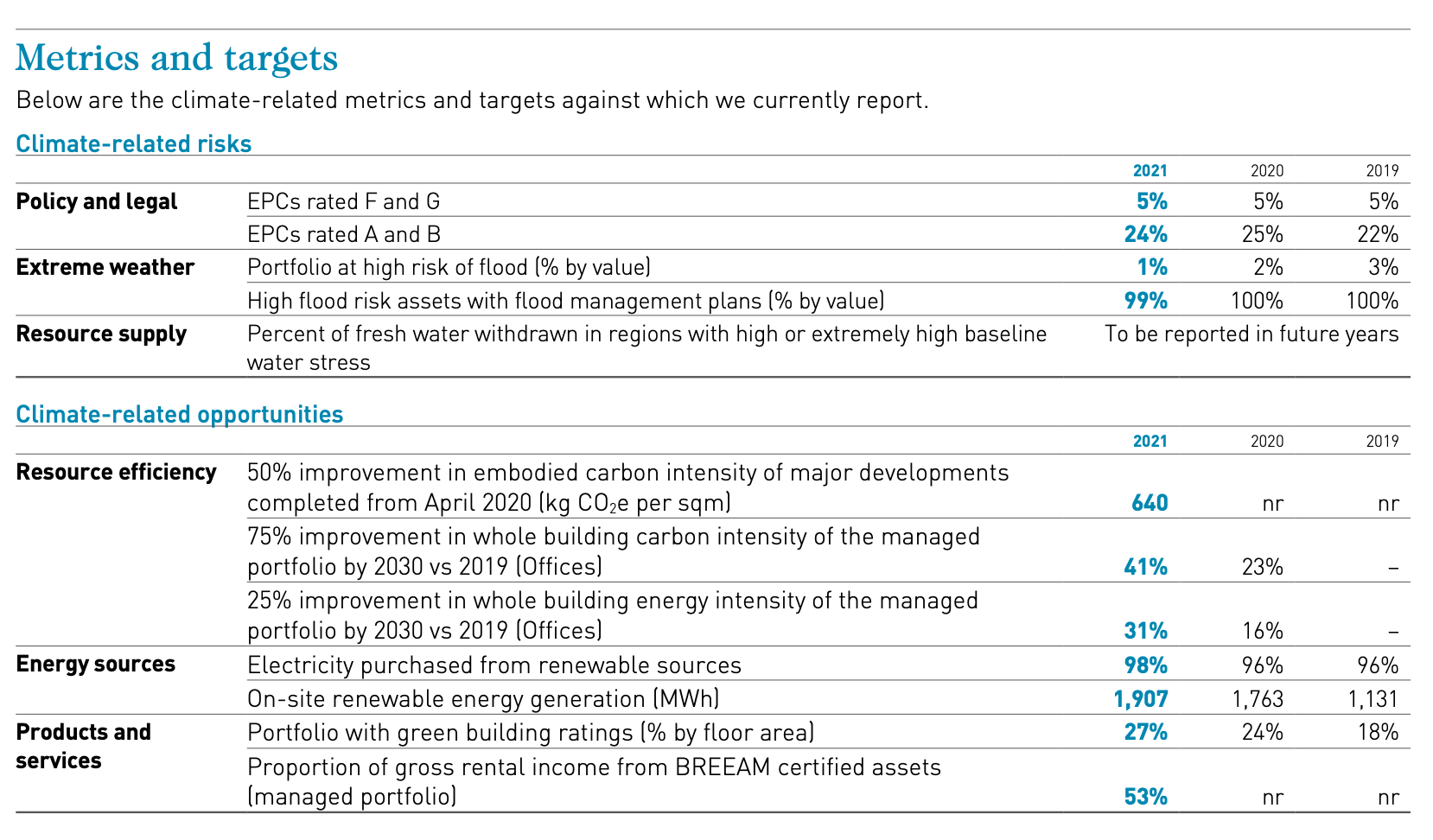

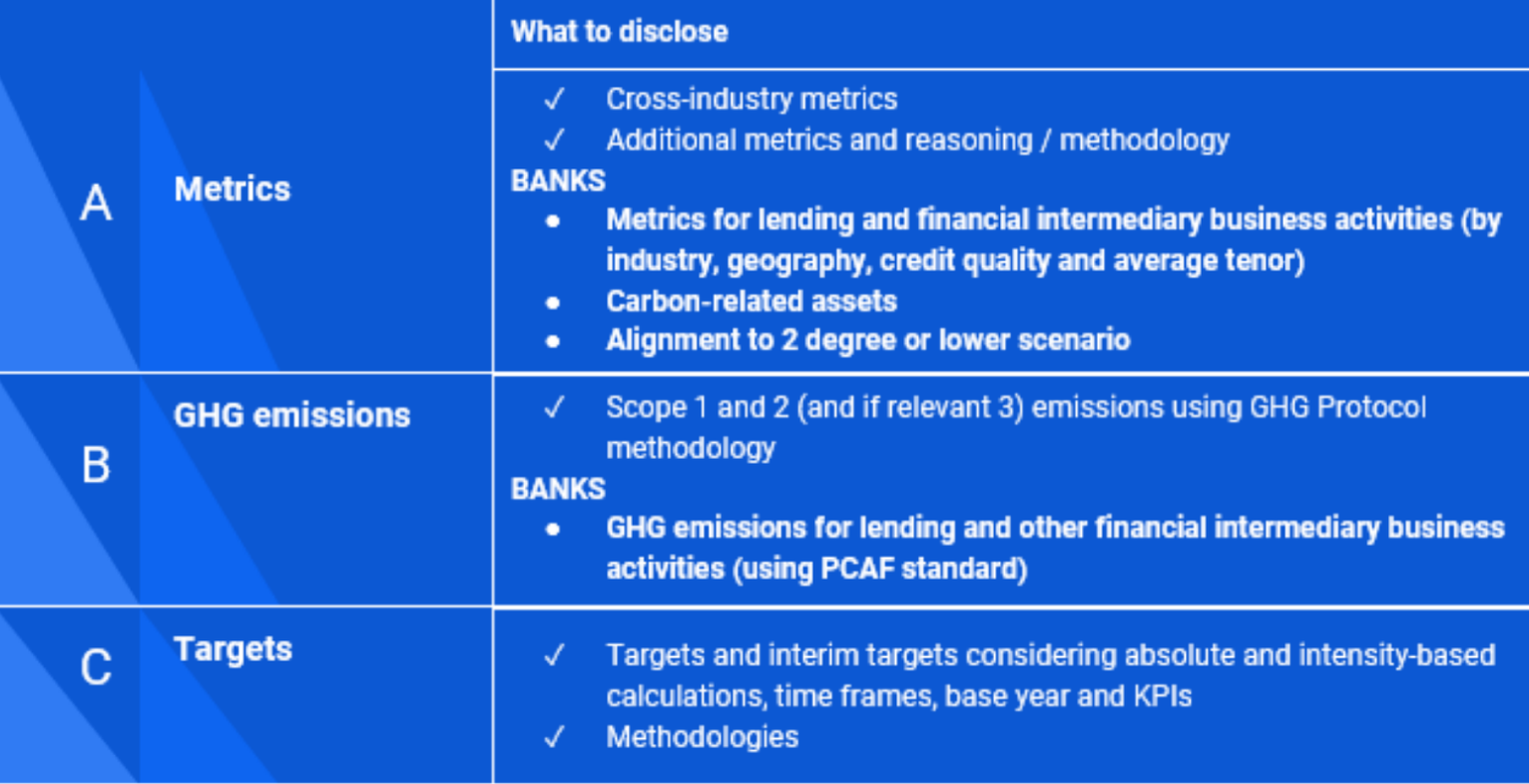

The ISSB and TCFD’s metrics and targets pillars recommend that companies disclose the metrics and targets used to assess and manage relevant climate-related risks and opportunities where such information is material.

- The relationship between the company’s strategy and business model, and the metrics and targets that are disclosed.

- The performance trends to get a better understanding of a company’s actions.

-

Disclose the metrics used by the organization to assess climate-related risks and opportunities in line with its strategy and risk management process.

