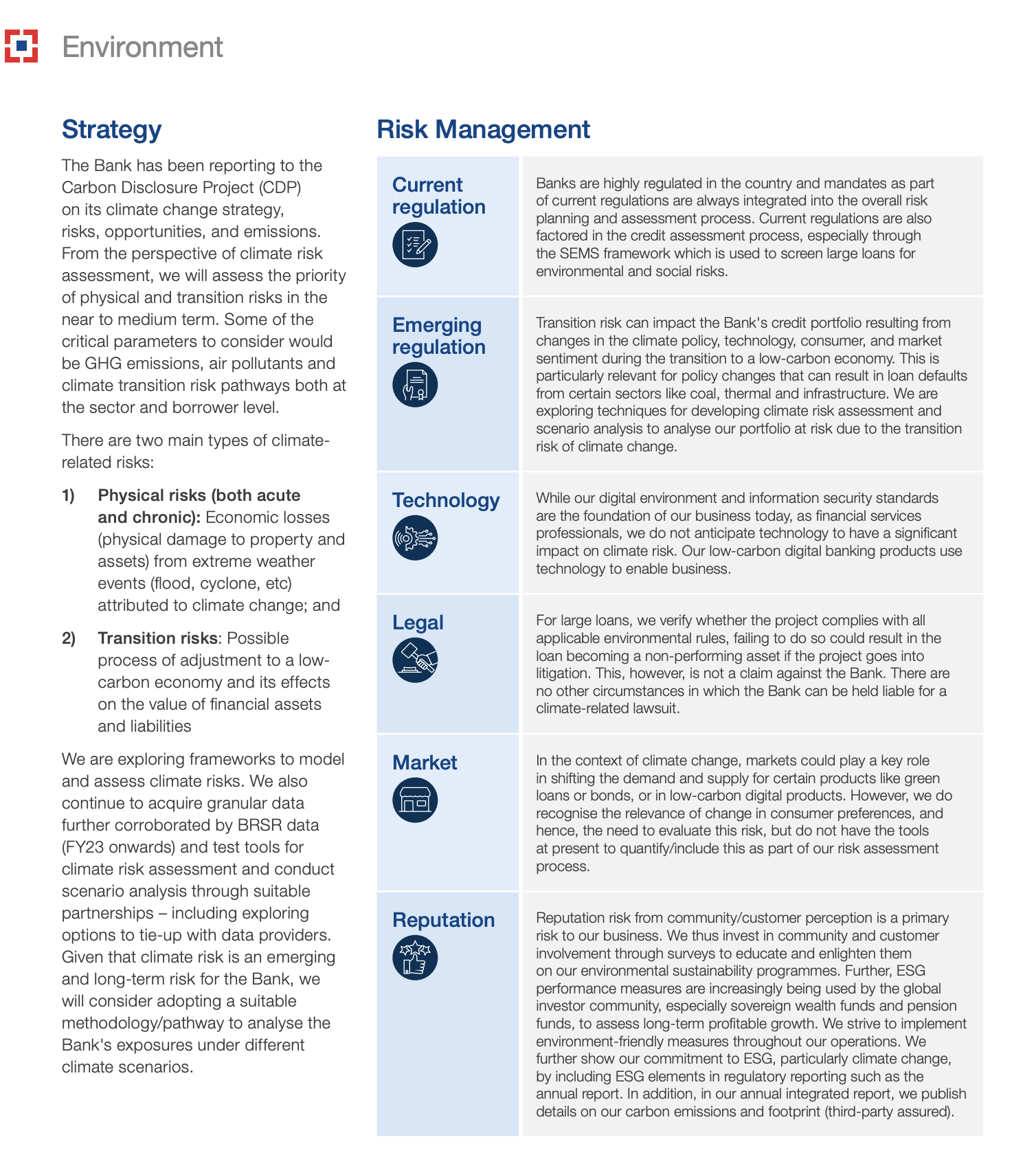

TCFD’s Risk Management pillar recommends companies to disclose how the company identifies, assesses, and manages climate-related risks.

