Promoting Sustainable Capital Markets

By World Bank Photo Collection: Traders Work On The Floor Of The Ghana Stock Exchange

Disclosure of strategic, governance, and performance information catalyzes sustainable investments. It fuels innovation in sustainable finance, enables better financial analysis, and creates more efficient capital markets.

Innovation in Sustainable Finance

Sustainability Disclosure is Fueling the Growth in Global Sustainable Assets

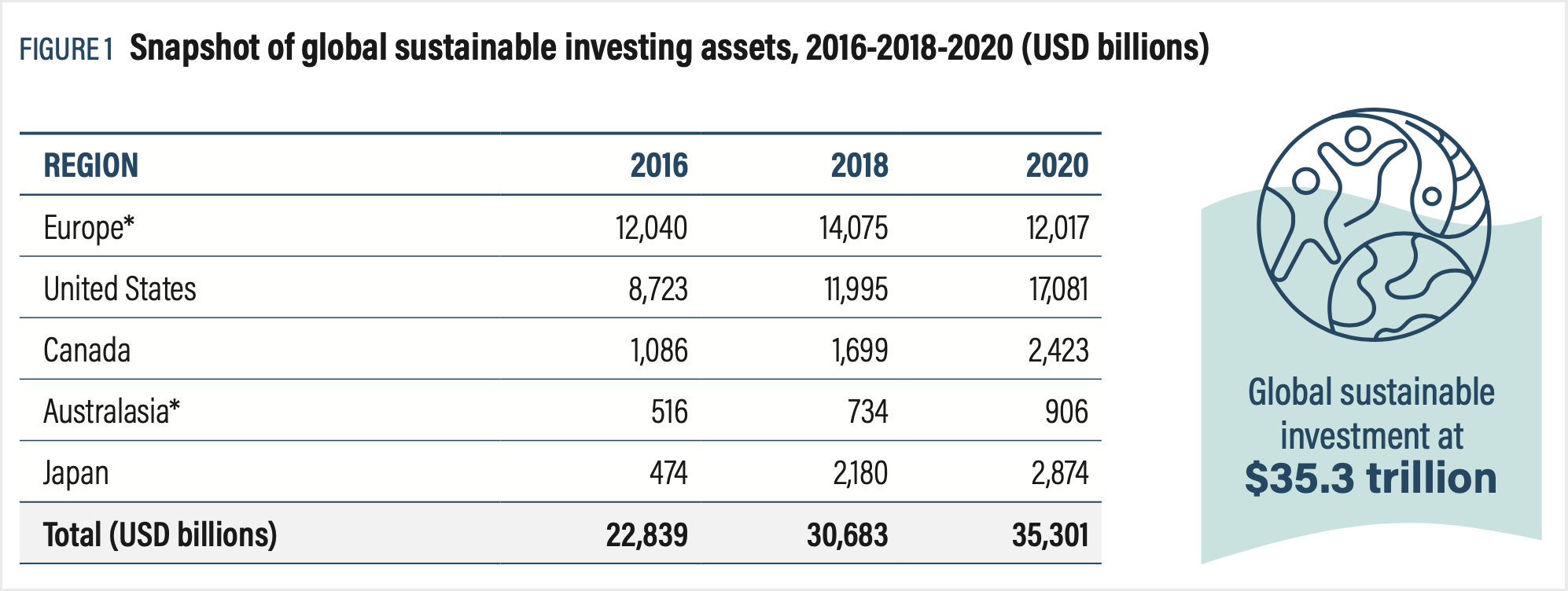

According to the Global Sustainable Investment Alliance, global sustainable assets grew to a record $35.3 trillion in 2020, with a substantial proportion invested in corporate equity or debt.