Consider including a discussion of:

- Which performance metrics are used to assess and manage financially material climate-related risks and opportunities?

- Does the company measure climate-related opportunities, such as revenue from products and services designed for a lower-carbon economy?

- Has the company established an internal carbon price?

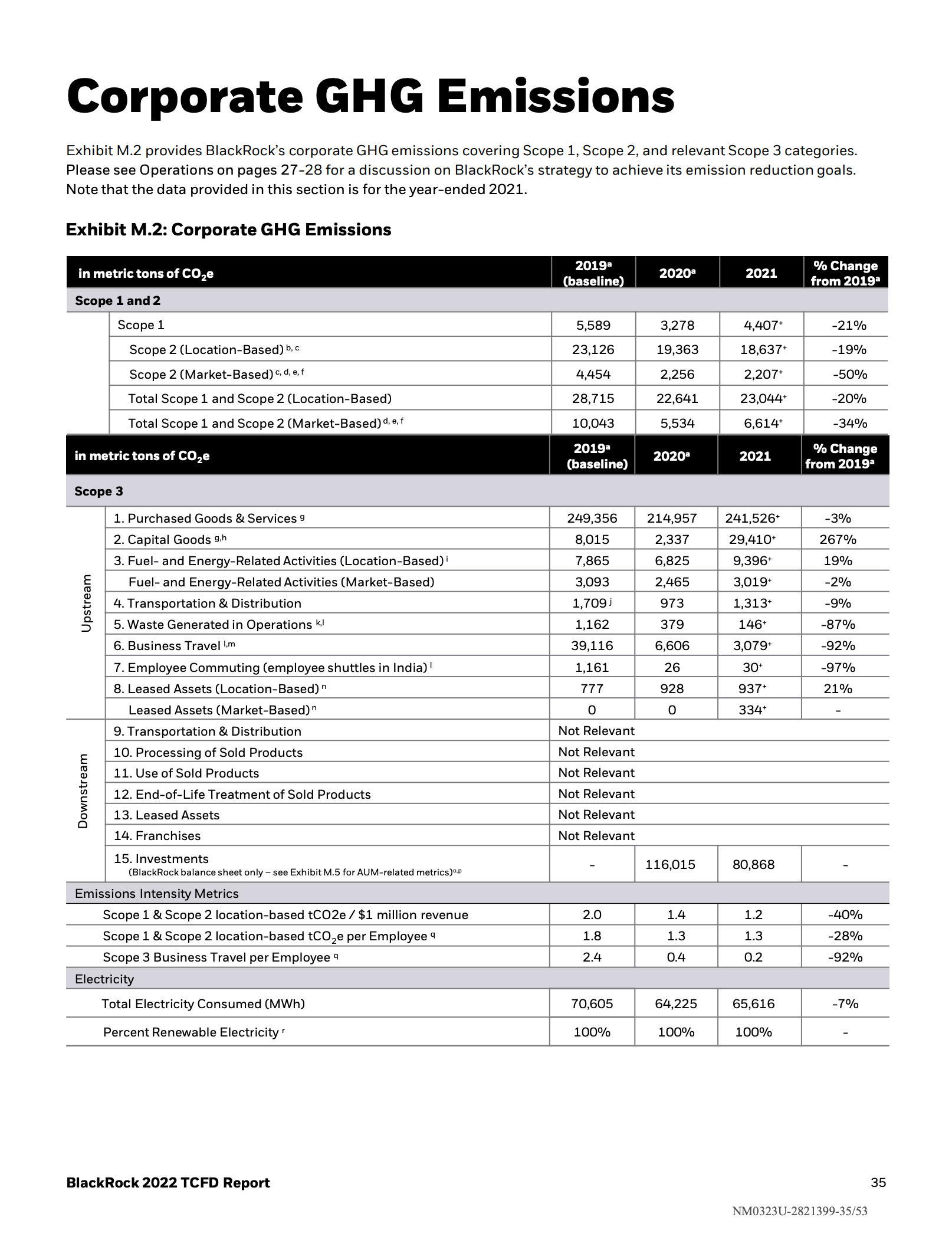

Task Force on Climate-related Financial Disclosures Guidance on Metrics, Targets, and Transition Plans emphasizes seven categories of metrics intended to support comparability.

