climate Risk Officer Forum, provides additional guidance for the insurance industry.

-

15. Are TCFD recommendations the same as science-based targets (SBTi)?

No. Science-based targets are a tool that can be used to fulfill the TCFD’s recommended disclosures but are not the same as the TCFD recommendations. The Science-Based Targets Initiative (SBTi) was established by the World Resources Institute, CDP, the World Wide Fund for Nature, and the UN Global Compact. It asks companies to publicly commit to setting carbon emission reduction targets that are in line with climate science. SBTi shows organizations how much and how quickly they need to reduce their greenhouse gas emissions to prevent the worst effects of climate change and to contribute to meeting the Paris Agreement. Organizations can use of this resource when setting targets and when creating a transition plan. For more information on transition plans and how to use SBTi in developing a transition plan, see the 2021 TCFD Guidance on Metrics, Targets, and Transition Plans (section E).

-

16. How does the TCFD define materiality?

The TCFD’s focus is on disclosing information that is deemed that is deemed financially material, which is information that will affect the organization’s financial performance, financial position, or both. To ensure as much compatibility as possible with national disclosure requirements for financial filings, the TCFD suggests that companies determine materiality for climate-related issues in the same way that they determine the materiality of other information included in their financial filings. The TCFD also cautions organizations against prematurely concluding that climate-related risks and opportunities are not material based on preconceptions of the longer-term nature of some climate-related risks.

-

17. Will disclosures through GRI and CDP become less relevant, considering increased alignment with the TCFD and other enterprise value–based frameworks and standards with the IFRS Foundation’s International Sustainability Standards Board (ISSB)?

Indeed, there is an alignment and convergence underway among disclosure frameworks and standards. However, different types of information will remain important to different stakeholders. The TCFD and ISSB are designed to meet investors' information needs while GRI caters to a broader array of information users. ISSB and GRI signed a cooperation agreement for aligning their working programs and the recently launched European Sustainability Reporting Standards Exposure Drafts, which include an Annex on Climate change focus on both the impact materiality and financial materiality (double materiality).

CDP supports the development of high-quality disclosure standards and frameworks to provide clarity, drive compliance, and support companies in their reporting needs in line with their mission to drive transparency and action to tackle the environmental crisis. For many years, CDP has worked in collaboration with other leading organizations to facilitate a “building block” approach towards more comprehensive corporate reporting based on existing standards, frameworks, and platforms, advocating for an interoperable set of global reporting standards that will support companies to disclose in the most meaningful and relevant ways. There is a harmonization and convergence movement which CDP helps lead, encouraging standards and frameworks setters to accelerate such global alignment.

CDP’s role is even more critical in a world of increased scrutiny, standardization, and regulation. As the only independent global environmental disclosure system, CDP can rapidly scale the adoption of all high-quality frameworks and standards. With nearly 20,000 organizations, including 18,700 companies' worth half of global market capitalization, already disclosing through CDP, its disclosure system is uniquely positioned to scale disclosure against new frameworks and standards across the global economy. CDP provides an implementation mechanism for the latest developments in disclosure standards and historically has driven the evolution of these standards. CDP has always evolved and adapted its questionnaires considering emerging new standards, priorities, or regulation and will continue doing so.

CDP aligned its questionnaire with the TCFD in 2018 and supports its adoption by businesses and financial institutions. From 2024, CDP will incorporate the IFRS S2 into its disclosure system, ensuring a rapid early adoption of the global baseline standard for sustainability-related financial information. It is CDP’s intention to adopt, align or integrate impactful, high quality global and jurisdictional-level standards including the US SEC climate disclosure rule and the European Sustainability Reporting Standards (ESRS).