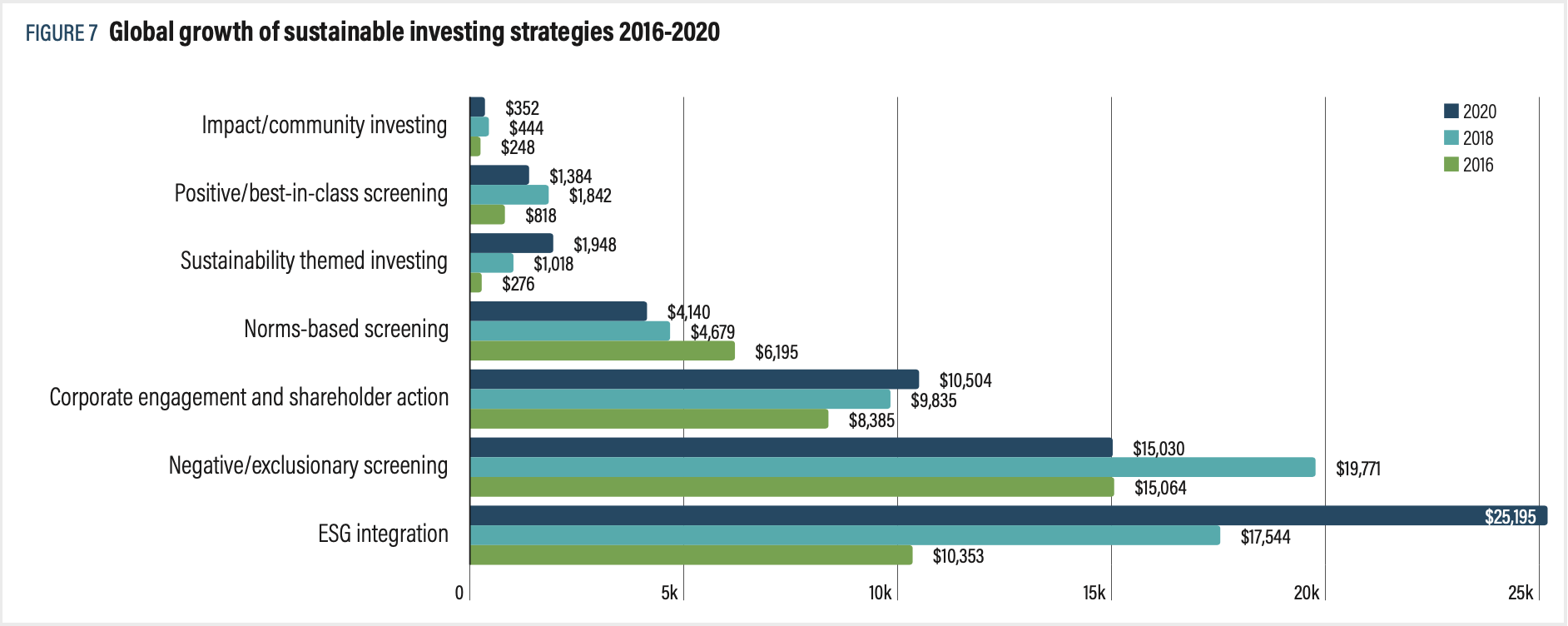

The three most popular investment strategies are:

- ESG Integration;

- Best-in-class screening;

- Corporate engagement.

All three investment strategies require a thorough understanding of companies’ strategies, governance, and performance on sustainability issues. As a result, institutional investors rely on publicly disclosed, easily accessible, and highly reliable ESG data to properly implement these strategies.

