Sustainability performance reporting provides a comprehensive picture of the impact of a company’s operations on the environment and society, including the value created or eroded that may not be captured in financial performance information.

Reporting on sustainability performance should answer the following information needs:

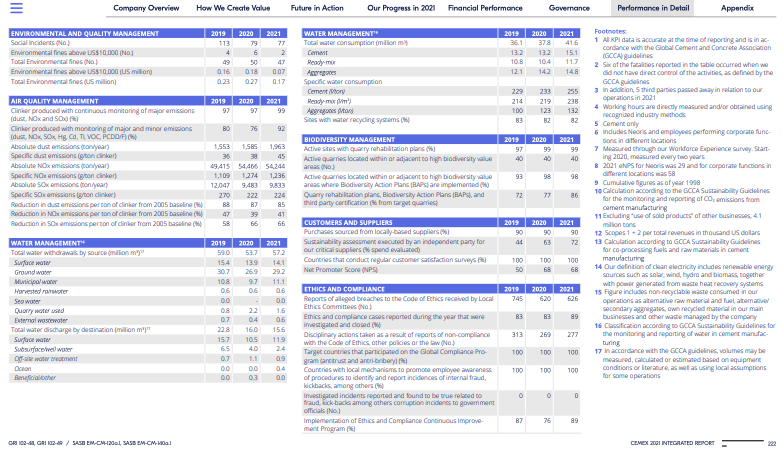

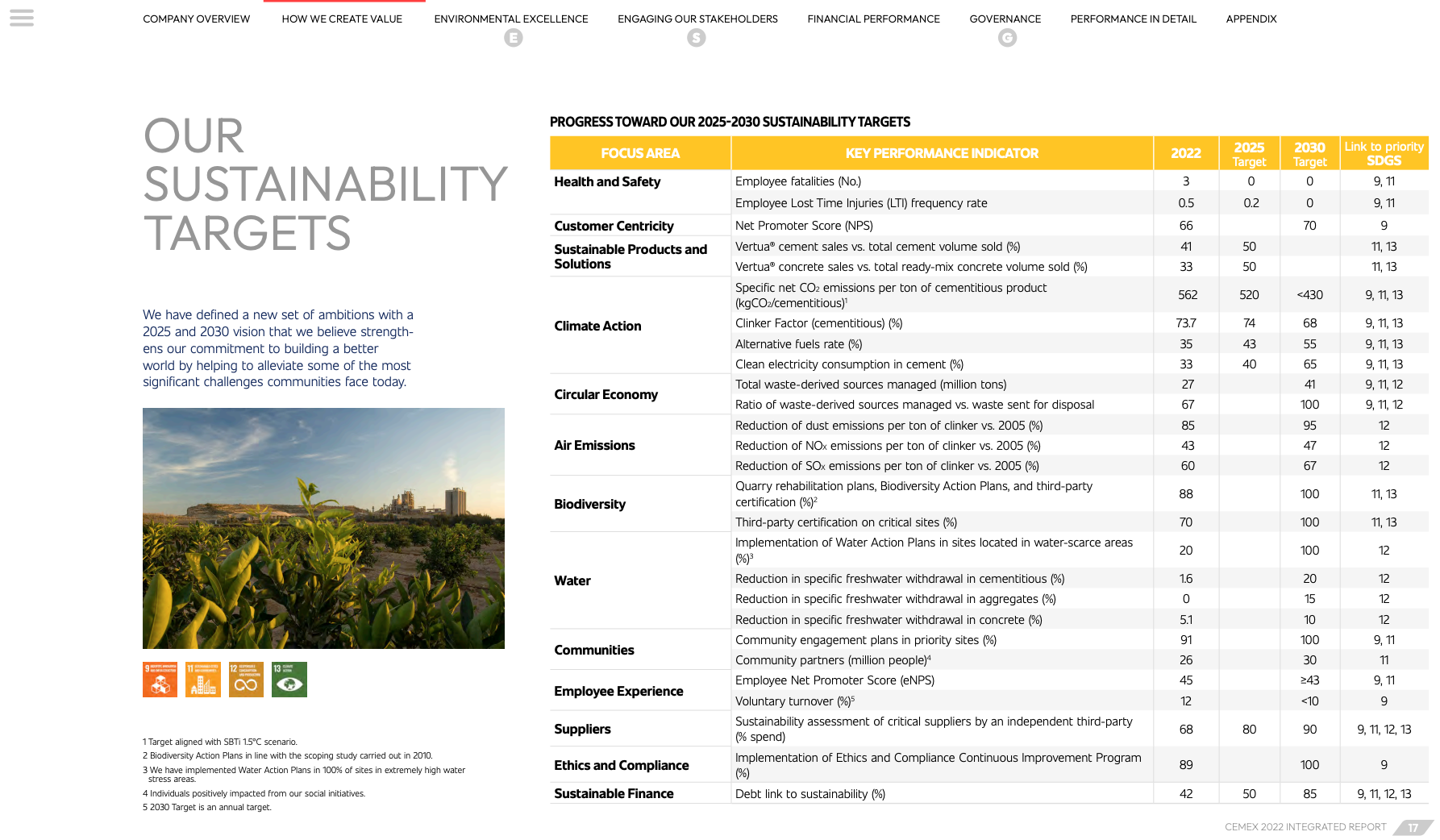

- Disclosure of key performance indicators (or metrics) and targets used to measure, monitor and manage material sustainability-related risks and opportunities. Provide consistent and comparable metrics and targets for the company’s material ESG issues to allow comparison of performance over time and with peers;

- Contribution to sustainable development. Provide an account of the company's contribution to broader societal and sustainability goals (for example, the Sustainable Development Goals (SDGs) and the Paris Climate Agreement).