What do investors want to know?

- Processes used to identify climate-related risks and opportunities, as well as their influence on business, strategy, and financial planning;

- Investors would be able to appropriately evaluate the impacts of climate change on a company’s business model by understanding how it identifies and manages climate-related risks and how it takes advantage of opportunities.

-

Climate-related risks

Climate change poses significant risks whether physical or transition risks to most, if not all organisations, whether in the short, medium long-term. Equally there are significant opportunities. These need to be worked through and considered as part of an organizations strategic planning and risk management processes. Depending on the action or inaction taken by organisations the climate-related risks will have financial impact, whether on their position, performance or future outlook.

Climate-related risks can include:

- Asset impairment, changes in the useful life or fair valuation of assets;

- Increased costs or reduced demand for products and services;

- Provisions and contingent liabilities arising from fines and penalties through more stringent emissions regulations;

- Changes in expected credit losses for loans and financial.

-

Climate-related opportunities

It’s important to acknowledge that climate change also has the potential to create opportunities for business. An important aspect of the TCFD framing is to ensure that businesses also identify relevant climate-related opportunities and develop strategies to capitalize on these.

Some examples of potential climate-related opportunities for businesses include:

- Growth and innovation through the development of products and services that contribute to climate mitigation and adaptation;

- Reduced costs through improved energy and resource efficiency;

- Improved reputation with employees, customers and other stakeholders;

- Improved resilience to business disruptions.