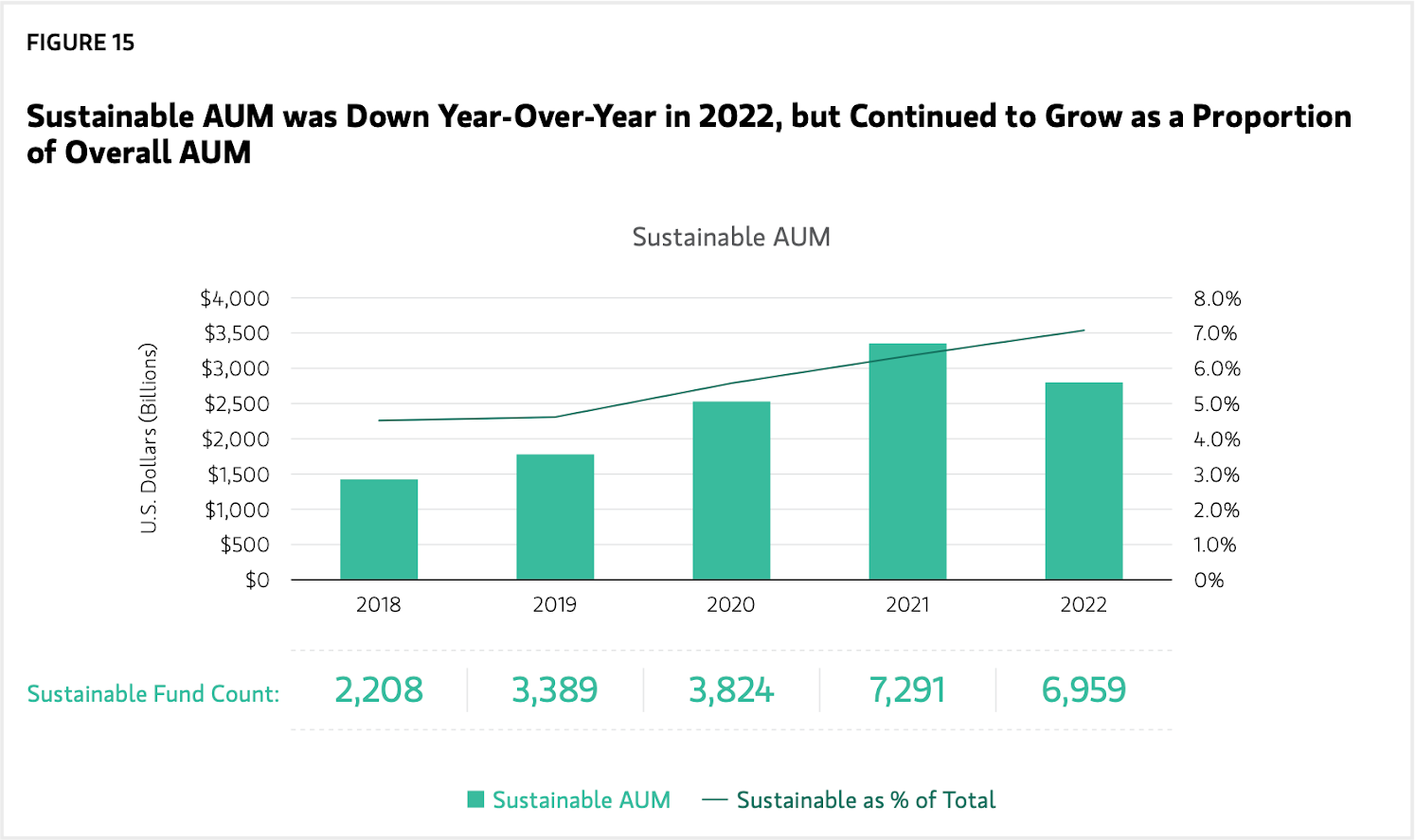

Sustainable assets under management (AUM) continued to grow in 2021. While they experienced a decline in 2022 in absolute terms amid extraordinary market conditions, they continued to grow as a proportion of overall AUM. The chart below shows the growth of sustainable AUM with a narrow focus on funds actively managed for sustainability.

The financial services firm Morningstar classifies funds as sustainable if “...in the prospectus or other regulatory filings, it is described as focusing on sustainability, impact investing, or environmental, social or governance (ESG) factors. Funds must claim to have a sustainability objective and/or use binding ESG criteria for their investment selection. Funds that employ only limited exclusions or only consider ESG factors in a non-binding way are not considered to be a sustainable investment product.” This classification corresponds broadly with the European Sustainable Finance Disclosure Regulation (SFDR) Article 9 definitions.

Impact Investing

IFC—in consultation with a core group of external stakeholders—developed the Operating Principles for Impact Management, which are now followed by over 140 privately and publicly owned funds and institutions. These Principles support the development of the impact investing industry by establishing a common discipline around the management of investments for impact, and promote transparency and credibility by requiring annual disclosures of impact management processes with periodic independent verification.

The Joint Impact Indicators are a harmonized set of indicators for key impact themes – climate, gender and job creation – used by a wide range of impact investors. They are aligned with the leading impact indicator sets: IRIS+ and HIPSO.

Impact investing is an approach that aims to contribute to the achievement of measured positive social and environmental impacts. It has emerged as a significant opportunity to mobilize capital into investments that target measurable positive social, economic, or environmental impact alongside financial returns. A growing number of investors are incorporating impact investments into their portfolios. Many are adopting the SDGs and other goals as a reference point to illustrate the relationship between their investments and impact.

A recent innovation in sustainable finance products is leveraging capital markets transparency, financial intermediation, and financing structuring to make impact measurement more transparent and accountable.

Sustainable finance includes use-of-proceed products with funds allocated to specific projects deemed sustainable. It also includes sustainability-linked products with interest rates tied to ambitious targets in key sustainability areas for the companies. Companies are increasingly using both use-of-proceed and sustainability-linked frameworks to create super green /social structures that maximize the accountability and credibility of social finance.

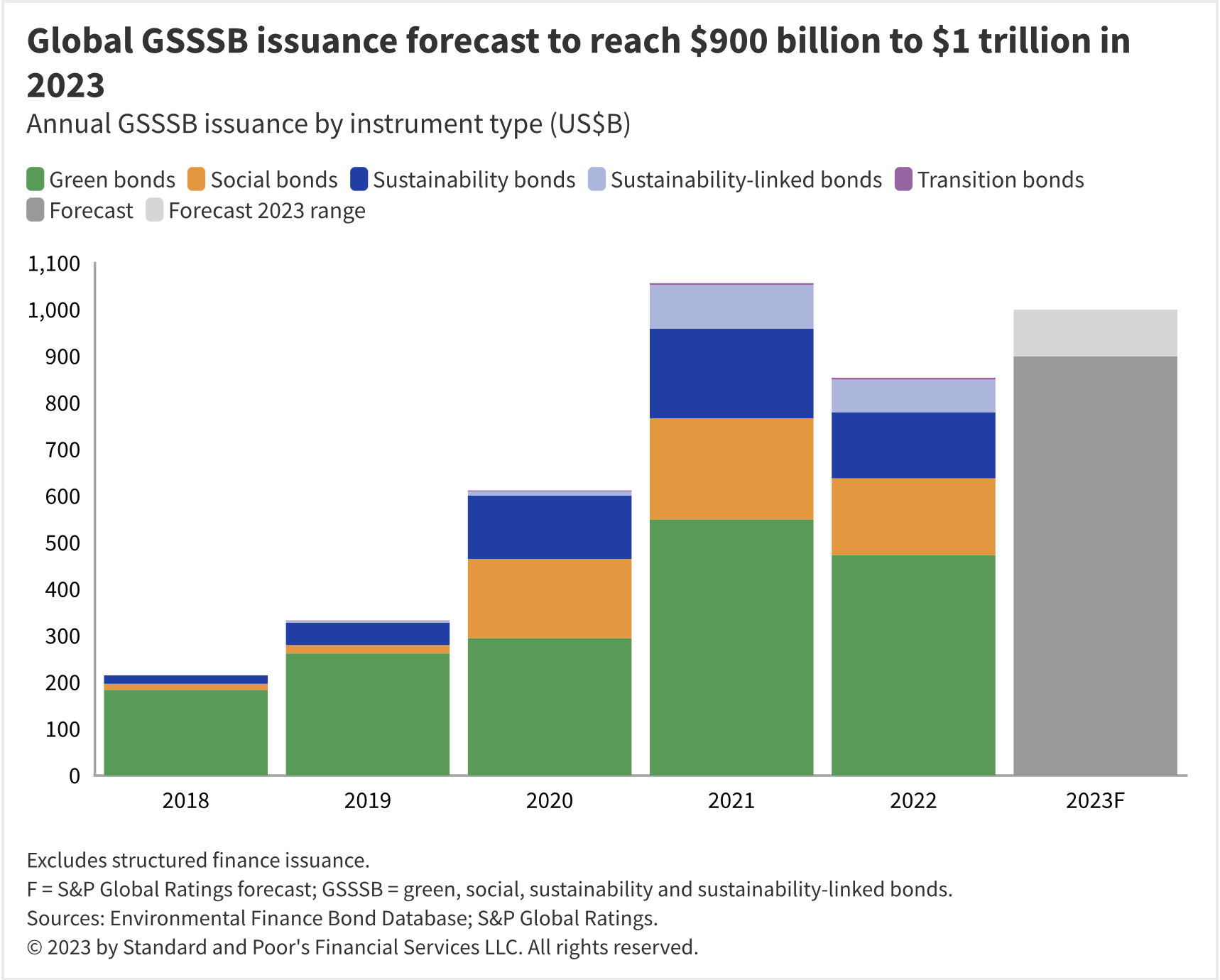

Standard and Poor’s Financial Services forecasts sustainable bond issuance to reach $1 trillion in 2023, representing 14-16% of all global bond issuance.

Use-of-proceeds Finance

Use-of-proceed bonds and loans are financial instruments where the company (borrower) commits to invest the funds raised in pre-established projects and activities deemed impactful. These instruments work in combination with taxonomies of green, social, or sustainable projects or activities.

The International Capital Market Association (ICMA) and the Loan Syndications and Trading Association (LSTA) have established quasi-standard for the issuance of social bonds and loans, respectively, focusing on four core principles or components:

- Use of proceeds;

- Process for project evaluation and selection;

- Management of proceeds;

- Reporting and verification.

Learn More:

- IFC Green Bonds;

- Green, Social and Sustainability Bonds: A High-Level Mapping to the Sustainable Development Goals, ICMA, 2022;

- Guidance for financing the Blue Economy, building on the Green Bond Principles and the Green Loan Principles, IFC, 2022.

Sustainability-linked Finance

Sustainability-linked finance is designed to incentivize the borrower’s (company) achievement of environmental, social, or governance targets through pricing incentives. It is a fast growing market in sustainable finance, gaining traction with corporate issuers and investors looking to broaden the scope of sustainable finance and reward companies’ sustainability performance and outcomes.

It includes a range of corporate debt instruments – bonds, loans, credit – that are linked structurally to the company’s performance on predetermined sustainability goals and targets – allowing general-purpose uses of proceeds and supporting an integrated management and governance of sustainability.

Sustainability-linked finance has several advantages:

- Raises the credibility of sustainable finance by rewarding overall company sustainability performance and outcomes;

- Promotes integrated management and governance of sustainability;

- Opens the sustainable bond market to companies from diverse industries, geographies, and sustainability focus.

