Extra-financial analysis systematically assesses a company's environmental, social, and governance (ESG) policies. By identifying and monitoring the performance of material sustainability issues, it can translate sustainability performance into financial performance.

Extrafinancial analysis focuses on the impact of sustainability on the main elements of financial valuation:

- Impact on revenue and costs;

- Impact on assets and liabilities;

- Impact on cost of capital;

- Projected (proforma) financial results and scenario planning.

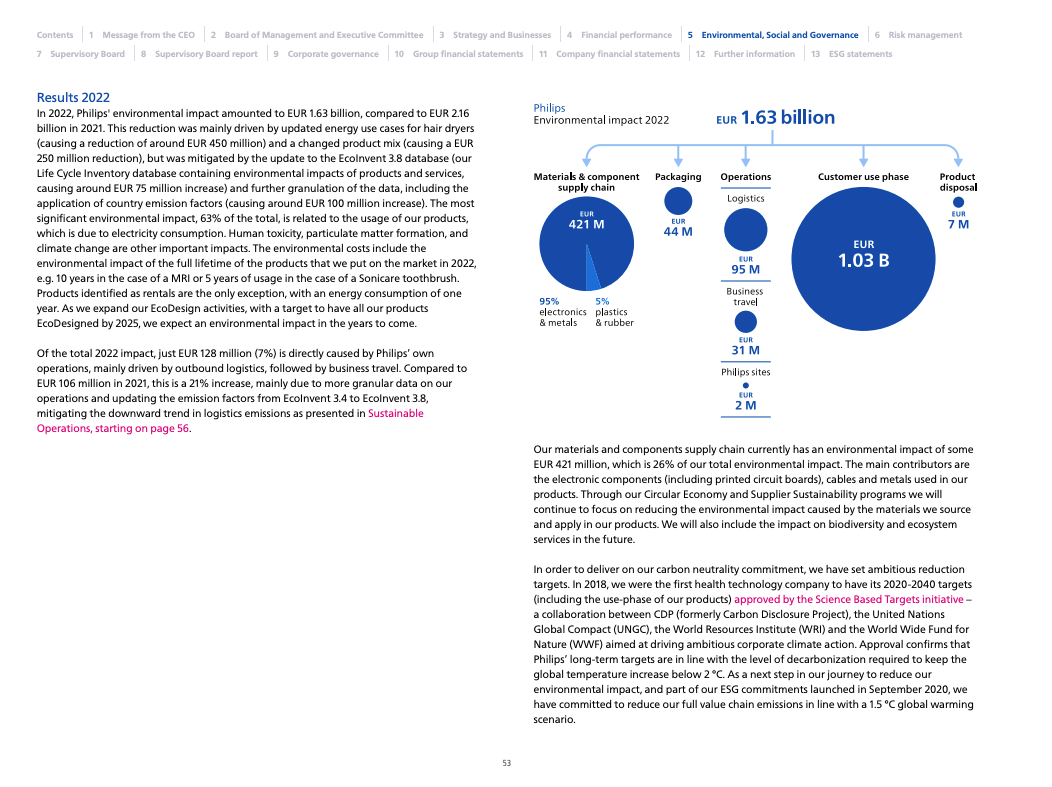

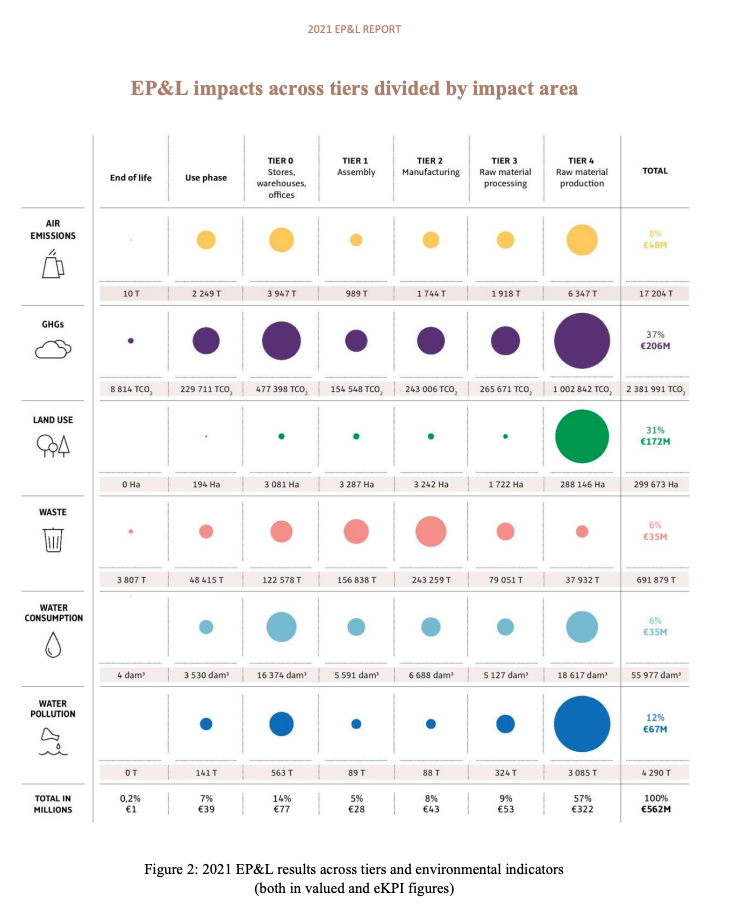

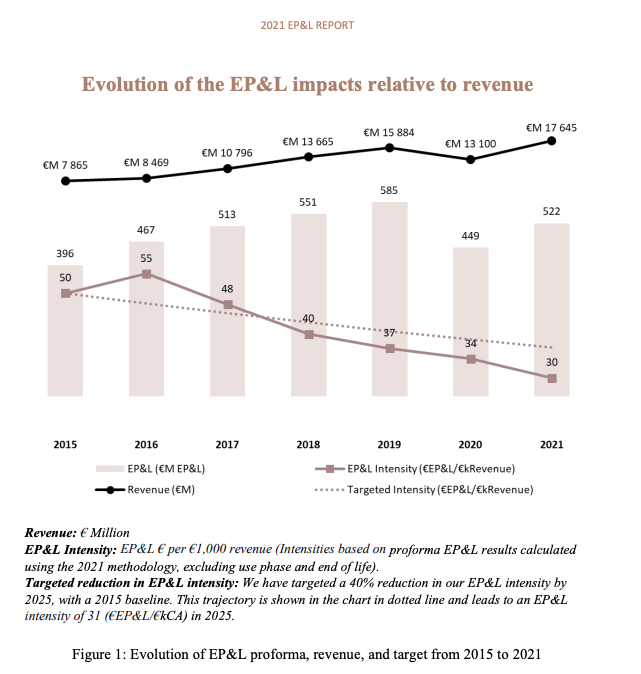

Extrafinancial analysis incorporates several emerging practices trying to account for the financial impact of sustainability, including:

- Efficiency and effectiveness of sustainability solutions;

- Full cost accounting and environmental profit and loss;

- Internal price on carbon and other externalities; and

- Planning for various scenarios of climate warming.