Recommended Disclosure

Provide a quantitative measurement of the company’s performance on a range of ESG issues that the company determines to be material, disclosing the metrics and targets used to assess and manage material sustainability-related risks and opportunities.

International Sustainability Standards Board (ISSB) IFRS S1 on General Requirements for Disclosure of Sustainability-Related Financial Information includes disclosure on metrics and targets as one of the four pillars for sustainability disclosure (governance, strategy, risk management and metrics, and targets). Find below an excerpt from the standard for your reference.

-

ISSB IFRS S1 General Requirements for Disclosure of Sustainability-Related Financial Information (Excerpt)

Metrics and Targets

45 The objective of sustainability-related financial disclosures on metrics and targets is to enable users of general purpose financial reports to understand an entity’s performance in relation to its sustainability-related risks and opportunities, including progress towards any targets the entity has set, and any targets it is required to meet by law or regulation.

46 An entity shall disclose, for each sustainability-related risk and opportunity that could reasonably be expected to affect the entity’s prospects:

(a) metrics required by an applicable IFRS Sustainability Disclosure Standard; and

(b) metrics the entity uses to measure and monitor:

(i) that sustainability-related risk or opportunity; and

(ii) its performance in relation to that sustainability-related risk or opportunity, including progress towards any targets the entity has set, and any targets it is required to meet by law or regulation.

47 In the absence of an IFRS Sustainability Disclosure Standard that specifically applies to a sustainability-related risk or opportunity, an entity shall apply paragraphs 57–58 to identify applicable metrics.

48 Metrics disclosed by an entity applying paragraphs 45–46 shall include metrics associated with particular business models, activities or other common features that characterise participation in an industry.

49 If an entity discloses a metric taken from a source other than IFRS Sustainability Disclosure Standards, the entity shall identify the source and the metric taken.

50 If a metric has been developed by an entity, the entity shall disclose information about:

(a) how the metric is defined, including whether it is derived by adjusting a metric taken from a source other than IFRS Sustainability Disclosure Standards and, if so, which source and how the metric disclosed by the entity differs from the metric specified in that source;

(b) whether the metric is an absolute measure, a measure expressed in relation to another metric or a qualitative measure (such as a red, amber, green—or RAG—status);

(c) whether the metric is validated by a third party and, if so, which party; and

(d) the method used to calculate the metric and the inputs to the calculation, including the limitations of the method used and the significant assumptions made.

51 An entity shall disclose information about the targets it has set to monitor progress towards achieving its strategic goals, and any targets it is required to meet by law or regulation. For each target, the entity shall disclose:

(a) the metric used to set the target and to monitor progress towards reaching the target;

(b) the specific quantitative or qualitative target the entity has set or is required to meet;

(c) the period over which the target applies;

(d) the base period from which progress is measured;

(e) any milestones and interim targets;

(f) performance against each target and an analysis of trends or changes in the entity’s performance; and

(g) any revisions to the target and an explanation for those revisions.

52 The definition and calculation of metrics, including metrics used to set the entity’s targets and monitor progress towards reaching them, shall be consistent over time. If a metric is redefined or replaced, an entity shall apply paragraph B52.

53 An entity shall label and define metrics and targets using meaningful, clear and precise names and descriptions.

Source: ISSB IFRS S1 General Requirements for Disclosure of Sustainability-Related Financial Information.

-

European Sustainability Reporting Standards ESRS 2 – General Disclosures (Excerpt)

5. Metrics and targets

70. This chapter sets out Minimum Disclosure Requirements that shall be included when the undertaking discloses information on its metrics and targets related to each material

sustainability matter. They shall be applied together with the Disclosure Requirements, includingApplication Requirements, provided in the relevant topical ESRS. They shall also be applied

when the undertaking prepares entity-specific disclosures.71. The corresponding disclosures shall be located alongside disclosures prescribed by the topical ESRS.

72. If the undertaking cannot disclose the information on targets required under the relevant topical ESRS, because it has not set targets with reference to the specific sustainability matter concerned, it shall disclose this to be the case, and provide reasons for not having adopted targets. The undertaking may disclose a timeframe in which it aims to adopt them. Minimum disclosure requirement – Metrics MDR-M – Metrics in relation to material sustainability matters.

73. The undertaking shall apply the requirements for the content of disclosures in this provision when it discloses on the metrics it has in place with regard to each material sustainability matter.

74. The objective of this Minimum Disclosure Requirement is to provide an understanding of the metrics the undertaking uses to track the effectiveness of its actions to manage material sustainability matters.

75. The undertaking shall disclose any metrics that it uses to evaluate performance and

effectiveness, in relation to a material impact, risk or opportunity.76. Metrics shall include those defined in ESRS, as well as metrics identified on an entity-specific basis, whether taken from other sources or developed by the undertaking itself.

77. For each metric, the undertaking shall:

(a) disclose the methodologies and significant assumptions behind the metric, including the limitations of the methodologies used;

(b) disclose whether the measurement of the metric is validated by an external body other

than the assurance provider and, if so, which body;(c) label and define the metric using meaningful, clear and precise names and descriptions;

(d) when currency is specified as the unit of measure, use the presentation currency of its

financial statements. Minimum Disclosure Requirement – Targets MDR-T – Tracking effectiveness of policies and actions through targets78. The undertaking shall apply the requirements for the content of disclosures in this provision when it discloses information about the targets it has set with regard to each material sustainability matter.