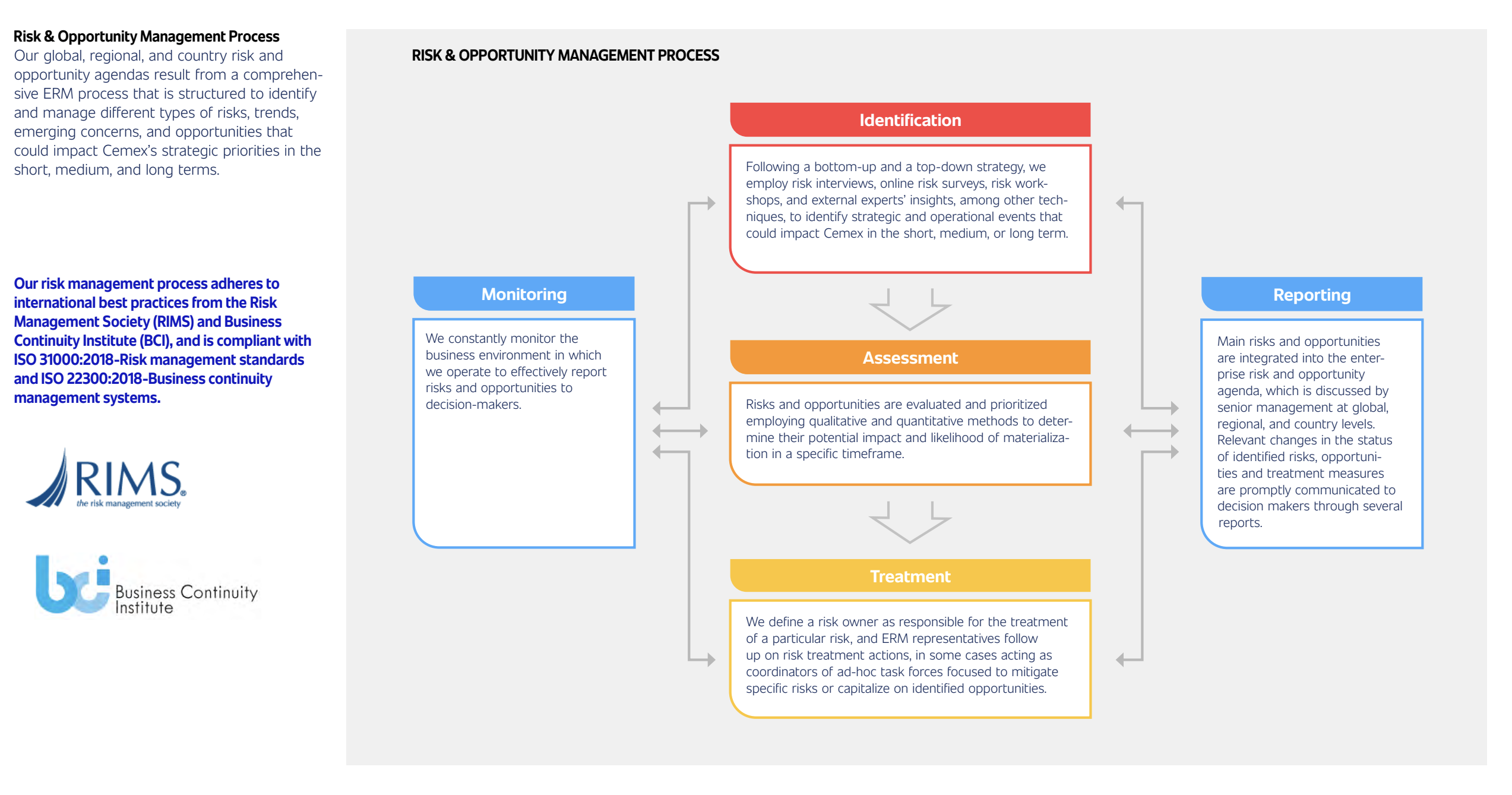

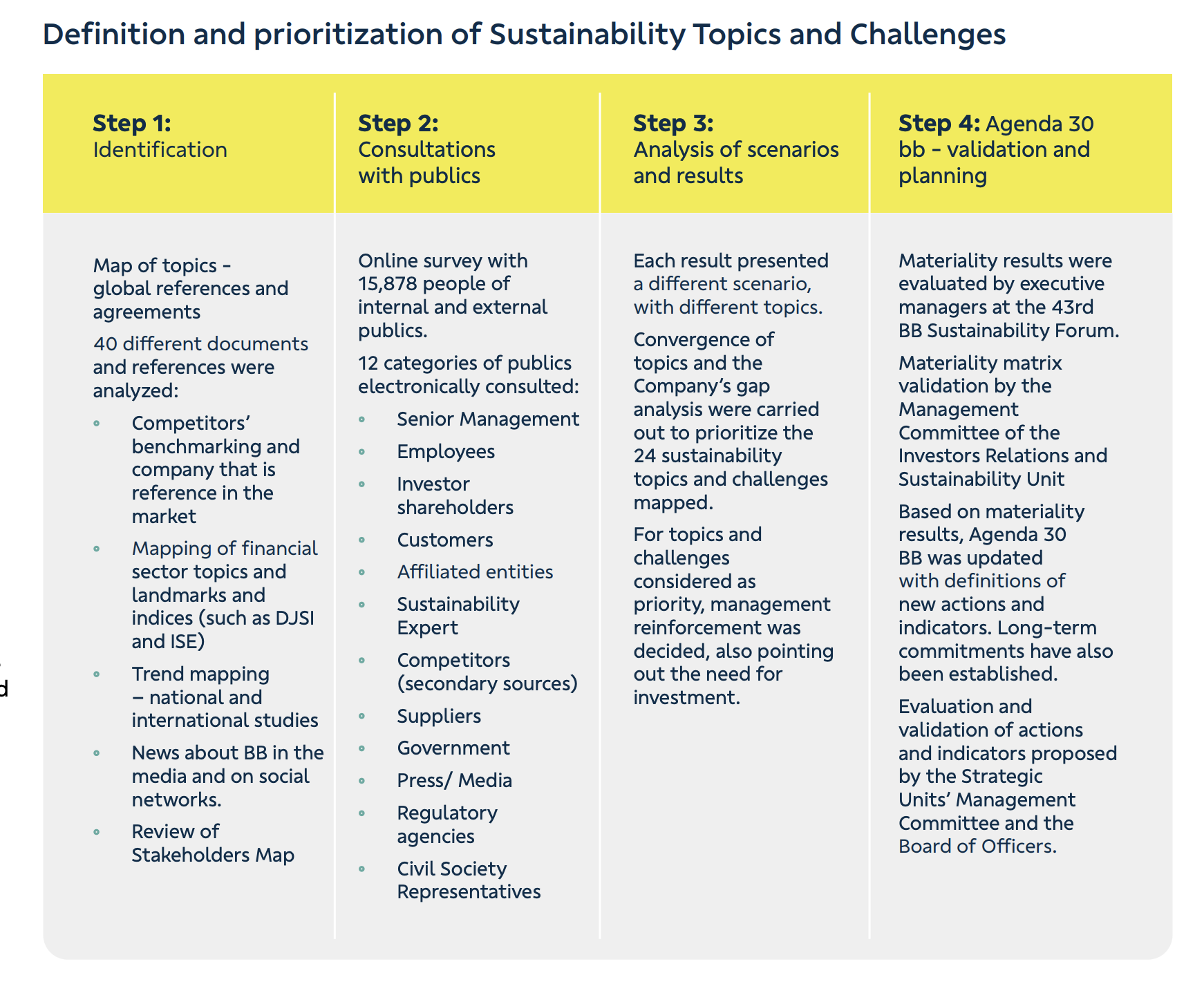

Describe the organization’s processes for identifying and assessing climate-related risks and opportunities.

Consider including a discussion of:

- How do you determine the relative significance of climate-related risks vs other risks?

- Specifically, what input parameters do you use to identify risks (e.g.: data sources, the scope of operations covered and the detail used in assumptions)?

- Do you consider existing and emerging regulatory requirements related to climate change?

- Did you use climate-related scenario-analysis to inform your risk identification process? If so, how did you use it?

- Existing risk classification frameworks used?

- Did you use the same process for monitoring risks as last year, or did anything change?

Describe the organization’s processes for managing climate-related risks.

Consider including a discussion of:

- How do you make decisions to mitigate, transfer, accept, or control those risks?

- How do you prioritize climate-related risks?