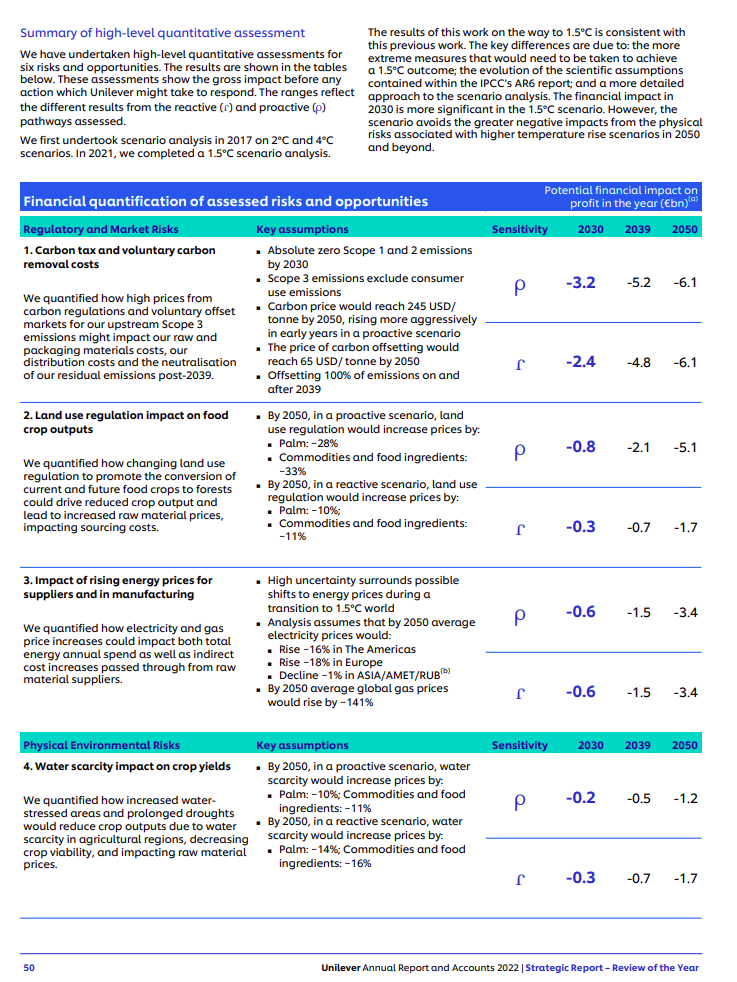

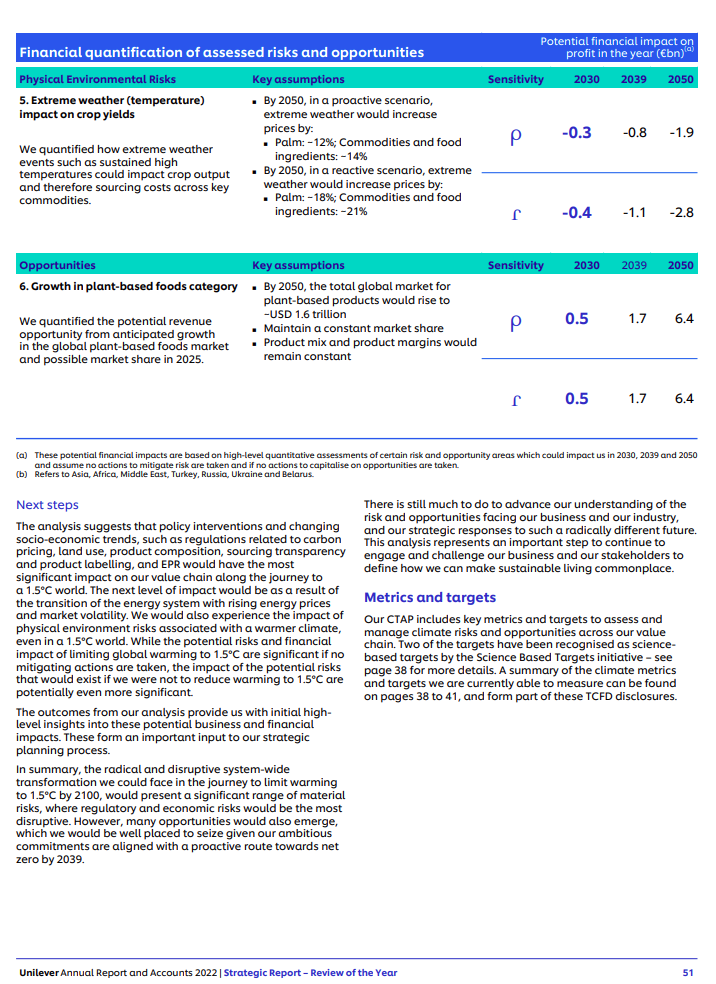

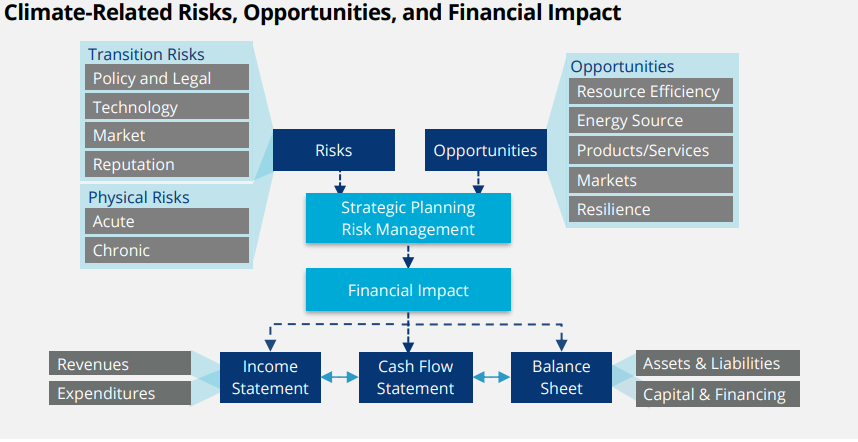

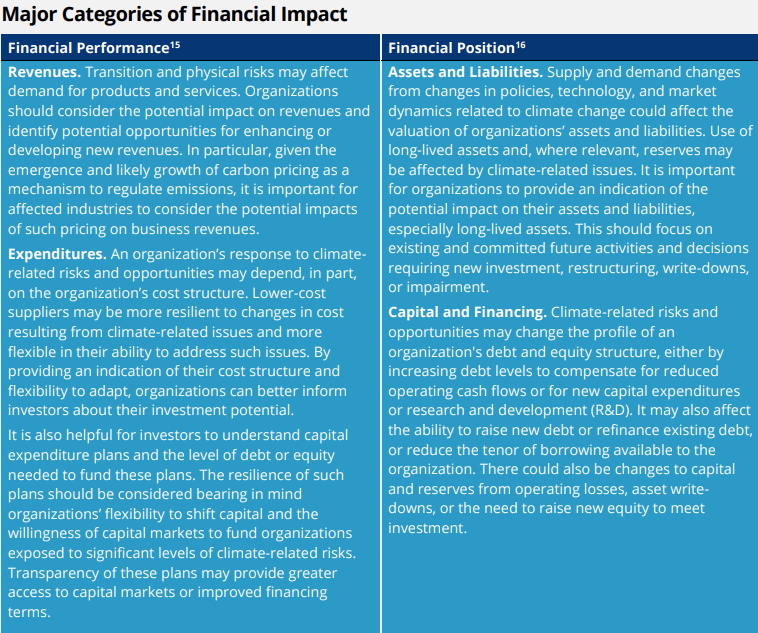

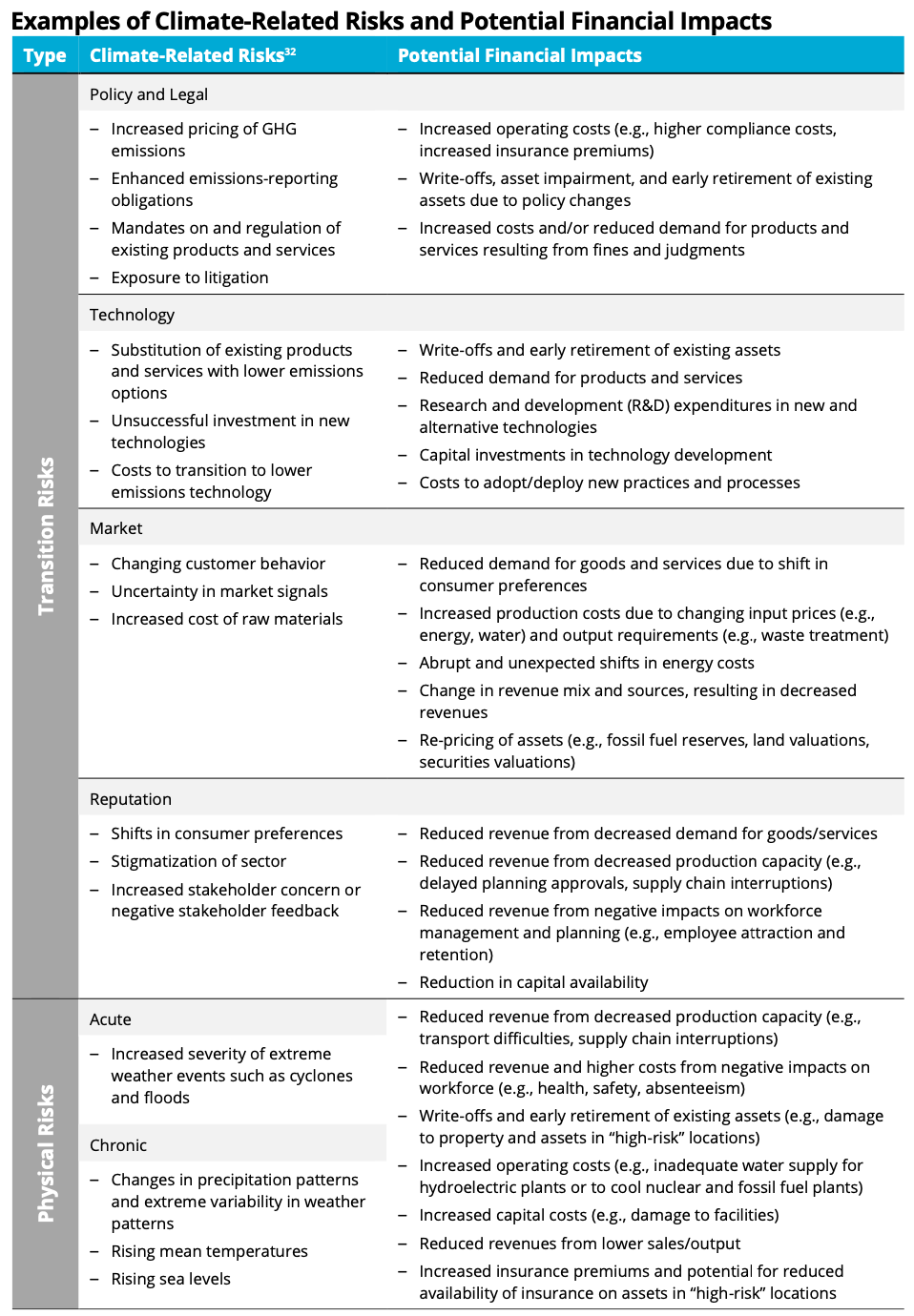

In the figures below, the Task Force on Climate-related Financial Disclosure (TFCD) provides:

- A detailed framework for analysis of the financial impacts of climate change;

- Various climate-related risks and opportunities and how they are likely to impact financial performance and position, including in the income statement, cash flow statement, and balance sheet.