79. The objective of this Minimum Disclosure Requirement is to provide for each material

sustainability matter an understanding of:(a) whether and how the undertaking tracks the effectiveness of its actions to address

material impacts, risks and opportunities, including the metrics it uses to do so;(b) measurable time-bound outcome-oriented targets set by the undertaking to meet the

policy’s objectives, defined in terms of expected results for people, the environment or the

undertaking regarding material impacts, risks and opportunities;(c) the overall progress towards the adopted targets over time;

(d) in the case that the undertaking has not set measurable time-bound outcome-oriented

targets, whether and how it nevertheless tracks the effectiveness of its actions to address

material impacts, risks and opportunities and measures the progress in achieving its

policy objectives; and(e) whether and how stakeholders have been involved in target setting for each material

sustainability matter.80. The undertaking shall disclose the measurable, outcome-oriented and time-bound targets on material sustainability matters it has set to assess progress. For each target, the disclosure shall include the following information:

(a) a description of the relationship of the target to the policy objectives;

(b) the defined target level to be achieved, including, where applicable, whether the target is absolute or relative and in which unit it is measured;

(c) the scope of the target, including the undertaking’s activities and/or its upstream and/or downstream value chain where applicable and geographical boundaries;

(d) the baseline value and base year from which progress is measured;

(e) the period to which the target applies and if applicable, any milestones or interim targets;

(f) the methodologies and significant assumptions used to define targets, including where

applicable, the selected scenario, data sources, alignment with national, EU or

international policy goals and how the targets consider the wider context of sustainable

development and/or local situation in which impacts take place;(g) whether the undertaking’s targets related to environmental matters are based on

conclusive scientific evidence;(h) whether and how stakeholders have been involved in target setting for each material

sustainability matter;(i) any changes in targets and corresponding metrics or underlying measurement

methodologies, significant assumptions, limitations, sources and processes to collect

data adopted within the defined time horizon. This includes an explanation of the

rationale for those changes and their effect on comparability (see Disclosure

Requirement BP-2 Disclosures in relation to specific circumstances of this Standard); and(j) the performance against its disclosed targets, including information on how the target is

monitored and reviewed and the metrics used, whether the progress is in line with what

had been initially planned, and an analysis of trends or significant changes in the

performance of the undertaking towards achieving the target.81. If the undertaking has not set any measurable outcome-oriented targets:

(a) it may disclose whether such targets will be set and the timeframe for setting them, or the reasons why the undertaking does not plan to set such targets;

(b) it shall disclose whether it nevertheless tracks the effectiveness of its policies and

actions in relation to the material sustainability-related impact, risk and opportunity,

and if so:i. any processes through which it does so;

ii. the defined level of ambition to be achieved and any qualitative or quantitative

indicators it uses to evaluate progress, including the base period from which

progress is measured.Source: European Sustainability Reporting Standards ESRS 2 – General Disclosures (Excerpt)

The following resources provide a comprehensive set of metrics that companies can use to prepare their sustainability statements:

Most common E&S metrics: This table presents a summary of the most commonly reported and tracked E&S metrics, based on an IFC analysis of widely used E&S disclosure frameworks and standards.

IFC’s ESG Performance Indicators for Capital Markets: IFC’s ESG Performance Indicators are a sustainability data framework aimed at enhancing sustainability reporting in emerging capital markets. The indicators are based on IFC’s E&S Performance Standards and Corporate Governance Methodology.

Suggested metrics for industry-specific sustainability issues: This table presents a sample of metrics that capture performance on industry-specific sustainability issues, based on the Sustainability Accounting Standards Board’s Sustainability Accounting Standards.

Targets: Targets are the quantifiable benchmarks the company needs to reach to meet its strategic objectives.

- Strategic Objectives, Key Performance Indicators and Targets;

- Climate disclosure - Metrics and Targets.

Market Trend: Convergence of Sustainability Metrics

The material sustainability metrics presented in the sustainability statements will vary among companies because accounting for sustainability is evolving with multiple standards being developed. However, a number of recent initiatives aim to converge ESG reporting standards and material sustainability metrics. We expect metrics to become increasingly standardized.

The following are examples of initiatives aiming at converging sustainability reporting standards and standardizing sustainability metrics.

- Statement of Intent to Work Together Towards Comprehensive Corporate Reporting: Summary of Alignment Discussions among Leading Sustainability and Integrated Reporting Organizations CDP, CDSB, GRI, IIRC, and Sustainability Accounting Standards Board;

- Measuring Stakeholder Capitalism: Towards Common Metrics and Consistent Reporting of Sustainable Value Creation (World Economic Forum, 2020).

-

Application: Sustainability Performance and Extrafinancial Analysis

Investors increasingly examine sustainability performance by identifying and tracking sustainability issues that have material impacts on a company’s operational and financial performance. Extrafinancial analysis helps to understand how sustainability impacts financial performance, focusing on the main elements of company valuation (revenue and costs, assets and liabilities, cost of capital, and scenario planning).

-

Application: Sustainability Performance and Sustainable Finance

Disclosure on sustainability performance is important for corporate finance and investor relations. Recent trends in sustainable finance point to a strong emphasis on the integration of sustainability in core management and governance of companies and linking financial products directly to actual performance on relevant sustainability factors.