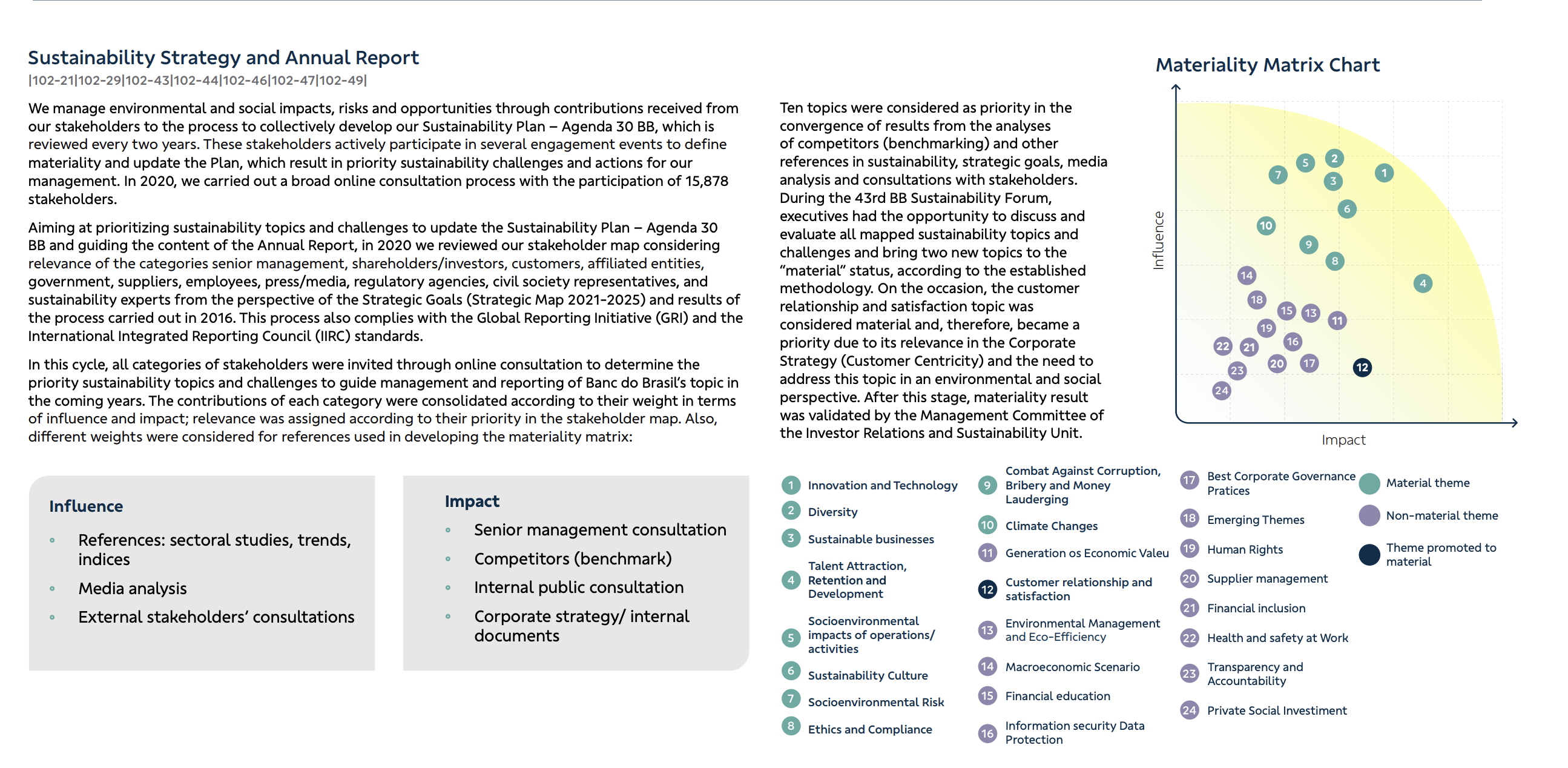

- How are materiality determinations made within your organization?

Describe how processes for identifying, assessing, and managing climate-related risks are integrated into the organization’s overall risk management.

Consider including a discussion of:

- Whether climate risk is considered a business risk?

- If it is material, should it be reported separately?

Describe the organization’s processes to identify, assess, prioritize and monitor opportunities.

For additional resources on TCFD, visit the TCFD Knowledge Hub and the TCFD publications web page.

For additional resources on the IFRS Sustainability Disclosure Standards, visit the IFRS Sustainability Knowledge Hub.

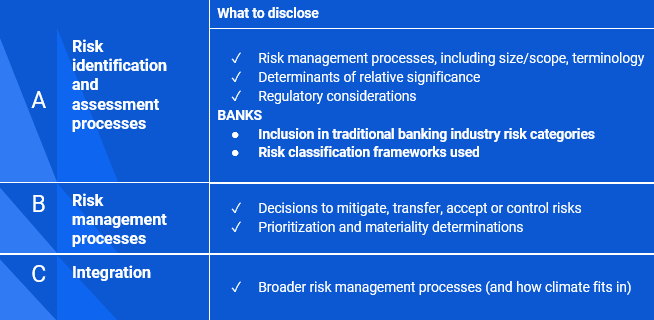

Top tips for getting started with disclosure

- Leverage existing processes and disclosures;

- Connect information;

- Cross referencing within and across reports (annual, sustainability, TCFD);

- Provide clear, concise and proportional information;

- Clearly define time horizons - short, medium and long-term;

- Start with qualitative reporting, if no data are available;

- Create an internal roadmap for climate-related disclosures;

- Liaise with different functions and teams that address climate change.