Source: Task Force on Climate-related Financial Disclosures Guidance on Metrics, Targets, and Transition Plans, 2021 -

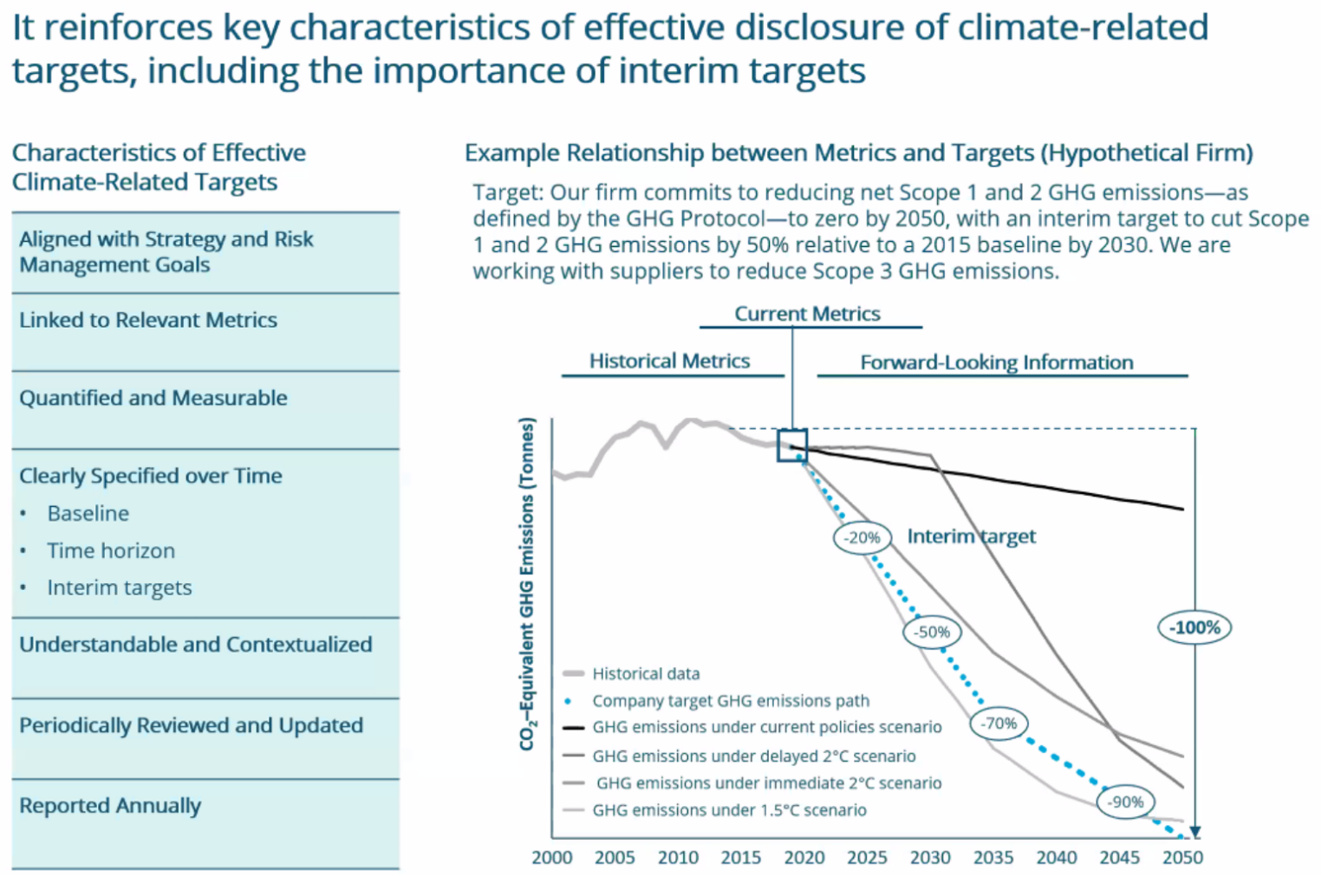

Disclose Scope 1, Scope 2, and, if appropriate, Scope 3 greenhouse gas (GHG) emissions, and the related risks.

Consider including a discussion of:

- The company’s greenhouse gas emissions, broken down into the relevant scopes aligned to the greenhouse gas protocol.

- A description of the value chain (scope 3) activities which are relevant for the business and the emissions associated with them or plans to calculate these.

- Relevant methodologies, estimation techniques, and any data gaps for the greenhouse gas calculations.

-

Describe the targets used by the organization to manage climate-related risks and opportunities and performance against targets.

Consider including a discussion of:

- How has the company established and communicated climate-related performance targets?

- Do the company’s targets align with anticipated regulatory requirements, market constraints, or other goals?

- Do disclosures specify whether targets are absolute or intensity-based, the time frames over which they apply, and the base year from which progress is measured?

