Sustainability Reporting by Financial Institutions

World Bank Photo Collection

Financial Institutions – or the financial services sector, consist of companies that take part in the following activities: Asset Management (including Private Equity), Commercial Banking, Commercial Finance (including Trade Finance, Asset Finance, and Leasing), Investment Banking and Brokerage, and Insurance.

Disclosure by financial institutions should reflect the unique role that these institutions play in the economy and society - mainly as risk intermediaries and responsible investors.

IFC works through financial institutions to provide much-needed access to finance for millions of individuals and micro, small, and medium enterprises that we would never be able to reach directly.

Learn More about IFC’s work with Financial Institutions

Banks and financial institutions act as risk intermediaries – they provide individuals and corporations with financial security by absorbing risk through a combination of fixed debt and flexible assets. For example, clients can benefit from fixed terms and interest rates on their loans, while they may withdraw their deposits, sell their investments, or repay their loans at any time. This situation creates inherent liquidity risks and solvency risks for banks, where their assets (clients’ debt) can fluctuate in value but cannot be adjusted or sold, and their debts (clients’ assets) can be called in at any time.

Therefore, risk management is a critical issue for financial institutions to protect the financial well-being of clients and customers and the stability of the economy and society. The annual report should address how banks and financial institutions manage risk, focusing on the following categories:

- Credit risk: Risk of a counterparty not performing on its contract or obligation;

- Liquidity risk: Risk arising from an inability to meet obligations when they come due;

- Market risk: Risk of losses from changes in the value of assets and liabilities resulting from market conditions, such as interest rates;

- Operational risk: Risk of loss resulting from the failure of internal processes, systems, human factors, or external events.

Enhancing the Risk Disclosures of Banks

The Enhanced Disclosure Task Force (EDTF) was established by the Financial Stability Board to identify fundamental disclosure principles, recommendations, and leading practices to enhance risk disclosures of banks. In October 2012, the EDTF published a set of 7 disclosure principles and 32 recommendations for improving risk disclosures. While the report - Enhancing the Risk Disclosures of Banks - cover all areas of risk, the recommendations focus on the following key areas:

- A bank’s business models, the key risks that arise from them and how those risks are measured;

- A bank’s liquidity position, its sources of funding and the extent to which its assets are not available for potential funding needs;

- The calculation of a bank’s risk-weighted assets (RWAs) and the drivers of changes in both RWAs and the bank’s regulatory capital;

- The relationship between a bank’s market risk measures and its balance sheet, as well as risks that may be outside those measures; and

- The nature and extent of a bank’s loan forbearance and modification practices and how they may affect the reported level of impaired or non-performing loans.

Only a few of the most common environmental and social issues are directly relevant financial institutions. Rather the industry faces very specific issues, including the impact of environmental and social issues on the companies in which they invest or provide loans and financial services.

Several internationally recognized frameworks provide specific recommendations for financial institutions to manage and disclose key environmental and social information:

- Principles for Responsible Banking – UNEP FI;

- The Equator Principles;

- IFC’s Environmental and Social Performance Standards;

- Recommendations of the Task Force on Climate-related Financial Disclosures (TCFD);

- Sustainability Accounting Standards Board Standards (SASB Standards).

Resources and Networks:

Frameworks for ESG reporting by financial institutions reflect these organizations' unique nature and their powerful role as financial intermediaries in promoting environmental stewardship among clients, generating social impact, and raising sustainable finance.

Material environmental, social, and governance issues of banks and financial institutions include:

- The process of incorporating environmental and social factors in the financial analysis;

- Portfolio-level exposure to environmental and social risks for loans, mortgages, equity investments, bonds, and other financial instruments;

- Scenario analysis projecting the consequences of different climate scenarios on the company's profitability;

- Strategies and initiatives to ensure access to financial services for underserved communities;

- Raising and allocating capital for activities and investments deemed environmentally and socially beneficial;

- Project-specific data for environmentally and socially sensitive projects.

International Good Practices Resources

Recommendations of the Task Force on Climate-related Financial Disclosures.

Annex D in Implementing the Recommendations of the Task Force on Climate-related Financial Disclosures provides supplemental guidance for the Financial Sector, including for Banks, Insurance Companies, Assets Owners, and Asset Managers.

Below are excerpts from the disclosure recommendations for banks:

- Strategy. Banks should describe significant concentrations of credit exposure to carbon-related assets. Additionally, banks should consider disclosing their climate-related risks (transition and physical) in their lending and other financial intermediary business activities;

- Risk Management. Banks should consider characterizing their climate-related risks in the context of traditional banking industry risks categories such as credit, market, liquidity, and operational risks;

- Metrics and Targets. Banks should provide the metrics used to assess the impact of (transition and physical) climate-related risks on their lending and other financial intermediary business activities in the short, medium, and long term. Banks should also provide the amount and percentage of carbon-related assets relative to total assets and the amount of lending and other financing connected with climate-related opportunities.

The supplement also provides recommendations on Carbon Footprinting and Exposure Metrics for Assets Owners and Asset Managers.