Creating an internal roadmap for climate-related disclosures

Where to disclose climate-related financial information?

- Disclosure should be provided in the mainstream annual report;

- Intention was not for separate TCFD statements or additional sustainability reporting;

- Integrated into reporting and connected to financial information;

- Subject to the same governance processes and sign off as the financial report;

- Accessible to investors as primary users.

International Sustainability Standards Board

IFRS S2 on Climate-related disclosures includes disclosure on Risk Management as one of the four pillars for climate-related financial disclosure (Governance, Strategy, Risk Management and Metrics and Targets). IFRS S2 climate-related disclosures should be read in conjunction with the IFRS S1 on General Sustainability-related Disclosures.

For additional resources on the IFRS Sustainability Disclosure Standards, visit the IFRS Sustainability Knowledge Hub.

-

ISSB IFRS S2 Climate-related Disclosures (Excerpt)

RISK MANAGEMENT

The objective of climate-related financial disclosures on risk management is to enable users of general purpose financial reports to understand an entity’s processes to identify, assess, prioritise and monitor climate-related risks and opportunities, including whether and how those processes are integrated into and inform the entity’s overall risk management process.

25 - To achieve this objective, an entity shall disclose information about:

(a) the processes and related policies the entity uses to identify, assess, prioritise and monitor climate-related risks, including information about:

(i) the inputs and parameters the entity uses (for example, information about data sources and the scope of operations covered in the processes);

(ii) whether and how the entity uses climate-related scenario analysis to inform its identification of climate-related risks;

(iii) how the entity assesses the nature, likelihood and magnitude of the effects of those risks (for example, whether the entity considers qualitative factors, quantitative thresholds or other criteria);

(iv) whether and how the entity prioritises climate-related risks relative to other types of risk;

(v) how the entity monitors climate-related risks; and

(vi) whether and how the entity has changed the processes it uses compared with the previous reporting period;(b) the processes the entity uses to identify, assess, prioritise and monitor climate-related opportunities, including information about whether and how the entity uses climate-related scenario analysis to inform its identification of climate-related opportunities; and

(c) the extent to which, and how, the processes for identifying, assessing, prioritising and monitoring climate-related risks and opportunities are integrated into and inform the entity’s overall risk management process.26 - In preparing disclosures to fulfil the requirements in paragraph 25, an entity shall avoid unnecessary duplication in accordance with IFRS S1 (see paragraph B42(b) of IFRS S1). For example, although an entity shall provide the information required by paragraph 25, if oversight of sustainability-related risks and opportunities is managed on an integrated basis, the entity would avoid duplication by providing integrated risk management disclosures instead of separate disclosures for each sustainability-related risk and opportunity.

European Sustainability Reporting Standards

The European Sustainability Reporting Standards has topic-specific standards on climate change, which includes disclosure on governance as one of the four pillars for climate-related disclosure (Governance, Strategy, Impact, Risk and Opportunity Management, and Metrics and Targets). It should be implemented in conjunction with the general disclosures required in the cross-cutting ESRS 2 General Disclosures.

-

European Sustainability Reporting Standards ESRS E1 – Climate Change

ESRS 2 General disclosures

12. The requirements of this section should be read and applied in conjunction with the disclosures required by ESRS 2 on Chapter 2 Governance, Chapter 3 Strategy and Chapter 4 Impact, risk and opportunity management. The resulting disclosures shall be presented in the sustainability statement alongside the disclosures required by ESRS 2, except for ESRS 2 SBM-3 Material impacts, risks and opportunities and their interaction with strategy and business model, for which the undertaking may, in accordance with ESRS2 paragraph 46, present the disclosures alongside the other disclosures required in this topical standard.