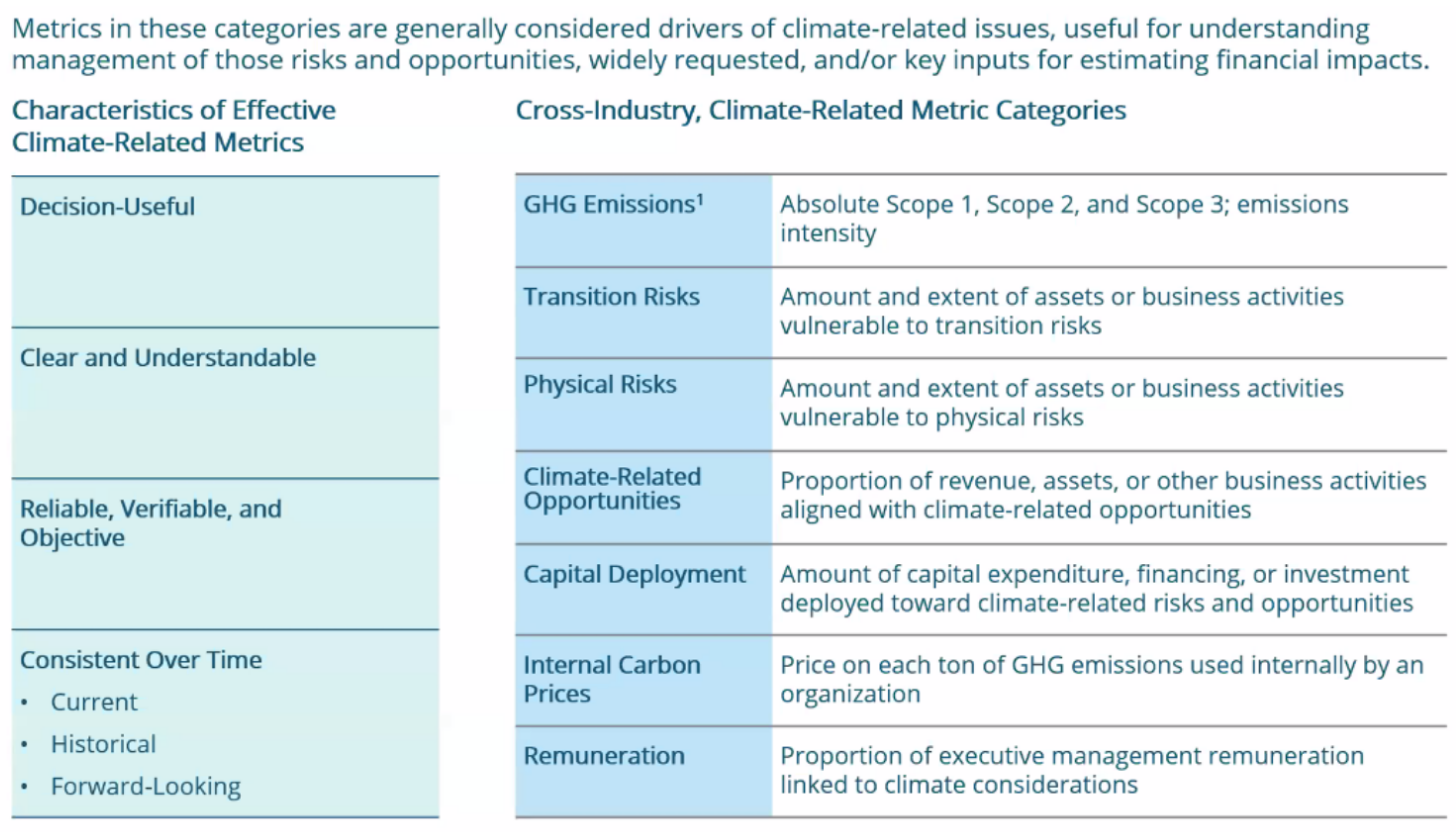

Task Force on Climate-related Financial Disclosures Guidance on Metrics, Targets, and Transition Plans emphasizes key characteristics of effective disclosure of climate-related targets, including the importance of interim targets.

Source: Task Force on Climate-related Financial Disclosures Guidance on Metrics, Targets, and Transition Plans, 2021

Metrics and Targets checklist

Top Tips for Getting Started with Disclosure

- Leverage existing processes and disclosures

- Connect information

- Cross reference within and across reports (annual, sustainability, TCFD)

- Provide clear, concise, and proportional information

- Clearly define time horizons (short-, medium-, and long-term)