- Weighted Average Carbon Intensity. Portfolio’s exposure to carbon-intensive companies, expressed in tons CO2e / $M revenue;

- Total Carbon Emissions. The absolute greenhouse gas emissions associated with a portfolio, expressed in tons CO2e;

- Carbon Footprint. Total carbon emissions for a portfolio normalized by the market value of the portfolio expressed in tons CO2e / $M invested;

- Carbon Intensity. The volume of carbon emissions per million dollars of revenue (carbon efficiency of a portfolio), expressed in tons CO2e / $M revenue;

- Exposure to Carbon Related Assets. The amount or percentage of carbon-related assets34 in the portfolio, expressed in $M or percentage of the current portfolio value.

International Good Practice Resources

The United Nations Environment Programme Finance Initiative (UNEP FI) Principles for Responsible Banking

The Principles for Responsible Banking by UNEP FI is a unique framework for ensuring that signatory banks’ strategy and practice align with the vision society has set out for its future in the United Nations Sustainable Development Goals and the Paris Climate Agreement.

International Good Practice Resources

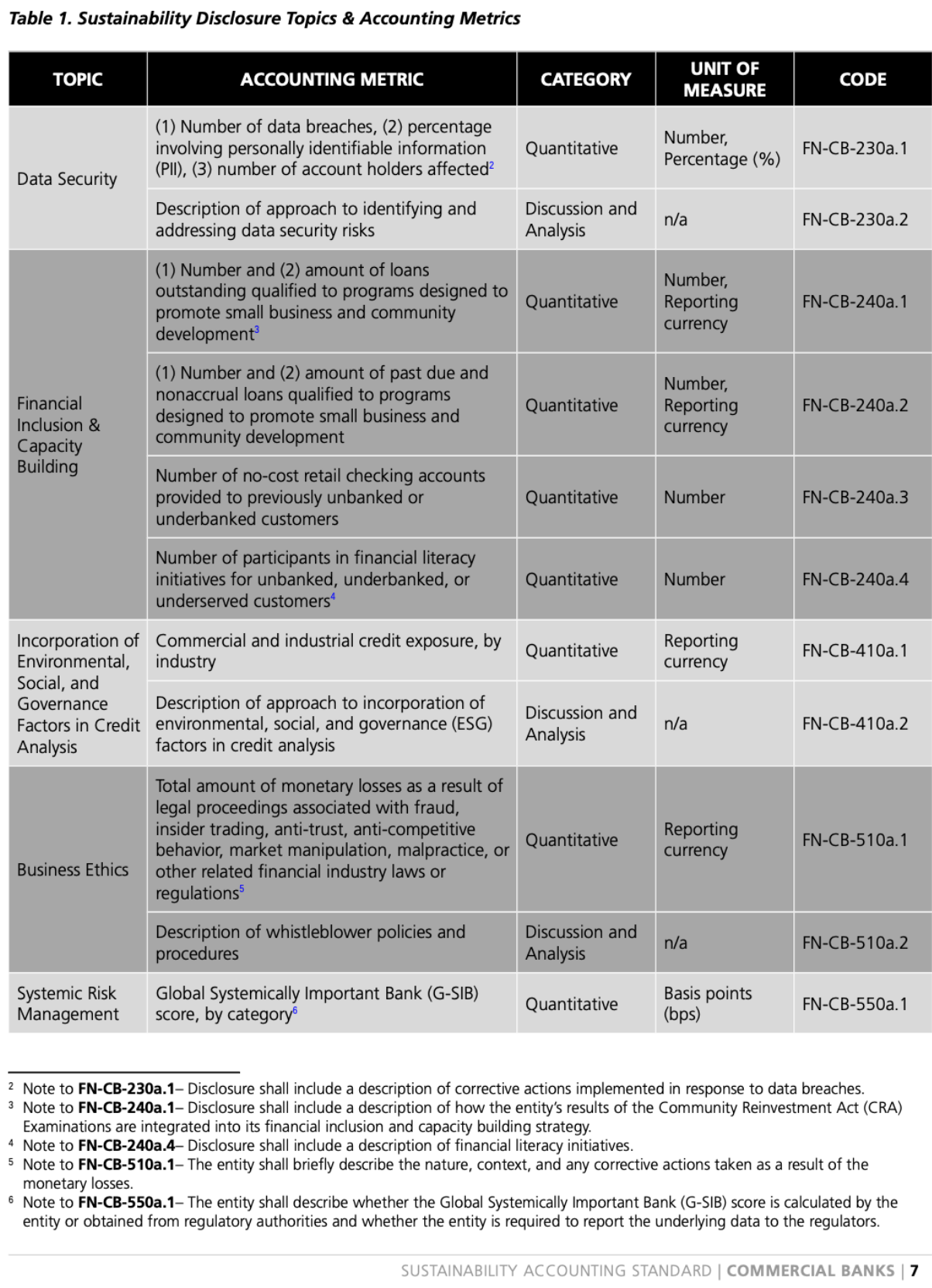

SASB Standards for Commercial Banks and other financial institutions

The SASB Standards – part of the IFRS Foundation – enable organizations to provide industry-based sustainability disclosures about risks and opportunities that affect enterprise value. They identify a subset of environmental, social, and governance issues most relevant to financial performance and enterprise value for 77 industries. The financial sector within the SASB includes 7 areas: wealth management, commercial banks, retail banks, insurance, investment banks, mortgage banks, and the securities market.

Below is an example of the SASB Standards for Commercial Banks.

Sustainability Disclosure Topics & Accounting Metrics