Financial Impact of Climate Change

Climate change poses significant physical or transition risks to most, if not all, companies, whether in the short, medium, or long-term and thus needs to be treated and reported in the same manner as other business risks that companies face. However, it is essential to acknowledge that climate change also has the potential to create opportunities for business. These need to be worked through and considered as part of a company's strategic planning and risk management processes. Then, depending on the action or inaction taken by the company, these risks and opportunities will have a financial impact on the company's position, performance, or future outlook.

-

Climate-related risks, opportunities, and financial impact

Source: Task Force on Climate-Related Financial Disclosures (TCFD). 2021. Implementing the Recommendations of the Task Force on Climate-Related Financial Disclosures. New York: TCFD, 9. -

Major categories of financial impact

Source: Task Force on Climate-Related Financial Disclosures (TCFD). 2021. Implementing the Recommendations of the Task Force on Climate-Related Financial Disclosures. New York: TCFD, 10. -

Examples of climate-related risks and potential financial impact

Source: Task Force on Climate-Related Financial Disclosures (TCFD). 2017. Recommendations of the Task Force on Climate-related Financial Disclosures. New York: TCFD, 10. -

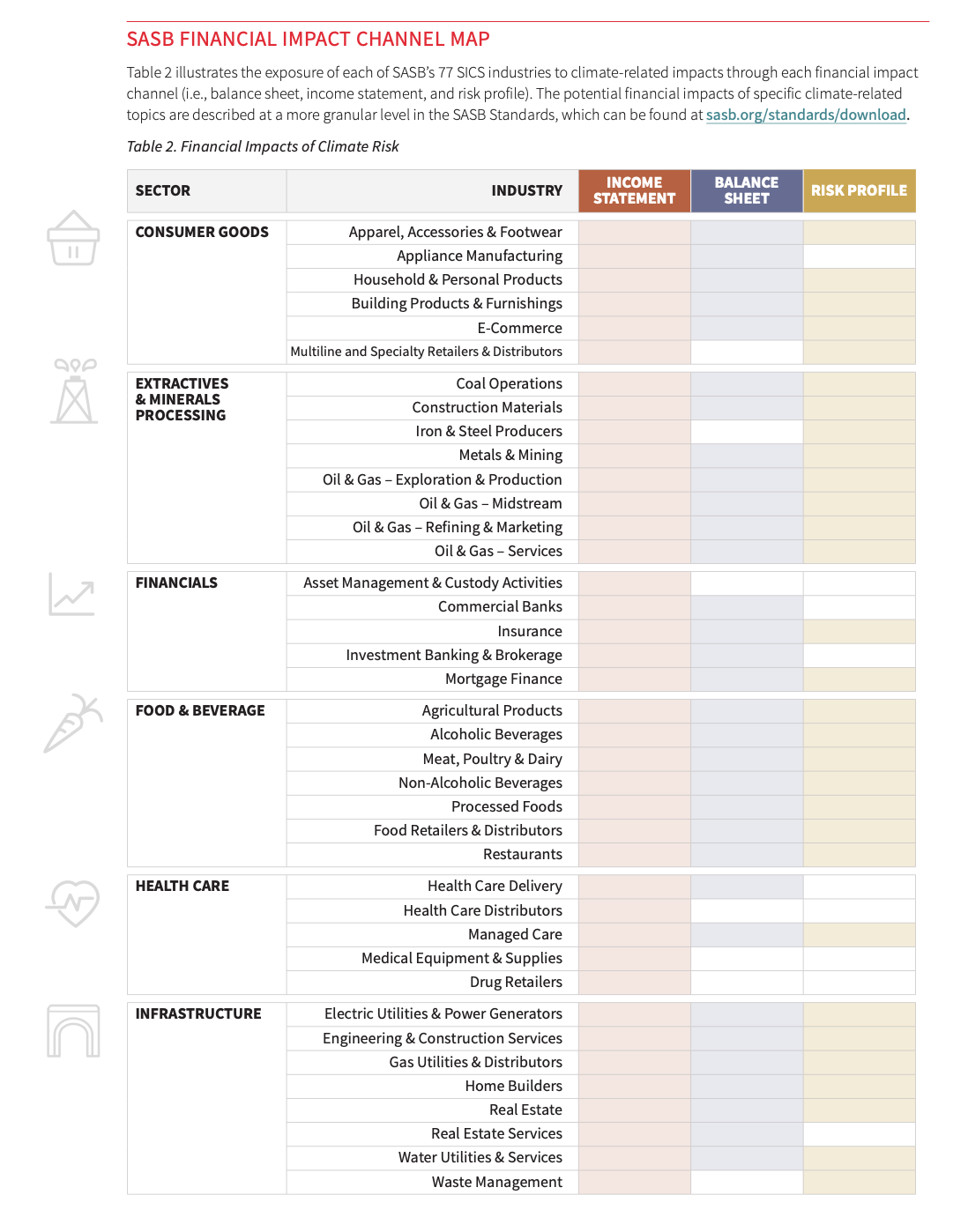

Financial Impact of Climate Risks – SASB Standards

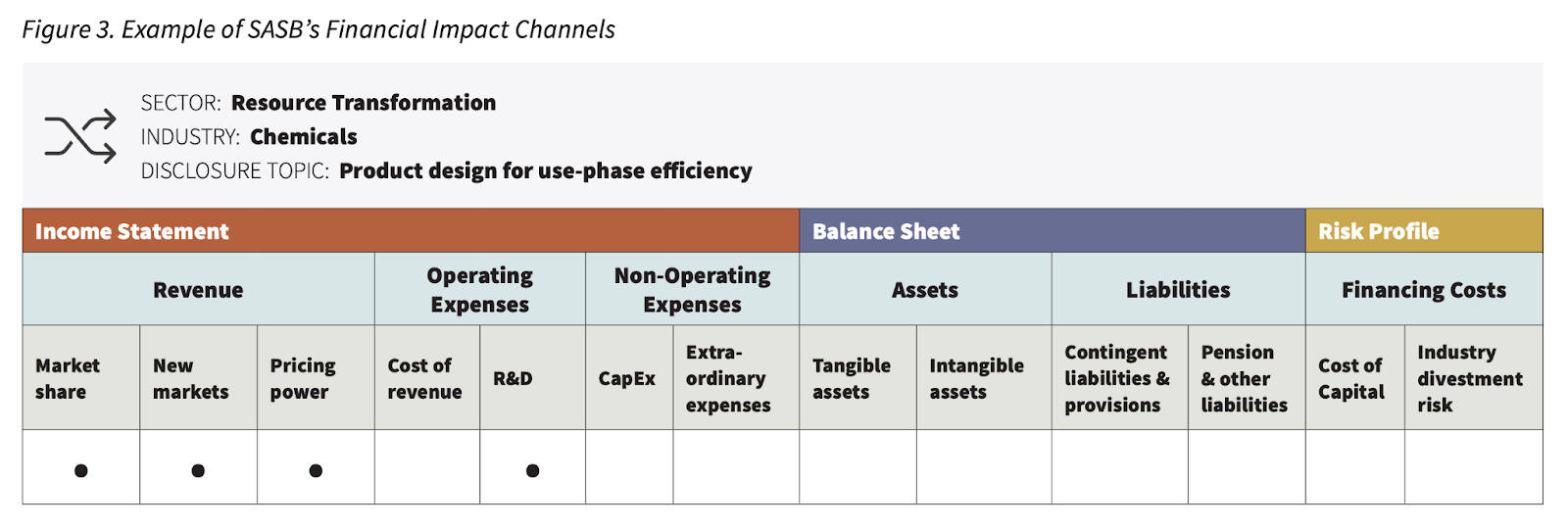

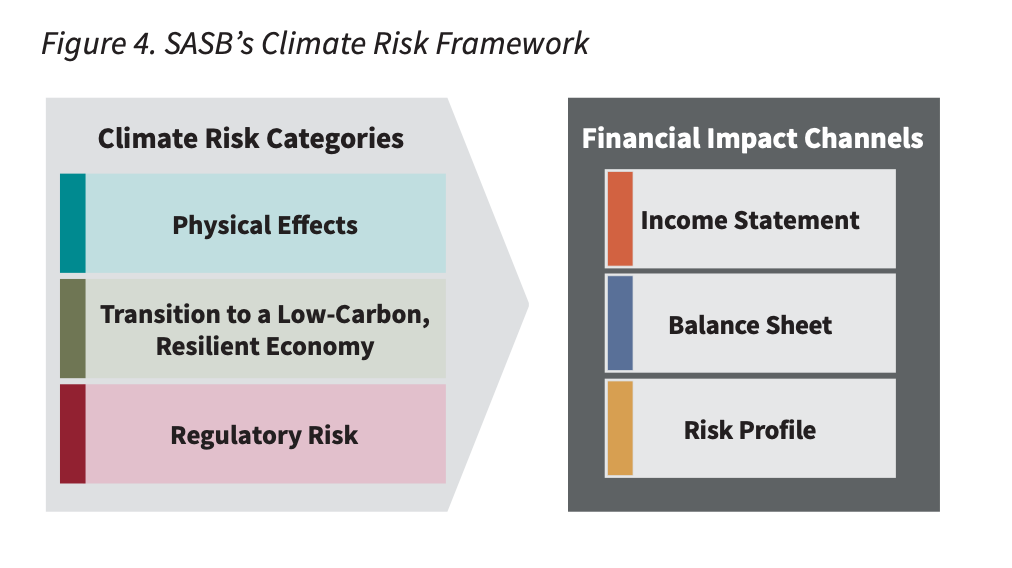

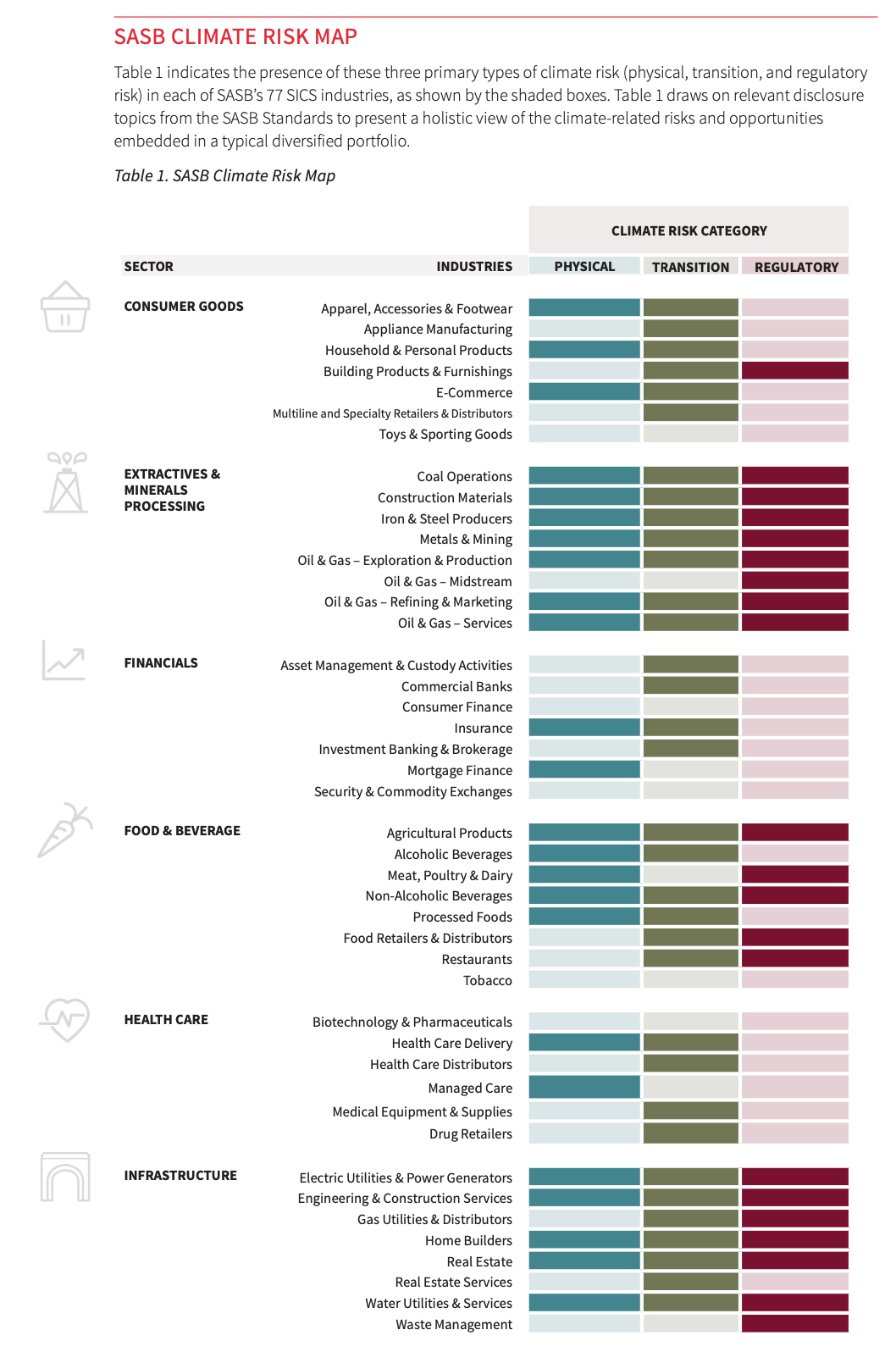

The excerpts from the Sustainability Accounting Board (SASB)’s Climate Risk Technical Bulletin provide a detailed analysis of the financial impact of climate change in 10 sectors and 79 industries.

SASB identifies four distinct channels of financial impact for sustainability issues, including climate risk: Revenue Impacts and Operating Costs, Asset Value, and Financing Costs.

Source: Sustainability Accounting Standards Board (SASB) Standards. Copyright © 2022 by the Value Reporting Foundation. Sustainability Accounting Board (SASB)’s Climate Risk Technical Bulletin. San Francisco: SASB Standards, 9.

Source: Sustainability Accounting Standards Board (SASB) Standards. Copyright © 2022 by the Value Reporting Foundation. Sustainability Accounting Board (SASB)’s Climate Risk Technical Bulletin. San Francisco: SASB Standards, 10.

Source: Sustainability Accounting Standards Board (SASB) Standards. Copyright © 2022 by the Value Reporting Foundation. Sustainability Accounting Board (SASB)’s Climate Risk Technical Bulletin. San Francisco: SASB Standards, 14

Source: Sustainability Accounting Standards Board (SASB) Standards. Copyright © 2022 by the Value Reporting Foundation. Sustainability Accounting Board (SASB)’s Climate Risk Technical Bulletin. San Francisco: SASB Standards, 17.

-

Task Force for Climate-related Financial Disclosures (TFCD) Recommendations

In December 2015, the Financial Stability Board (FSB) — an international body that monitors and makes recommendations about the global financial system — launched the Task Force for Climate-Related Financial Disclosures (TFCD) to improve and increase reporting of climate-related financial information.

The TCFD recommendations were launched in 2017 “to help identify the information needed by investors, lenders, and insurance underwriters to appropriately assess and price climate-related risks and opportunities.” The recommendations were intended for voluntary implementation, but they are increasingly becoming mandatory, being adopted in markets such as Brazil, Japan, Singapore, Switzerland, the United Kingdom, and others. More than 3,800 companies disclosed TCFD reports as of October 2022.

For additional resources on TCFD, visit the TCFD Knowledge Hub and the TCFD publications web page.

Recommendations of the TFCD on Climate-related Disclosure and Scenario Analysis

“The disclosure of organizations’ forward-looking assessments of climate-related issues is important for investors and other stakeholders in understanding how vulnerable individual organizations are to transition and physical risks and how such vulnerabilities are or would be addressed. As a result, the Task Force believes that organizations should use scenario analysis to assess potential business, strategic, and financial implications of climate-related risks and opportunities and disclose those, as appropriate, in their annual financial filings.”Source: Task Force on Climate-Related Financial Disclosures (TCFD). 2017. Recommendations of the Task Force on Climate-related Financial Disclosures. New York: TCFD, 25.

-

UNEP FI’s 2023 Climate Risk Landscape report

UNEP FI’s 2023 Climate Risk Landscape report assists financial institutions in better understanding the diverse and dynamic landscape of climate risk tools. The report explores the major market trends in physical risk and transition risk tools and provides detailed analysis on dozens of individual tools.

-

IFC the First Development Institution to Make TCFD Disclosure on Climate Risks and Opportunities

IFC is the first multilateral development institution to disclose climate-related risks and opportunities under the guidelines of the Task Force on Climate-related Financial Disclosure (TCFD), as part of its annual report since 2018, taking steps to identify and mitigate climate-related financial risks and opportunities.

-

International Sustainability Standards Board (ISSB) Standards and European Sustainability Reporting Standards (ESRS)

In recent years, momentum and efforts have grown to develop globally harmonized sustainability reporting standards. These efforts resulted in the development of the IFRS Sustainability Disclosure Standards, a global baseline for sustainability disclosures and the European Sustainability Reporting Standards. Both disclosure standards have topic-specific standards for reporting of climate-related information: IFRS S2 Climate-Related Disclosures and ESRS E1 Climate Change.

The IFRS Foundation’s International Sustainability Standards Board (ISSB) takes over responsibility for monitoring progress of companies’ climate-related disclosures from the Financial Stability Board’s (FSB) Task Force on Climate-related Financial Disclosures (TCFD) as of January 2024.

In practice this means that companies applying ISSB IFRS S1 and IFRS S2 will meet the TCFD recommendations as the recommendations are fully incorporated into the ISSB Standards. ISSB Standards requirements go beyond TCFD recommendations.

The IFRS Foundation has published a comparison of the requirements in IFRS S2 Climate-related Disclosures and the TCFD recommendations.

According to the ISSB’s announcement, companies can continue to use the TCFD recommendations should they choose to do so, and some companies may still be required to use the TCFD recommendations.

The Taskforce on Nature-related Financial Disclosures (TNFD) released in March 2023 the fourth version of its beta framework for the disclosure of nature-related information