Beyond the Balance Sheet Disclosure and Transparency Toolkit

IFC's Disclosure and Transparency Toolkit fills an information gap between companies, their investors, and stakeholders on ESG practices, focusing on emerging markets.

Going Beyond the Balance Sheet

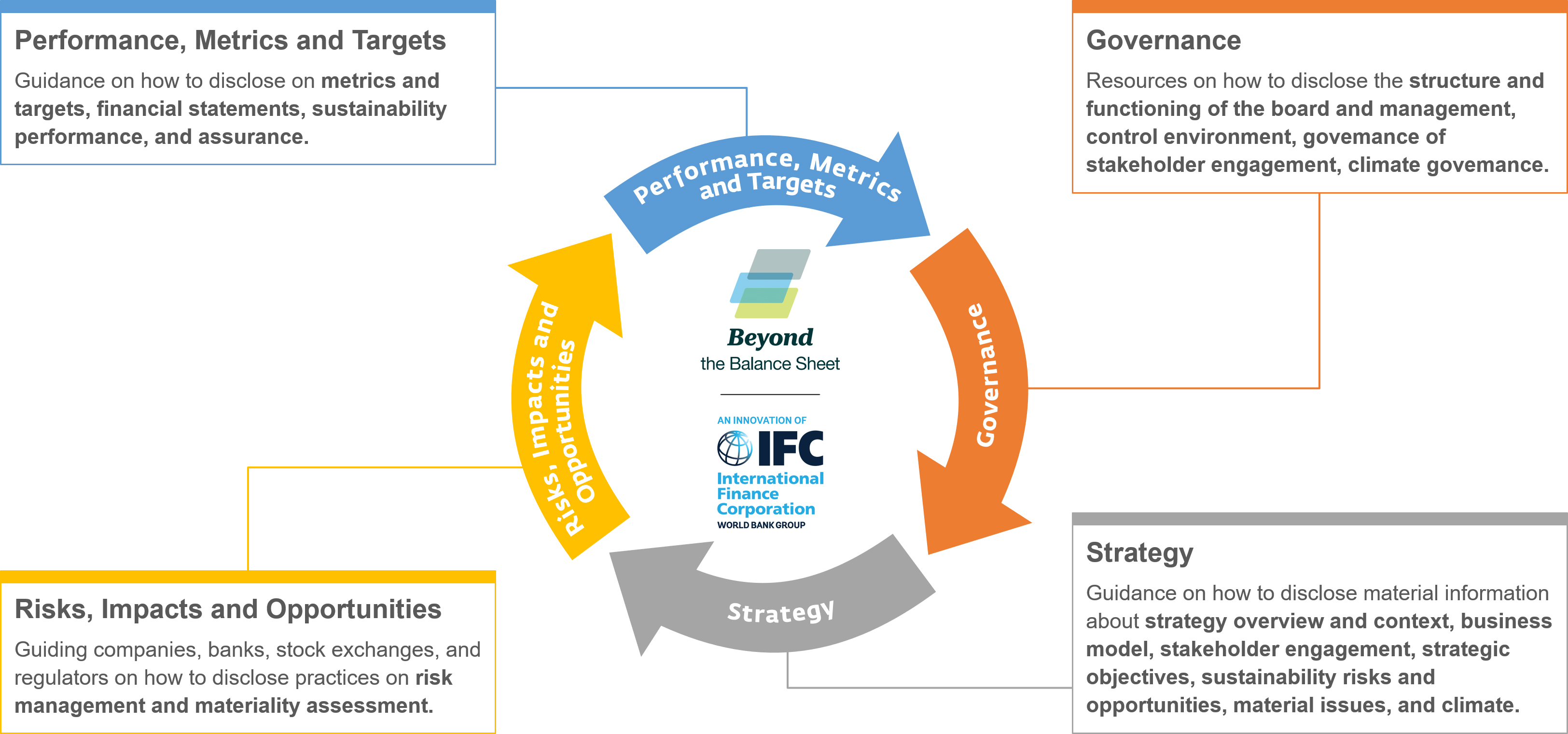

The Toolkit provides companies with step-by-step guidance on how to prepare comprehensive and integrated annual reports. It goes beyond traditional financial reporting and addresses the modern corporate value creation pillars – strategy, governance, risk management, and performance that integrate material sustainability (ESG) factors.

Comprehensive and Integrated Reporting. Meeting information needs of all stakeholders.

Emerging markets companies and market players use the toolkit to promote higher standards of disclosure and transparency - working with companies, banks, stock exchanges, and regulators. The goal is to improve investor confidence and mitigate some inherent risks of investing in emerging markets and sustainable development.