Impact, risk and opportunity management

Disclosure requirement related to ESRS 2 IRO-1 – Description of the processes to identify and assess material climate-related impacts, risks and opportunities20. The undertaking shall describe the process to identify and assess climate-related impacts, risks and opportunities.

This description shall include its process in relation to:

(a) impacts on climate change, in particular, the undertaking’s GHG emissions (as required by Disclosure Requirement ESRS E1-6);

(b) climate-related physical risks in own operations and along the upstream and downstream value chain, in particular:

i. the identification of climate-related hazards, considering at least high emission

climate scenarios; and

ii. the assessment of how its assets and business activities may be exposed and are sensitive to these climate-related hazards, creating gross physical risks for the undertaking.

(c) climate-related transition risks and opportunities in own operations and along the upstream and downstream value chain, in particular:

i. the identification of climate-related transition events, considering at least a climate scenario in line with limiting global warming to 1.5°C with no or limited overshoot; and

ii. the assessment of how its assets and business activities may be exposed to these climate-related transition events, creating gross transition risks or opportunities for the undertaking.21. When disclosing the information required under paragraphs 20 (b)and 20 (c) the undertaking shall explain how it has used climate-related scenario analysis, including a range of climate scenarios, to inform the identification and assessment of physical risks and transition risks and opportunities over the short-, medium- and long-term.

Disclosure Requirement E1-2 – Policies related to climate change mitigation and adaptation

22. The undertaking shall describe its policies adopted to manage its material impacts,

risks and opportunities related to climate change mitigation and adaptation.23. The objective of this Disclosure Requirement is to enable an understanding of the extent to which the undertaking has policies that address the identification, assessment, management and/or remediation of its material climate change mitigation and adaptation impacts, risks and opportunities.

24. The disclosure required by paragraph 22 shall contain the information on the policies the undertaking has in place to manage its material impacts, risks and opportunities related to climate change mitigation and adaptation in accordance with ESRS 2 MDR-P Policies adopted to manage material sustainability matters.

25. The undertaking shall indicate whether and how its policies address the following areas:

(a) climate change mitigation;

(b) climate change adaptation;

(c) energy efficiency;

(d) renewable energy deployment; and

(e) otherDisclosure Requirement E1-3 – Actions and resources in relation to climate change policies

26. The undertaking shall disclose its climate change mitigation and adaptation actions and the resources allocated for their implementation.

27. The objective of this Disclosure Requirement is to provide an understanding of the key actions taken and planned to achieve climate-related policy objectives and targets.

28. The description of the actions and resources related to climate change mitigation and adaptation shall follow the principles stated in ESRS 2 MDR-A Actions and resources in relation to material sustainability matters.

29. In addition to ESRS 2 MDR-A, the undertaking shall:

(a) when listing key actions taken in the reporting year and planned for the future, present

the climate change mitigation actions by decarbonisation lever including the naturebased solutions;

(b) when describing the outcome of the actions for climate change mitigation, include the

achieved and expected GHG emission reductions; and

(c) relate significant monetary amounts of CapEx and OpEx required to implement the actions taken or planned to:

i. the relevant line items or notes in the financial statements;

ii. the key performance indicators required under Commission Delegated

Regulation (EU) 2021/2178; and

iii. if applicable, the CapEx plan required by Commission Delegated Regulation (EU) 2021/2178