- Start with qualitative reporting if no data are available

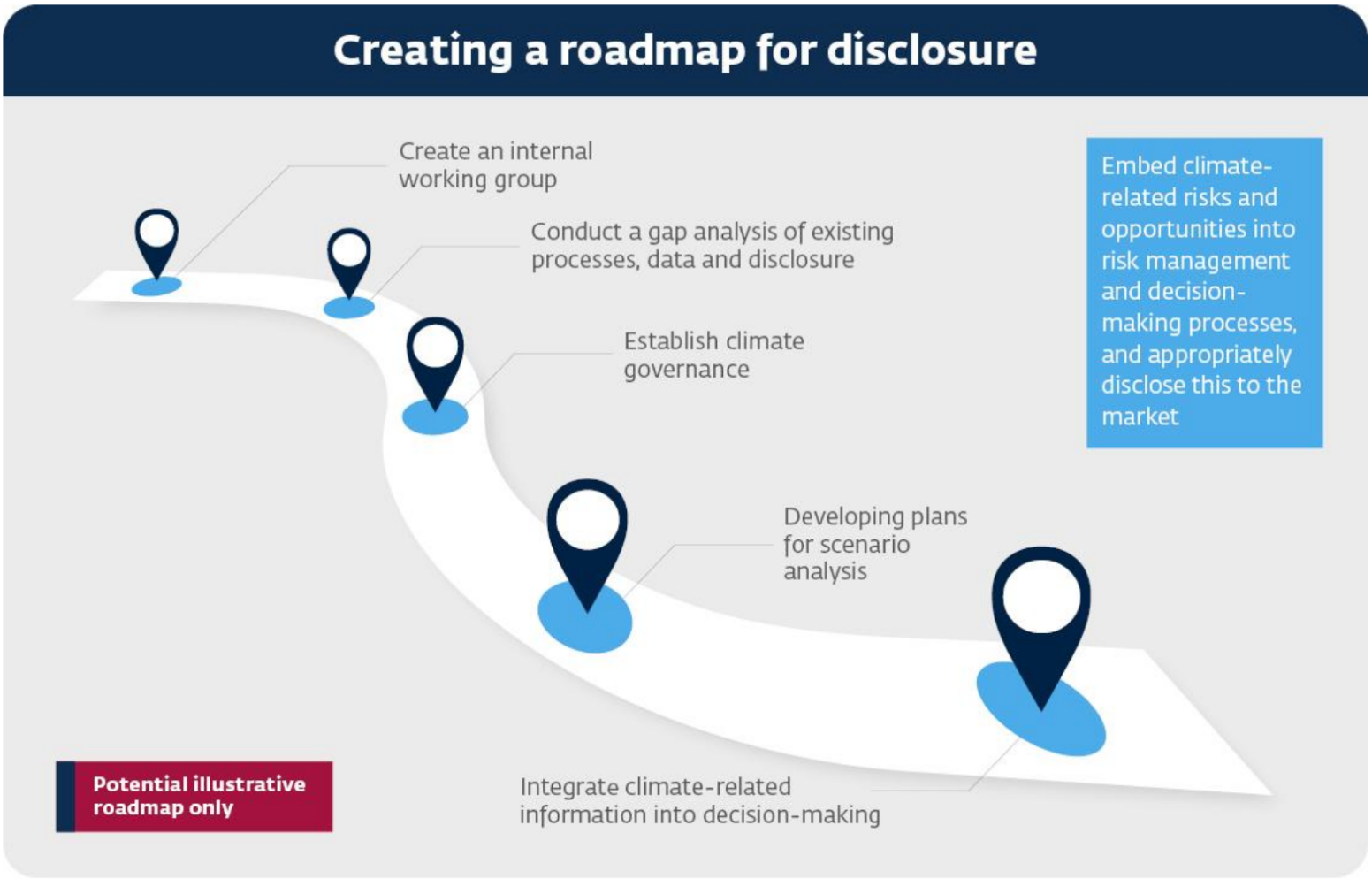

- Create an internal road map for climate-related disclosures

- Coordinate with different functions and teams that address climate change

Creating an Internal Road Map for Climate-Related Disclosures

Where to Disclose Climate-Related Financial Information

- Disclosure should be provided in the mainstream report, also referred to as the annual report, registration document, or 10-K.

- Intention is not for separate TCFD statements or additional sustainability reporting.

- Integrated into reporting and connected to financial information.

- Subject to the same governance processes and sign off as the financial report

- Accessible to investors as primary users

International Sustainability Standards Board

IFRS S2 on Climate-related disclosures includes disclosure on Risk Management as one of the four pillars for climate-related financial disclosure (Governance, Strategy, Risk Management and Metrics and Targets). IFRS S2 climate-related disclosures should be read in conjunction with the IFRS S1 on General Sustainability-related Disclosures.

IFRS S2 requires:

- Scope 1, 2, and 3 emissions, both aggregated and disaggregated (see IFRS S2 paragraph 29 for more detail)

- Climate-related risks, both physical and transition

- Climate-related opportunities

- Capital deployment towards climate-related risks and opportunities

- Information on internal carbon prices

- Information on whether and how remuneration is tied to climate-related considerations

- Detailed information on climate-related targets

European Sustainability Reporting Standards

The first set of the European Sustainability Reporting Standards contain topic-specific standards on climate change ESRS E1 Climate Change, which companies should implement together with the general disclosures required in the cross-cutting ESRS 2 General Disclosures. Find below an excerpt from the standard for your reference.

-

International Sustainability Standards Board

IFRS S2 on Climate-related disclosures includes disclosure on Risk Management as one of the four pillars for climate-related financial disclosure (Governance, Strategy, Risk Management and Metrics and Targets). IFRS S2 climate-related disclosures should be read in conjunction with the IFRS S1 on General Sustainability-related Disclosures.

IFRS S2 requires:

- Scope 1, 2, and 3 emissions, both aggregated and disaggregated (see IFRS S2 paragraph 29 for more detail)

- Climate-related risks, both physical and transition

- Climate-related opportunities

- Capital deployment towards climate-related risks and opportunities

- Information on internal carbon prices

- Information on whether and how remuneration is tied to climate-related considerations

- Detailed information on climate-related targets

ISSB IFRS S2 Climate-related Disclosures (Excerpt)

Metrics and targets

27 The objective of climate-related financial disclosures on metrics and targets is to enable users of general purpose financial reports to understand an entity’s performance in relation to its climate-related risks and opportunities, including progress towards any climate-related targets it has set, and any targets it is required to meet by law or regulation.

28 To achieve this objective, an entity shall disclose:

(a) information relevant to the cross-industry metric categories (see paragraphs 29–31);

(b) industry-based metrics that are associated with particular business models, activities or other common features that characterise participation in an industry (see paragraph 32); and

(c) targets set by the entity, and any targets it is required to meet by law or regulation, to mitigate or adapt to climate-related risks or take advantage of climate-related opportunities, including metrics used by the governance body or management to measure progress towards these targets (see paragraphs 33–37).