A new kind of financial instrument, sustainability-linked finance, is gaining traction because both corporate issuers and investors are looking beyond green bonds and loans to broaden the scope of sustainable finance and align with the trend to integrate sustainability in companies’ core management and governance.

Sustainability - linked finance refers to a range of financial instruments that are linked to the issuer’s performance on predetermined sustainability goals and targets, allowing for a general purpose, rather than targeted use of proceeds.

Companies and stakeholders are increasingly using sustainability statements to improve the quality and comparability of sustainability information.

Definition

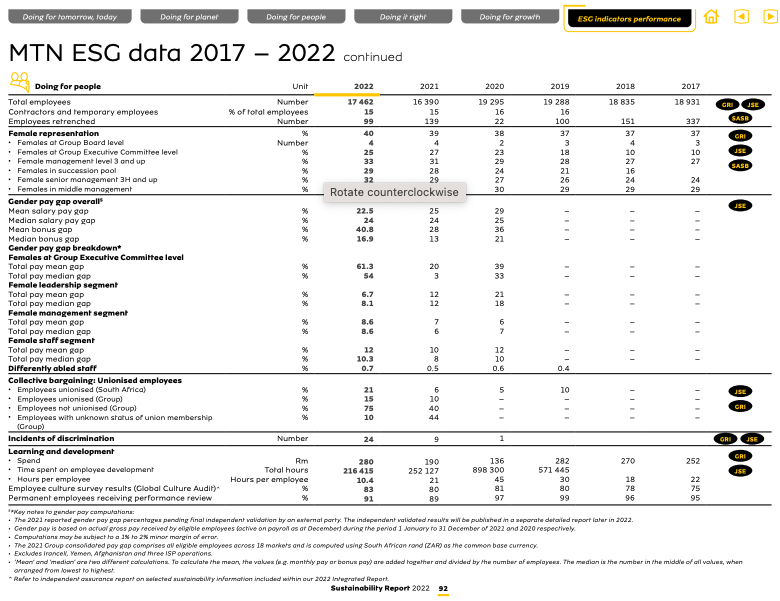

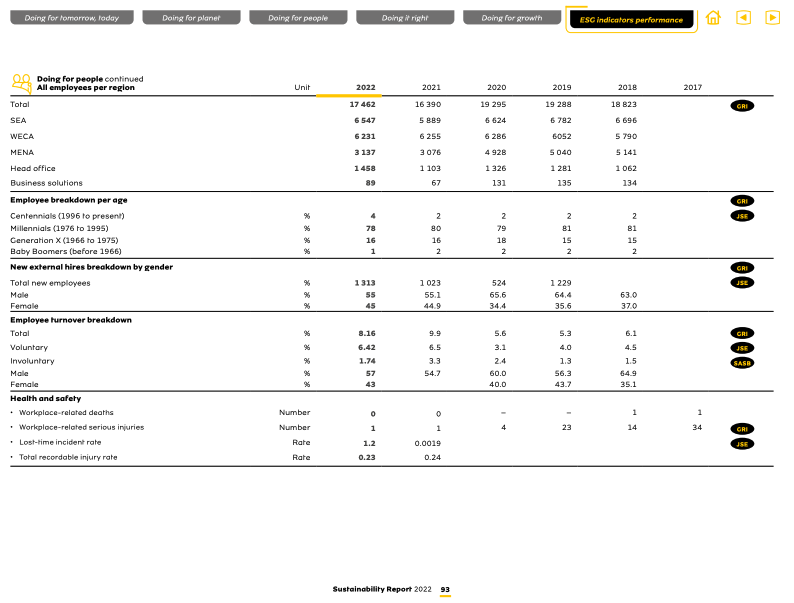

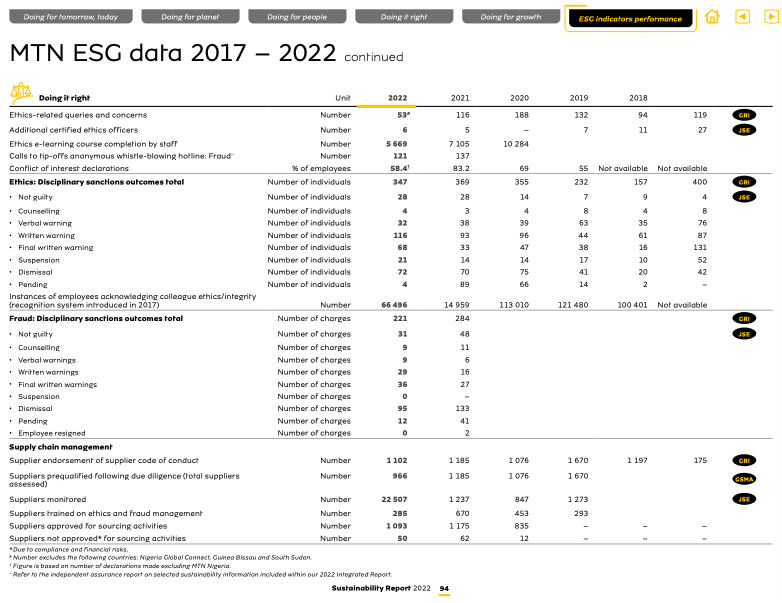

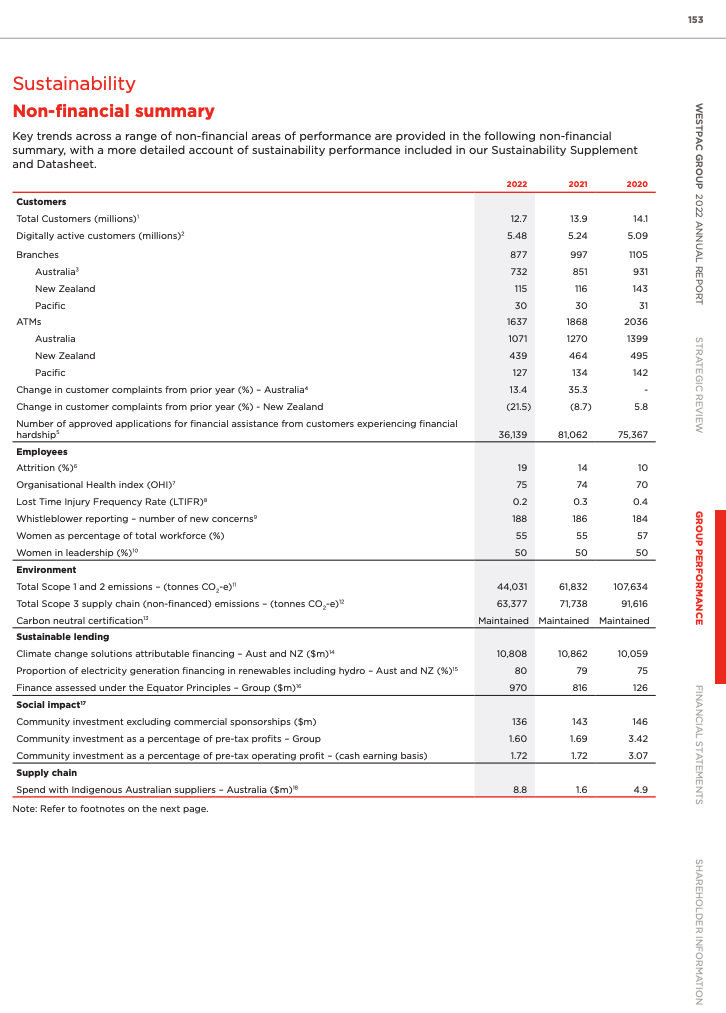