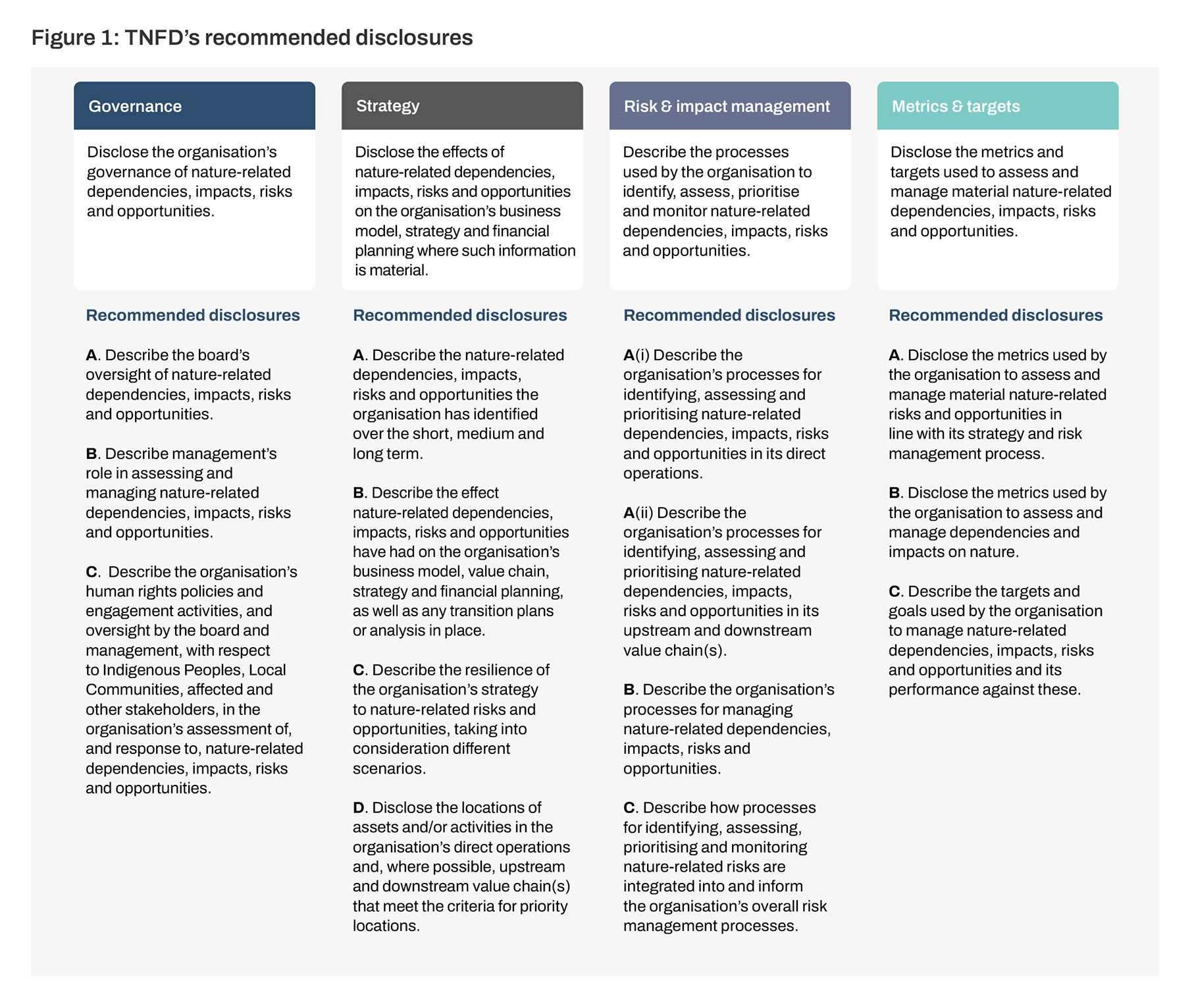

Nature loss poses both risks and opportunities for business, now and in the future. More than half of the world’s economic output – US$44tn of economic value generation – is moderately or highly dependent on nature. The Taskforce on Nature-related Financial Disclosures (TNFD) was announced in July 2020 to develop and deliver a risk management and disclosure framework for organizations to report and act on evolving nature-related risks, with the ultimate aim of supporting a shift in global financial flows away from nature-negative outcomes and toward nature-positive outcomes. In September 2023, TNFD launched the final Recommendations of the Taskforce on Nature-related Financial Disclosures , aligned with TCFD’s four-pillar structure.