Climate-related metrics

29 An entity shall disclose information relevant to the cross-industry metric categories of:

(a)greenhouse gases—the entity shall:

(i) disclose its absolute gross greenhouse gas emissions generated during the reporting period, expressed as metric tonnes of CO2 equivalent (see paragraphs B19–B22), classified as:

(1) Scope 1 greenhouse gas emissions;

(2) Scope 2 greenhouse gas emissions; and

(3) Scope 3 greenhouse gas emissions;

(ii) measure its greenhouse gas emissions in accordance with the Greenhouse Gas Protocol: A Corporate Accounting and Reporting Standard (2004) unless required by a jurisdictional authority or an exchange on which the entity is listed to use a different method for measuring its greenhouse gas emissions (see paragraphs B23–B25);

(iii) disclose the approach it uses to measure its greenhouse gas emissions (see paragraphs B26–B29) including:

(1) the measurement approach, inputs and assumptions the entity uses to measure its greenhouse gas emissions;

(2) the reason why the entity has chosen the measurement approach, inputs and assumptions it uses to measure its greenhouse gas emissions; and

(3) any changes the entity made to the measurement approach, inputs and assumptions during the reporting period and the reasons for those changes;

(iv) for Scope 1 and Scope 2 greenhouse gas emissions disclosed in accordance with paragraph 29(a)(i)(1)–(2), disaggregate emissions between:

(1) the consolidated accounting group (for example, for an entity applying IFRS Accounting Standards, this group would comprise the parent and its consolidated subsidiaries); and

(2) other investees excluded from paragraph 29(a)(iv)(1) (for example, for an entity applying IFRS Accounting Standards, these investees would include associates, joint ventures and unconsolidated subsidiaries);

(v) for Scope 2 greenhouse gas emissions disclosed in accordance with paragraph 29(a)(i)(2), disclose its location-based Scope 2 greenhouse gas emissions, and provide information about any contractual instruments that is necessary to inform users’ understanding of the entity’s Scope 2 greenhouse gas emissions (see paragraphs B30–B31); and

(vi) for Scope 3 greenhouse gas emissions disclosed in accordance with paragraph 29(a)(i)(3), and with reference to paragraphs B32–B57, disclose:

(1) the categories included within the entity’s measure of Scope 3 greenhouse gas emissions, in accordance with the Scope 3 categories described in the Greenhouse Gas Protocol Corporate Value Chain (Scope 3) Accounting and Reporting Standard (2011); and

(2) additional information about the entity’s Category 15 greenhouse gas emissions or those associated with its investments (financed emissions), if the entity’s activities include asset management, commercial banking or insurance (see paragraphs B58–B63);

(b) climate-related transition risks—the amount and percentage of assets or business activities vulnerable to climate-related transition risks;

(c) climate-related physical risks—the amount and percentage of assets or business activities vulnerable to climate-related physical risks;

(d) climate-related opportunities—the amount and percentage of assets or business activities aligned with climate-related opportunities;

(e) capital deployment—the amount of capital expenditure, financing or investment deployed towards climate-related risks and opportunities;

(f) internal carbon prices—the entity shall disclose:

(i) an explanation of whether and how the entity is applying a carbon price in decision-making (for example, investment decisions, transfer pricing and scenario analysis); and

(ii) the price for each metric tonne of greenhouse gas emissions the entity uses to assess the costs of its greenhouse gas emissions;

(g) remuneration—the entity shall disclose:

(i) a description of whether and how climate-related considerations are factored into executive remuneration (see also paragraph 6(a)(v)); and

(ii) the percentage of executive management remuneration recognised in the current period that is linked to climate-related considerations.

30 In preparing disclosures to meet the requirements in paragraph 29(b)–(d), an entity shall use all reasonable and supportable information that is available to the entity at the reporting date without undue cost or effort.

31 In preparing disclosures to meet the requirements in paragraph 29(b)–(g), an entity shall refer to paragraphs B64–B65.

32 An entity shall disclose industry-based metrics that are associated with one or more particular business models, activities or other common features that characterise participation in an industry. In determining the industry-based metrics that the entity discloses, the entity shall refer to and consider the applicability of the industry-based metrics associated with disclosure topics described in the Industry-based Guidance on Implementing IFRS S2.

Clicmate-related targets

33 An entity shall disclose the quantitative and qualitative climate-related targets it has set to monitor progress towards achieving its strategic goals, and any targets it is required to meet by law or regulation, including any greenhouse gas emissions targets. For each target, the entity shall disclose:

(a) the metric used to set the target (see paragraphs B66–B67);

(b) the objective of the target (for example, mitigation, adaptation or conformance with science-based initiatives);

(c) the part of the entity to which the target applies (for example, whether the target applies to the entity in its entirety or only a part of the entity, such as a specific business unit or specific geographical region);

(d) the period over which the target applies;

(e) the base period from which progress is measured;

(f) any milestones and interim targets;

(g) if the target is quantitative, whether it is an absolute target or an intensity target; and

(h) how the latest international agreement on climate change, including jurisdictional commitments that arise from that agreement, has informed the target.

34 An entity shall disclose information about its approach to setting and reviewing each target, and how it monitors progress against each target, including:

(a) whether the target and the methodology for setting the target has been validated by a third party;

(b) the entity’s processes for reviewing the target;

(c) the metrics used to monitor progress towards reaching the target; and

(d) any revisions to the target and an explanation for those revisions.

35 An entity shall disclose information about its performance against each climate-related target and an analysis of trends or changes in the entity’s performance.

36 For each greenhouse gas emissions target disclosed in accordance with paragraphs 33–35, an entity shall disclose:

(a) which greenhouse gases are covered by the target.

(b) whether Scope 1, Scope 2 or Scope 3 greenhouse gas emissions are covered by the target.

(c) whether the target is a gross greenhouse gas emissions target or net greenhouse gas emissions target. If the entity discloses a net greenhouse gas emissions target, the entity is also required to separately disclose its associated gross greenhouse gas emissions target (see paragraphs B68–B69).