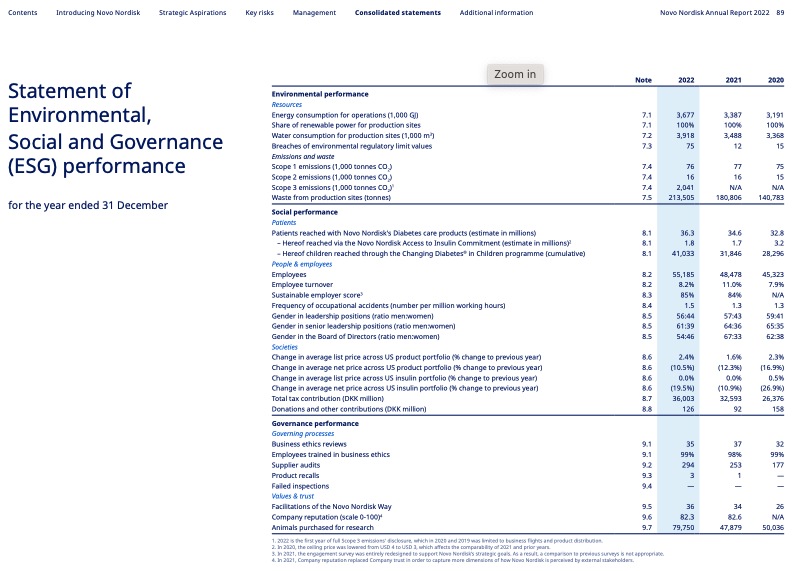

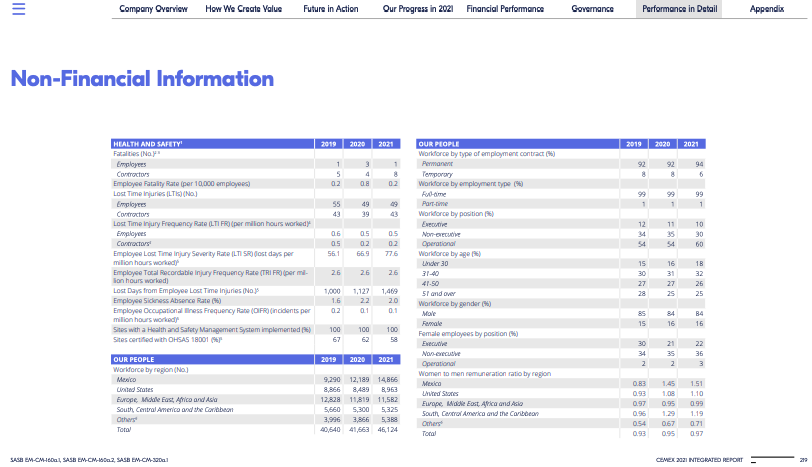

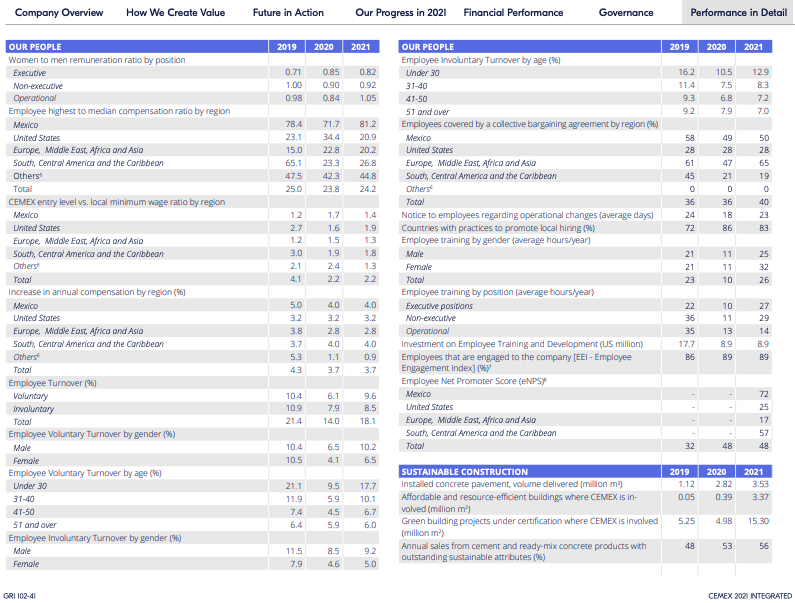

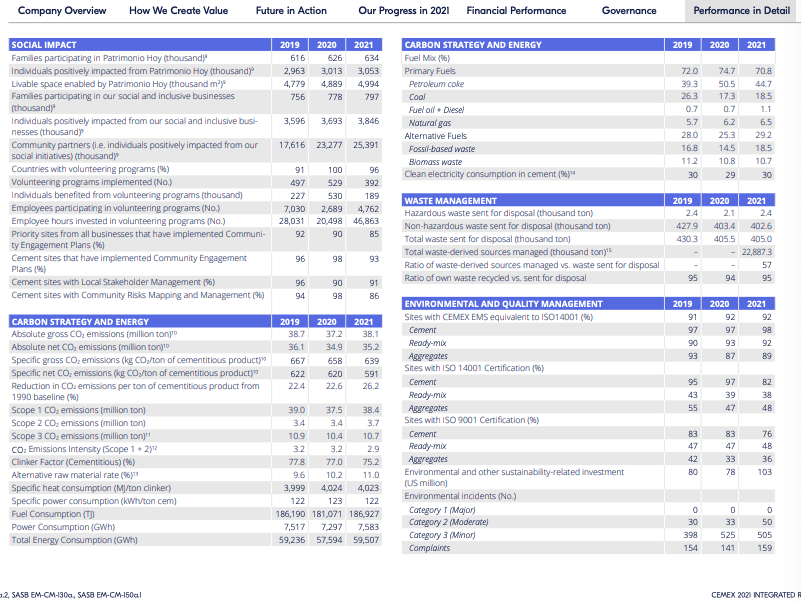

Sustainability statements – or sustainability performance summary – are defined by reference to financial statements and refer to a tabulated presentation of quantitative metrics reflecting a company’s sustainability performance on material environmental, social and governance issues. It promotes the importance of having comparable, quantitative and assured sustainability data of the same quality as financial data.

The first set of the European Sustainability Reporting Standards: ESRS 1 General Requirements, in section 8 introduces the content and structure of sustainability statements. Find below an excerpt from the standard for your reference.

Source: Annex I European Sustainability Reporting Standards first set: ESRS 1 General Requirements, p. 36.

Sustainability statements, like financial statements, are important for public accountability. Unlike sustainability key performance indicators, which are unique to the company’s business model and context, sustainability statements present an account of performance that is more standardized according to relevant sustainability metrics.

It is international good practice the information and data in the sustainability statements to be presented with comparative figures from the company’s past two-three completed fiscal years. The scope of the reported information should be clear, especially if it differs from year to year. Any changes to the coverage of information should be explained.

Ideally, ESG data should be subject to an annual assurance process by an independent provider. The board’s audit committee should oversee the sustainability information contained in the annual report.