Learn More:

- ICMA, Sustainability-Linked Bond Principles Related Questions, June 2022

- ICMA, Sustainability-Linked Bond Principles Related Questions, September 2023

- ICMA, Market Integrity and Greenwashing Risks in Sustainable Finance

- Sustainability-Linked Finance: Expanding Impact in Emerging Markets, Infrastructure, IFC

- Sustainability-Linked Finance—Mobilizing Capital for Sustainability in Emerging Markets, IFC, 2022

- Social KPIs Matter - Setting Meaningful Indicators for Sustainability-Linked Finance, IFC, 2023

- International Capital Market Association (ICMA) Sustainable Finance

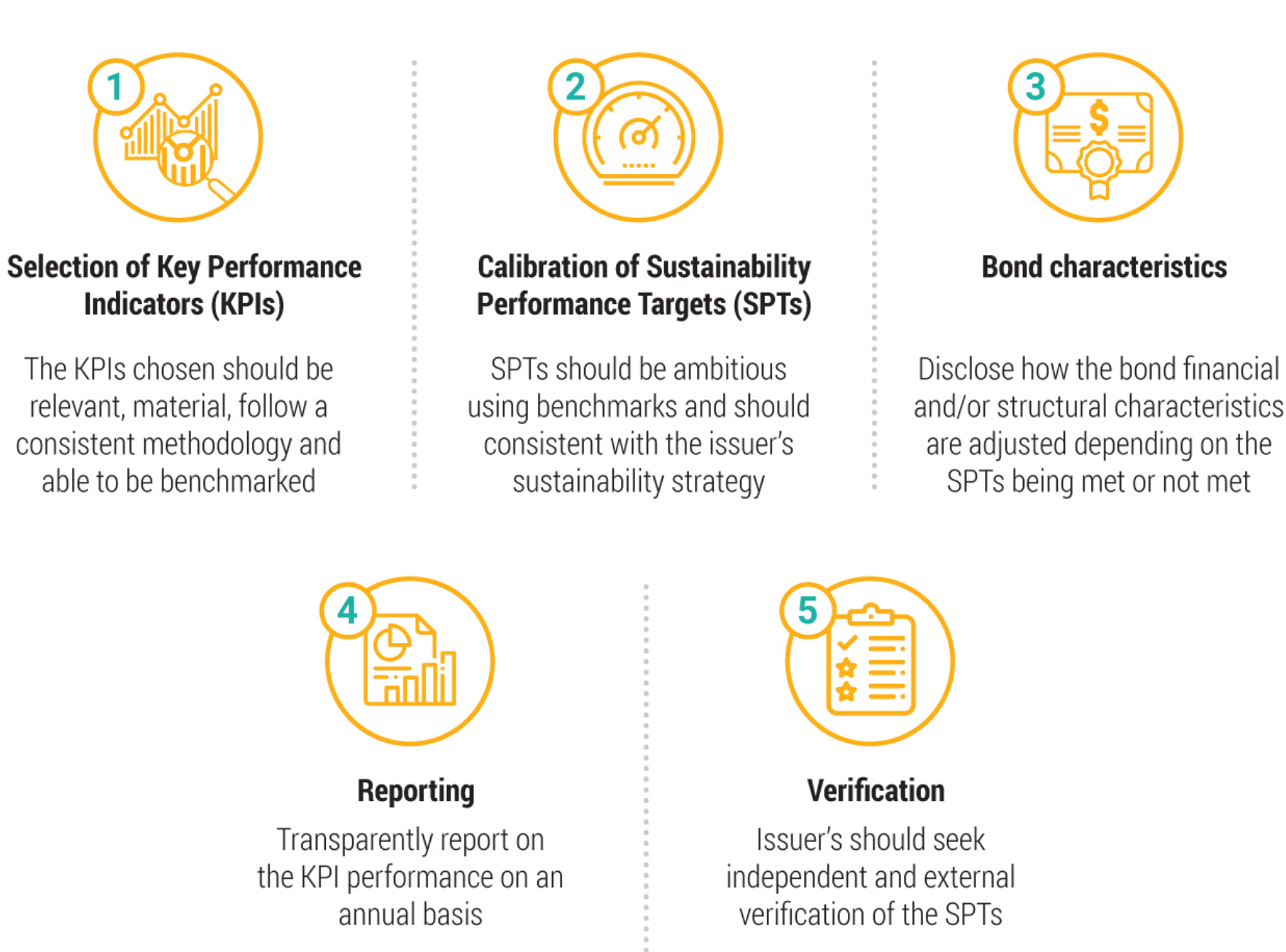

According to the International Capital Market Association (ICMA), Sustainability-Linked Bonds (SLBs) incentivize the company to achieve “material, quantitative, pre-determined, ambitious, regularly monitored and externally verified sustainability objectives through Key Performance Indicators “KPIs” and Sustainability Performance Targets (“SPT”).

Super Green /Social Structures

Companies increasingly use both use-of-proceed and sustainability-linked frameworks to strengthen the credibility of sustainable finance products. The typical approach is through a sustainable finance framework that outlines the company’s longer-term plans to finance sustainability projects and strategies, describing critical investments, material key performance indicators (KPIs), and expected results.

Emerging Models for Sustainable Corporate Finance

Companies and private financial institutions represent a majority of issuers of sustainable finance products. Such sustainable corporate finance is based on companies’ ability to integrate sustainability into its strategy, governance, risk management, and performance. Emerging models for sustainability-linked finance focus on the following:

- Strategic goals and targets on material sustainability issues;

- Incorporating sustainability in corporate governance and internal controls;

- Reporting and verification/assurance of sustainability performance.

The International Capital Market Association (ICMA) Sustainability-Linked Bond Principles’ Five Core Principles reflect the emerging models for sustainability-linked finance.

Sustainability-Linked Bond Principles – Five Core Principles

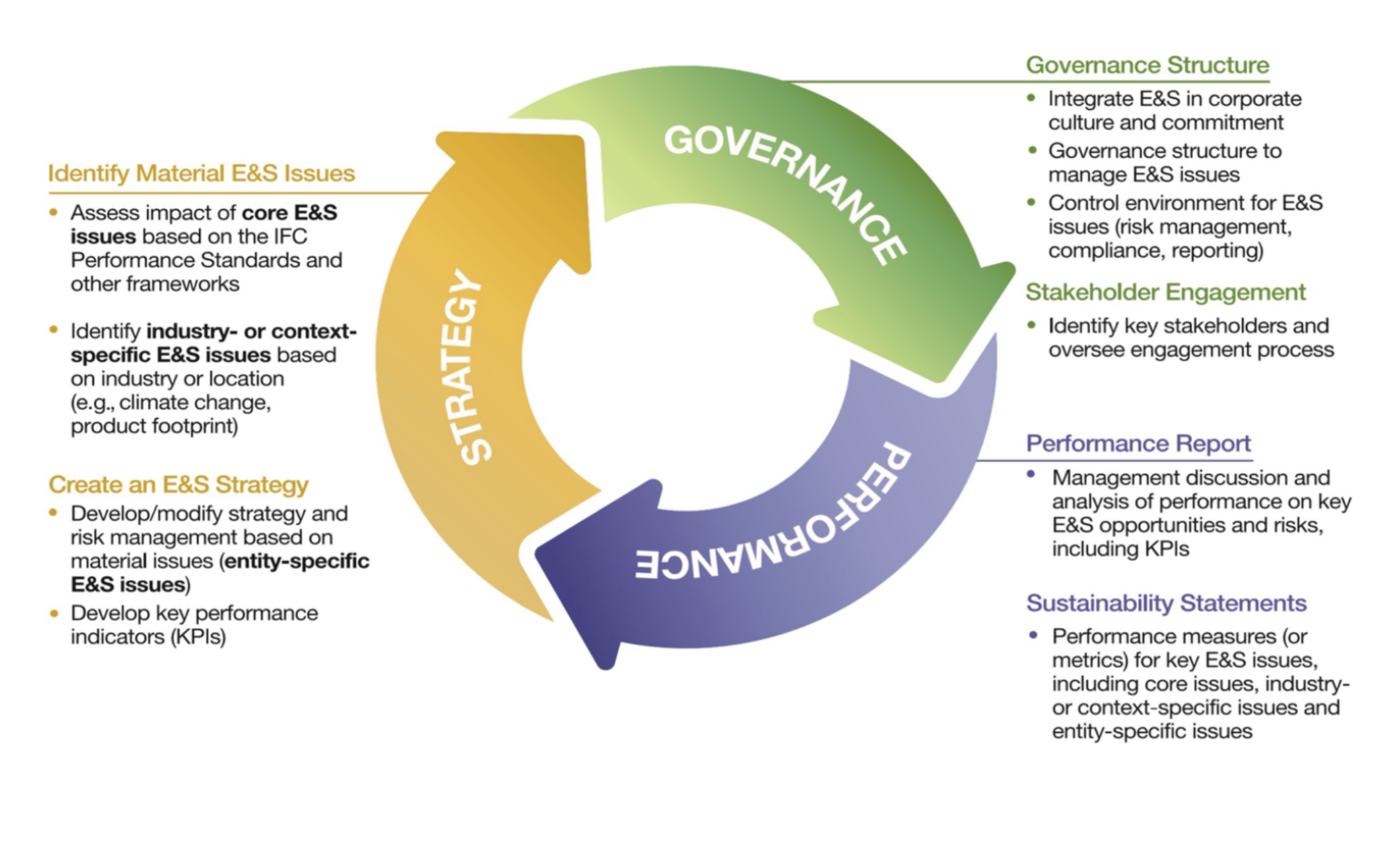

Leveraging IFC’s Disclosure and Transparency Framework to Promote Sustainable Finance

The IFC’s disclosure and transparency framework and toolkit prepare companies for the issuance of sustainability-linked finance by promoting a comprehensive and integrated approach to:

- Integrate sustainability in strategic goals and business model;

- Measure outcomes using targets and key performance indicators;

- Monitor the performance of governance, risk, compliance systems;

- Integrate sustainability and financial disclosures.

Better Financial Analysis

Academic studies have consistently found a strong link between sustainability and financial performance. Companies with effective management and disclosure of sustainability issues tend to have lower costs of capital, higher valuations, and better returns for shareholders.

When integrated with financial reporting, sustainability information can provide investors with a broader view of strategy and performance and give confidence in the long-term viability of the business model.

Nonfinancial information, such as climate change mitigation, employee turnover, or product quality, may be considered pre-financial or leading indicators.

Sustainability performance also provides insights into the quality of a company’s management, and its ability to:

- Understand key stakeholder priorities;

- Assess different time horizons;

- Achieve financial and nonfinancial objectives;

- Manage a diverse set of stakeholders.

Value Driver Model:

More Efficient Capital Markets

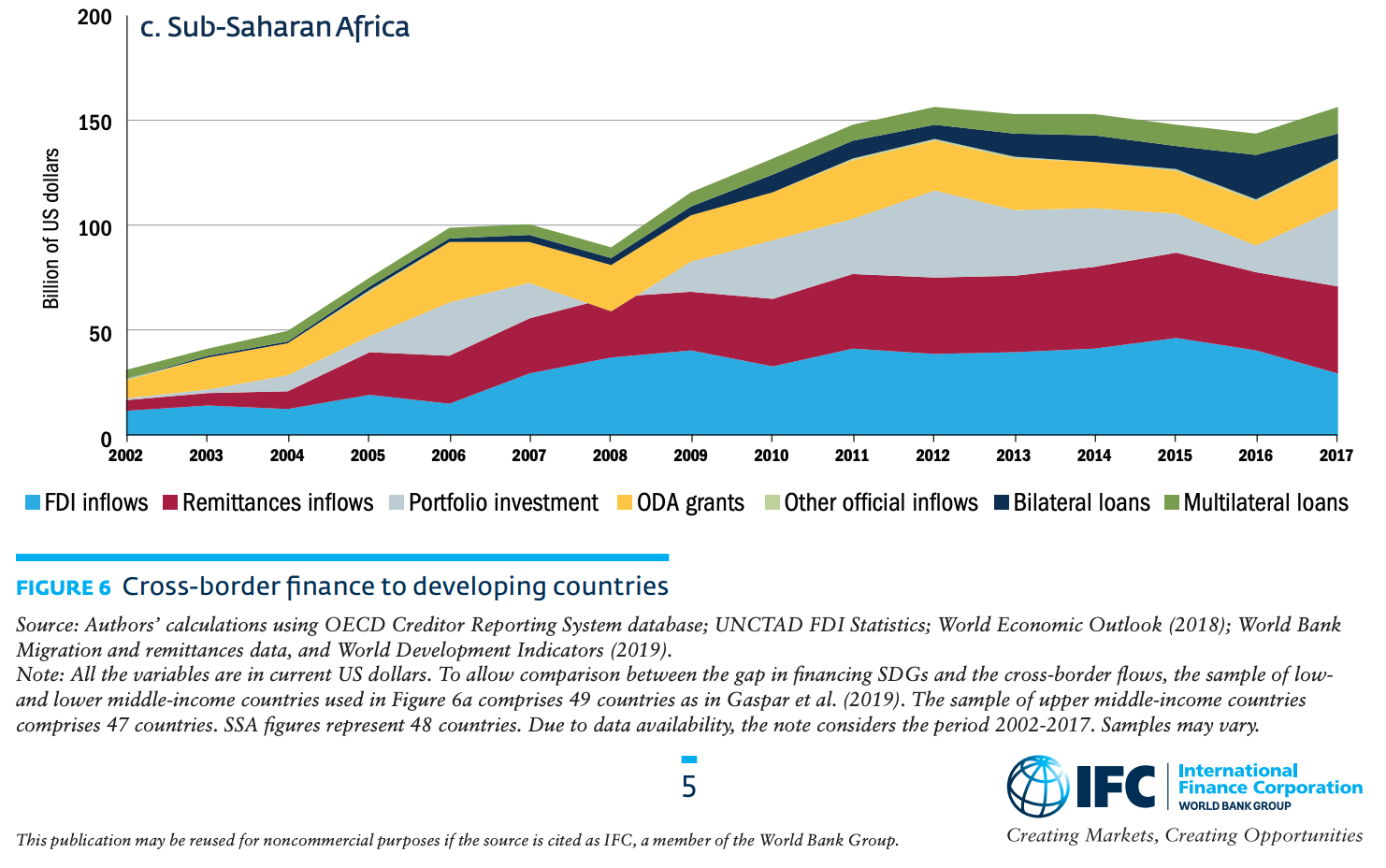

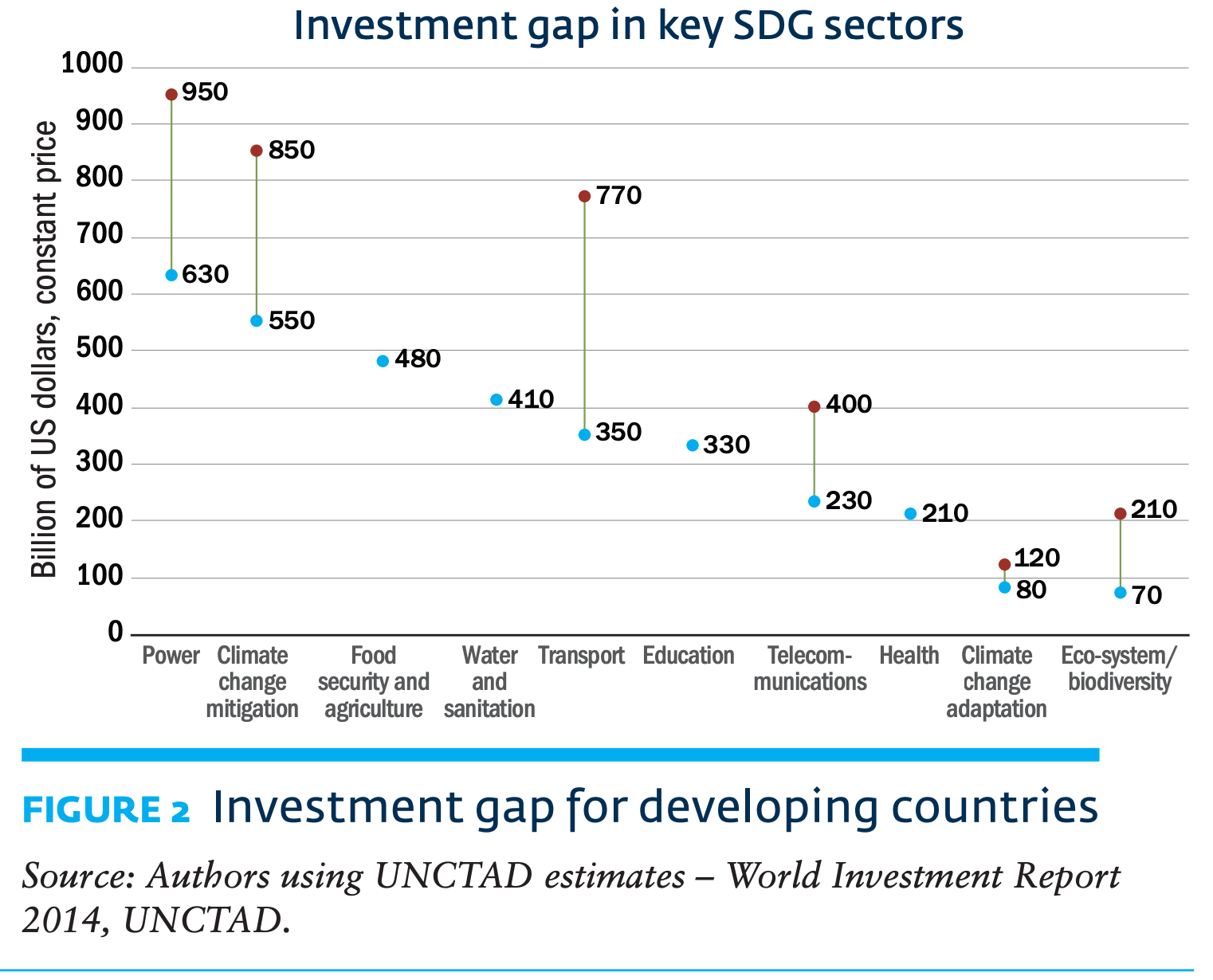

Reaching the UN Sustainable Development Goals in emerging markets requires a $4 trillion annual investment—far beyond the means of governments and development agencies.

Capital markets can play a crucial role in channeling private investments toward priority development needs, including:

- Helping people and businesses obtain long-term financing;

- Encouraging entrepreneurial innovation and accelerating job creation and economic growth;

- Shielding economies against fluctuations in international financial markets.

Enhanced corporate disclosure (including ESG) contributes to more liquid and efficient markets. It enables investors to make decisions based on material information and reduces information asymmetry for investors.

In emerging markets, economic and social development is often limited by insufficient flow of private capital.This is partly due to a heightened perception of risk in these countries, compounded by a lack of information and transparency. Integrated financial and sustainability disclosure also helps mitigate actual or perceived risks around weaker public institutions and governance, heightened social and environmental risks, and companies with controlling shareholders.