(d) whether the target was derived using a sectoral decarbonisation approach.

(e) the entity’s planned use of carbon credits to offset greenhouse gas emissions to achieve any net greenhouse gas emissions target. In explaining its planned use of carbon credits the entity shall disclose information including, and with reference to paragraphs B70–B71:

(i) the extent to which, and how, achieving any net greenhouse gas emissions target relies on the use of carbon credits;

(ii) which third-party scheme(s) will verify or certify the carbon credits;

(iii) the type of carbon credit, including whether the underlying offset will be nature-based or based on technological carbon removals, and whether the underlying offset is achieved through carbon reduction or removal; and

(iv) any other factors necessary for users of general purpose financial reports to understand the credibility and integrity of the carbon credits the entity plans to use (for example, assumptions regarding the permanence of the carbon offset).

37 In identifying and disclosing the metrics used to set and monitor progress towards reaching a target described in paragraphs 33–34, an entity shall refer to and consider the applicability of cross-industry metrics (see paragraph 29) and industry-based metrics (see paragraph 32), including those described in an applicable IFRS Sustainability Disclosure Standard, or metrics that otherwise satisfy the requirements in IFRS S1.

-

European Sustainability Reporting Standards – Esrs E1 – Climate Change

The European Sustainability Reporting Standards has topic-specific standards on climate change, which includes disclosure on governance as one of the four pillars for climate-related disclosure (Governance, Strategy, Impact, Risk and Opportunity Management, and Metrics and Targets). It should be implemented in conjunction with the general disclosures required in the cross-cutting ESRS 2 General Disclosures.

EUROPEAN SUSTAINABILITY REPORTING STANDARDS – ESRS E1 – CLIMATE CHANGE (EXCEPRT)

ESRS 2 General disclosures

12. The requirements of this section should be read and applied in conjunction with the disclosures required by ESRS 2 on Chapter 2 Governance, Chapter 3 Strategy and Chapter 4 Impact, risk and opportunity management. The resulting disclosures shall be presented in the sustainability statement alongside the disclosures required by ESRS 2, except for ESRS 2 SBM-3 Material impacts, risks and opportunities and their interaction with strategy and business model, for which the undertaking may, in accordance with ESRS2 paragraph 46, present the disclosures alongside the other disclosures required in this topical standard.

Disclosure Requirement E1-6 – Gross Scopes 1, 2, 3 and Total GHG emissions

44. The undertaking shall disclose in metric tonnes of CO2eq its45: (a) gross Scope 1 GHG emissions; (b) gross Scope 2 GHG emissions; (c) gross Scope 3 GHG emissions; and (d) total GHG emissions.

45. The objective of the Disclosure Requirement in paragraph 44 in respect of: (a) gross Scope 1 GHG emissions as required by paragraph 44 (a) is to provide an understanding of the direct impacts of the undertaking on climate change and the proportion of its total GHG emissions that are regulated under emission trading schemes. (b) gross Scope 2 GHG emissions as required by paragraph 44 (b) is to provide an understanding of the indirect impacts on climate change caused by the undertaking’s consumed energy whether externally purchased or acquired. (c) gross Scope 3 GHG emissions as required by paragraph 44 (c) is to provide an understanding of the GHG emissions that occur in the undertaking’s upstream and downstream value chain beyond its Scope 1 and 2 GHG emissions. For many undertakings, Scope 3 GHG emissions may be the main component of their GHG inventory and are an important driver of the undertaking’s transition risks. (d) total GHG emissions as required by paragraph 44 (d) is to provide an overall understanding of the undertaking’s GHG emissions and whether they occur from its own operations or the usptream and donwstream value chain. This disclosure is a prerequisite for measuring progress towards reducing GHG emissions in accordance with the undertaking’s climate-related targets and EU policy goals. The information from this Disclosure Requirement is also needed to understand the undertaking’s climate-related transition risks.

46. When disclosing the information on GHG emissions required under paragraph 44, the undertaking shall refer to ESRS 1 paragraphs from 62 to 67. In principle, the data on GHG emissions of its associates or joint ventures that are part of the undertaking’s upstream and downstream value chain (ESRS 1 Paragraph 67) are not limited to the share of equity held. For its associates, joint ventures, unconsolidated subsidiaries (investment entities) and contractual arrangements that are joint arrangements not structured through an entity (i.e., jointly controlled operations and assets), the undertaking shall include the GHG emissions in accordance with the extent of the undertaking’s operational control over them.

47. In case of significant changes in the definition of what constitutes the reporting undertaking and its upstream and downstream value chain, the undertaking shall disclose these changes and explain their effect on the year-to-year comparability of its reported GHG emissions (i.e., the effect on the comparability of current versus previous reporting period GHG emissions).

48. The disclosure on gross Scope 1 GHG emissions required by paragraph 44 (a) shall include: (a) the gross Scope 1 GHG emissions in metric tonnes of CO2eq; and (b) the percentage of Scope 1 GHG emissions from regulated emission trading schemes.

49. The disclosure on gross Scope 2 GHG emissions required by paragraph 44 (b) shall include: (a) the gross location-based Scope 2 GHG emissions in metric tonnes of CO2eq; and (b) the gross market-based Scope 2 GHG emissions in metric tonnes of CO2eq.

50. For Scope 1 and Scope 2 emissions disclosed as required by paragraphs 44 (a) and (b) the undertaking shall disaggregate the information, separately disclosing emissions from: (a) the consolidated accounting group (the parent and subsidiaries); and (b) investees such as associates, joint ventures, or unconsolidated subsidiaries that are not fully consolidated in the financial statements of the consolidated accounting group, as well as contractual arrangements that are joint arrangements not structured through an entity (i.e., jointly controlled operations and assets), for which it has operational control.

51. The disclosure of gross Scope 3 GHG emissions required by paragraph 44 (c) shall include GHG emissions in metric tonnes of CO2eq from each significant Scope 3 category (i.e. each Scope 3 category that is a priority for the undertaking) .

52. The disclosure of total GHG emissions required by paragraph 44 (d) shall be the sum of Scope 1, 2 and 3 GHG emissions required by paragraphs 44 (a) to (c). The total GHG emissions shall be disclosed with a disaggregation that makes a distinction of: (a) the total GHG emissions derived from the underlying Scope 2 GHG emissions being measured using the location-based method; and 76 (b) the total GHG emissions derived from the underlying Scope 2 GHG emissions being measured using the market-based method. GHG Intensity based on net revenue

53. The undertaking shall disclose its GHG emissions intensity (total GHG emissions per net revenue).

54. The disclosure on GHG intensity required by paragraph 53 shall provide the total GHG emissions in metric tonnes of CO2eq (required by paragraph 44 (d)) per net revenue.

55. The undertaking shall disclose the reconciliation to the relevant line item or notes in the financial statements of the net revenue amounts (the denominator in the calculation of the GHG emissions intensity required by paragraph 53).Source: Consult the full text of the Metrics and Targets section of the European Sustainability Reporting Standards ESRS E1 on Climate Change here.

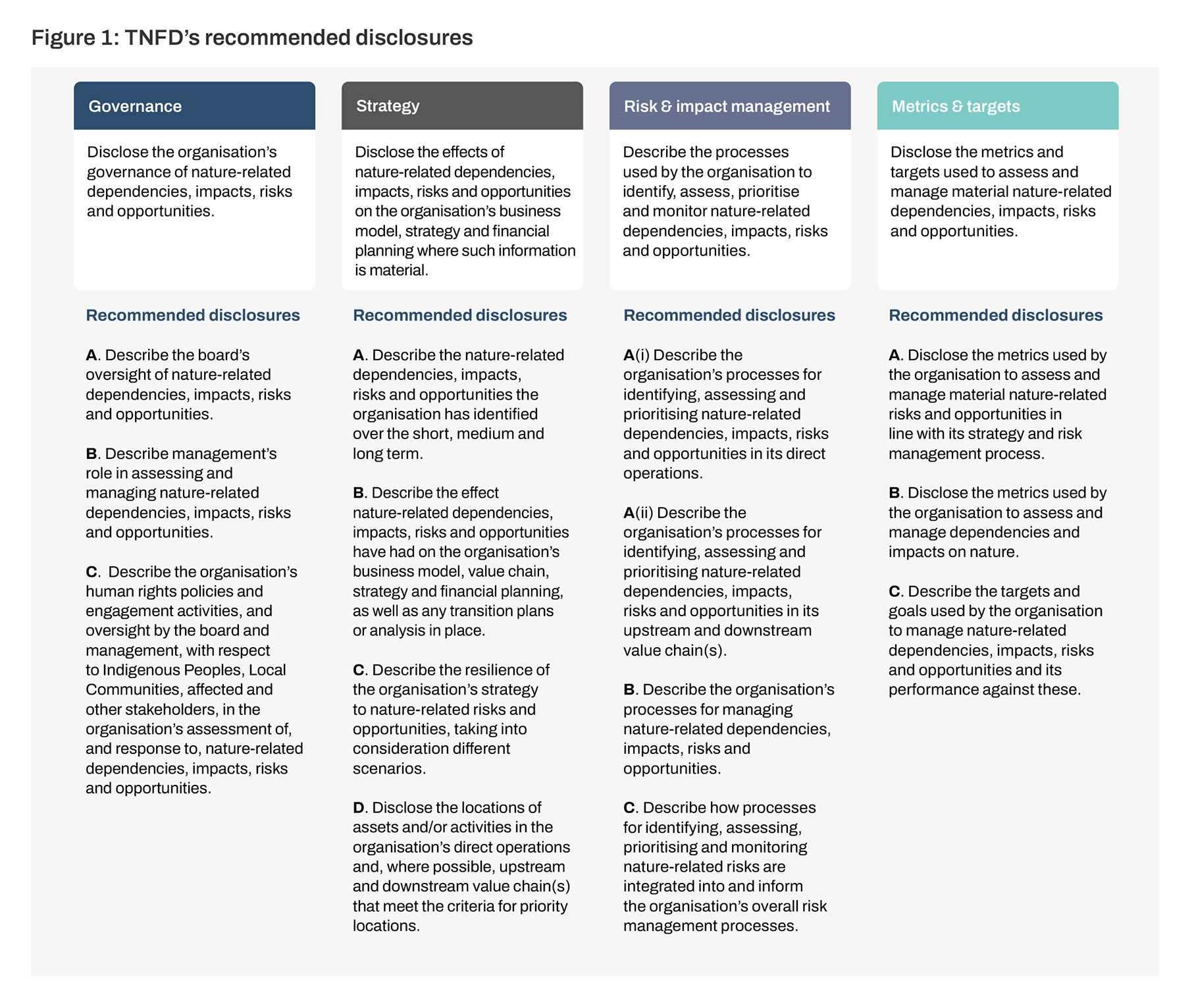

Task Force on Nature-Related Financial DisclosuresNature loss poses both risks and opportunities for businesses now and in the future. More than half of the world’s economic output—US$44 trillion of economic value generation—is moderately or highly dependent on nature. The Taskforce on Nature-Related Financial Disclosures (TNFD) was announced in July 2020 to develop and deliver a risk management and disclosure framework for organizations to report and act on evolving nature-related risks, with the ultimate aim of supporting a shift in global financial flows away from nature-negative outcomes and toward nature-positive outcomes. In September 2023, TNFD launched the final Recommendations of the Taskforce on Nature-related Financial Disclosures, aligned with TCFD’s four-pillar structure.