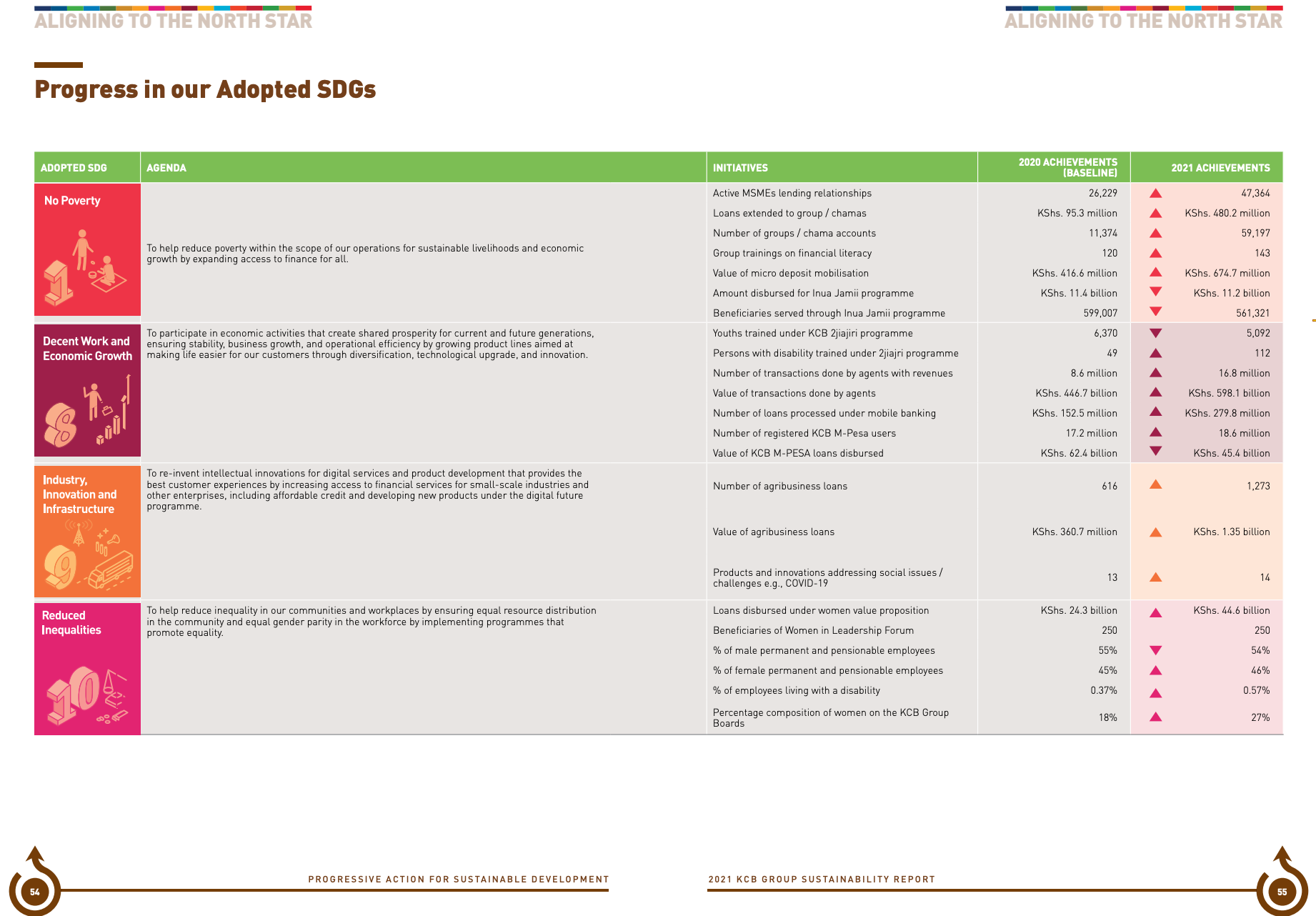

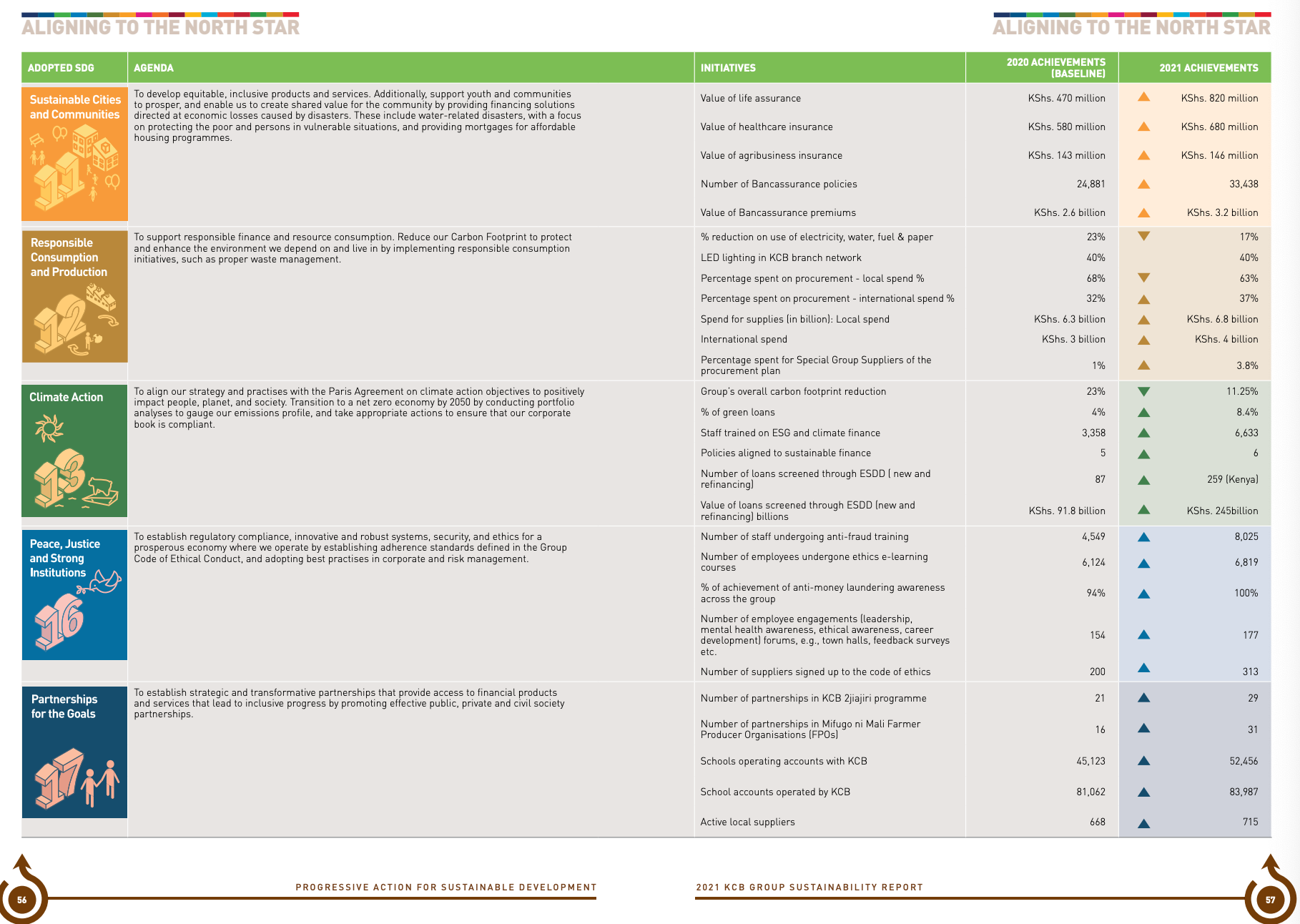

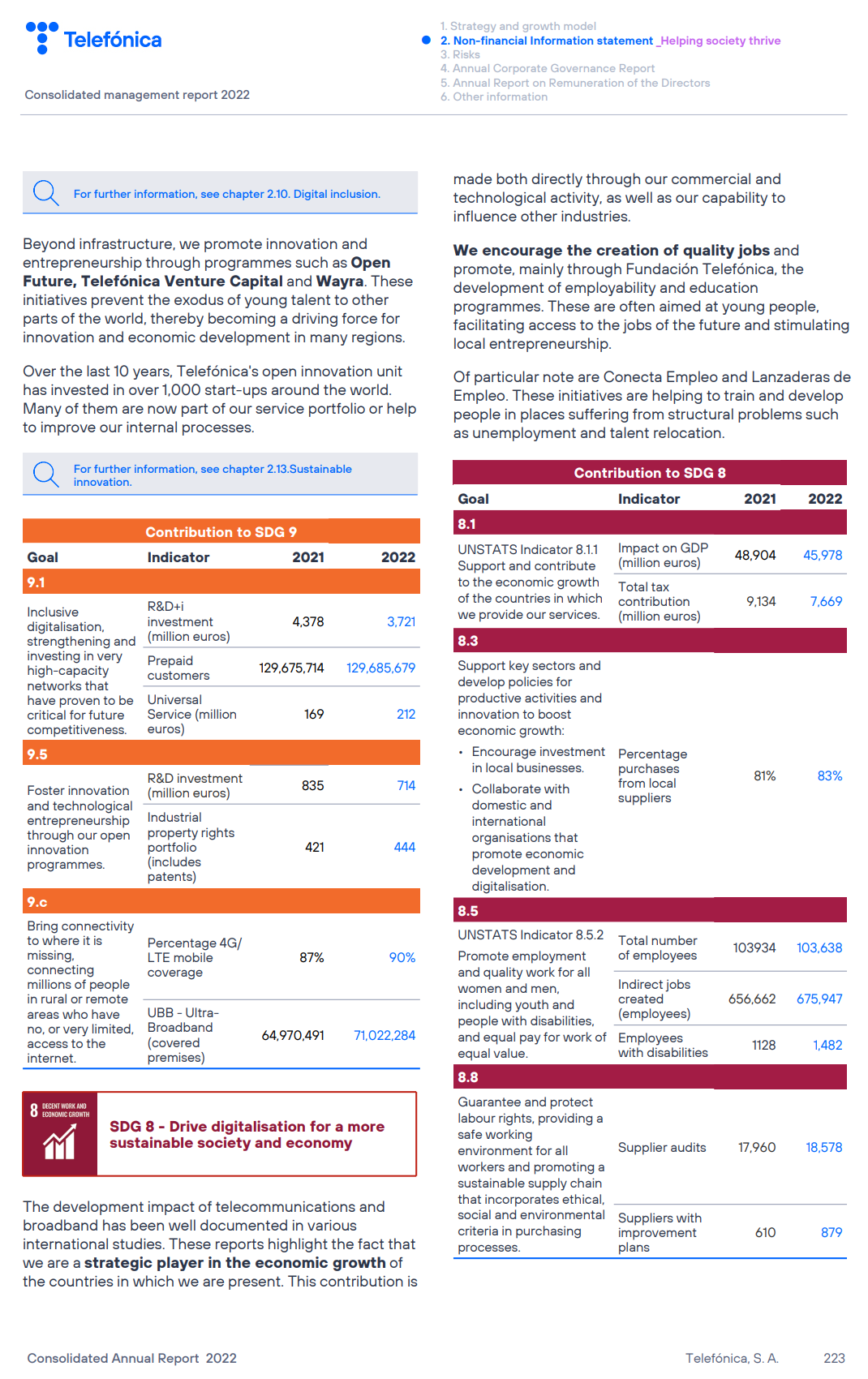

To substantiate their contribution to economic and social development, companies can report on performance metrics that measure their impacts on the SDGs, focusing on the SDGs that the company affects the most.

The following resources provide guidance to companies seeking to measure and report performance on the SDGs.

- SDG Goals, Targets, and Indicators Relevant for Business: This table shows a sample of SDGs, targets, and indicators relevant for business, including positive business contribution to the SDGs and mitigation of negative impact;

- Suggested metrics for the SDGs: This table provides examples of commonly reported ESG key performance indicators that have a direct correspondence with the UN SDGs and their indicators.

The need for accountability of companies’ direct contribution to sustainable development is consistent with a rising interest among investors to understand sustainability performance in the context of broader social and environmental outcomes.

According to the Principles for Responsible Investment (an UN-supported international network of financial institutions), achieving outcomes in line with the SDGs requires “collaboration on tools to contextualize outcomes data in the global thresholds and timelines required to achieve the SDGs.” Learn more about Principles for Responsible Investment.