The Toolkit supports IFC's strategy, which aims to create markets in emerging economies and unlock the trillions in annual investment needed to realize the World Bank's twin goals of ending extreme poverty and promoting shared prosperity—and achieve the United Nations Sustainable Development Goals.

LEARN MORE about IFC’s strategic alignment with the SDGs here.

Progressive Levels of Disclosure

The toolkit helps companies prepare disclosures adapted to their size, organization, and context of operation. Companies can use the toolkit in modules to implement different depths of reporting in each pillar and help companies gradually improve their disclosure practices.

The toolkit provides a model structure of an annual report. The model structure aligns with the main recommendations of the governance, strategy, risk management (impact, risk, and opportunity management), and metrics and targets pillars of the IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and IFRS S2 Climate-Related Disclosures and Delegated Act for the first set of European Sustainability Reporting Standards (ESRS). It will help your company prepare to disclose under the new standards.

The toolkit draws on IFC's experience in emerging markets investment and its Environmental and Social Sustainability Performance Standards and Corporate Governance Methodology. It incorporates all major global reporting standards and frameworks (incl. GRI, EFRAG, ISSB, SASB, TCFD) and best practices from leading companies.

- Companies based in or with significant operations in emerging markets;

- Investors and banks for valuation and credit analyses, including ESG factors;

- Regulators and stock exchanges for codes, guidance and standards;

- Director training organization for capacity building on disclosure and transparency;

- Academia.

The Toolkit won the WBG 2019 President’s Award for Excellence and IFC KNOWbel Award for WBG collaboration.

IFC and the World Bank won the UNCTAD ISAR 2022 Award in International Category for “Improving the Sustainability Reporting in Emerging Markets”. Watch the video about the Program.

IFC, UNSSE and CDP Training Program Wins the Climate Leadership Award at the 2023 Finance for the Future Awards. Read more about the award here.

- 25000: People trained;

- 150: Capacity building events;

- 40: Codes and scorecards;

- 20: ESG reporting guidelines;

- 5: Special topics (e.g. Climate, COVID);

- 3: Tools (e.g. E-learning);

- 5: Languages.

The toolkit was first introduced in print and translated in 4 different languages:

- English;

- Bahasa (Indonesia);

- မြန်မာဘာသာ (Myanmar);

- ខ្មែរ (Khmer);

- Tiếng Việt (Vietnam).

Video

Introduction to Beyond the Balance Sheet Platform

Recognition for the Winner of the UNCTAD ISAR Award for Improving Sustainability Reporting in Emerging Markets

Supplementary resources:

- Publication: Analysis of Best Practices in Environmental Disclosure Policies, December 2022;

- Tip Sheet: Expert Insights – ESG Disclosure and Transparency Online, Expanding Pathways for Sustainable Growth in Emerging Markets, June 2021;

- Disclosure and Transparency in Crisis - Increasing Resilience and Building Trust During and After COVID-19, February 2021;

- Networks: IFC, U.N. to Support Stock Exchanges in Advancing SDGs and Climate Efforts, May 2021 and IFC and UN Partnership Enhances ESG Disclosure and Transparency in Emerging Markets, March 2019;

- Roundtable Report: Beyond the Balance Sheet: ESG Integration, ESG Disclosure, and ESG Regulation, January 24, 2018;

- Webinars and Training;

- Publications;

- Online courses;

- News.

-

Governance

Increasingly, companies are considering environmental, social, and governance (ESG) matters to manage risks and capitalize on opportunities. By reporting on its governance practices and policies, risk oversight, internal control system, internal and external audit, the role of the board and management, companies help investors and other stakeholders understand how companies are addressing sustainability issues.

-

Strategy

A corporate strategy is a plan for future performance, a road map to achieving the company’s long-term goals and objectives. By reporting on progress in implementing strategic plans and delivering on long-term goals, companies provide important forward-looking information, transparency, and accountability to investors and other stakeholders.

-

Risk, Impacts, and Opportunities Management

Risks and opportunities are key external and internal variables that have a positive or negative influence on a company’s business model and its ability to create value (both financial and nonfinancial). A company does not operate in a vacuum. Its operations, products, and services have a positive or negative impact on its surrounding environment, employees, and clients and the communities in which it operates. Reporting on risks, impacts, and opportunities and how a company manages them helps investors and other stakeholders understand whether the company can address future challenges, reduce its impact, and realize opportunities.

-

Performance, Metrics and Targets

Performance information provides accountability to investors and stakeholders on how the company performs against its strategic goals and objectives. It includes an overall assessment of performance by management and the presentation of detailed financial and sustainability results. By reporting financial and sustainability data, companies provide investors and other stakeholders with decision-useful information and measure progress toward achieving sustainability targets.

For more information about the IFC Beyond the Balance Sheet Toolkit and Platform contact: