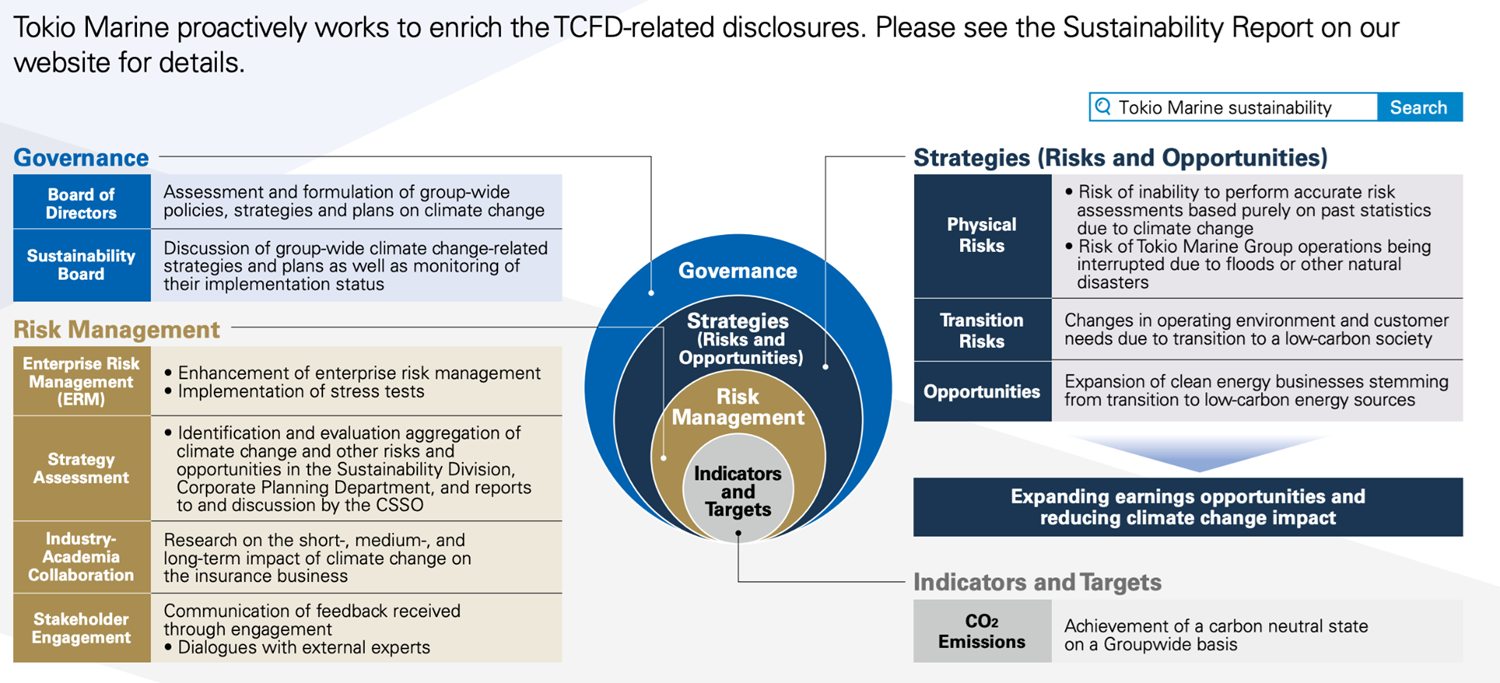

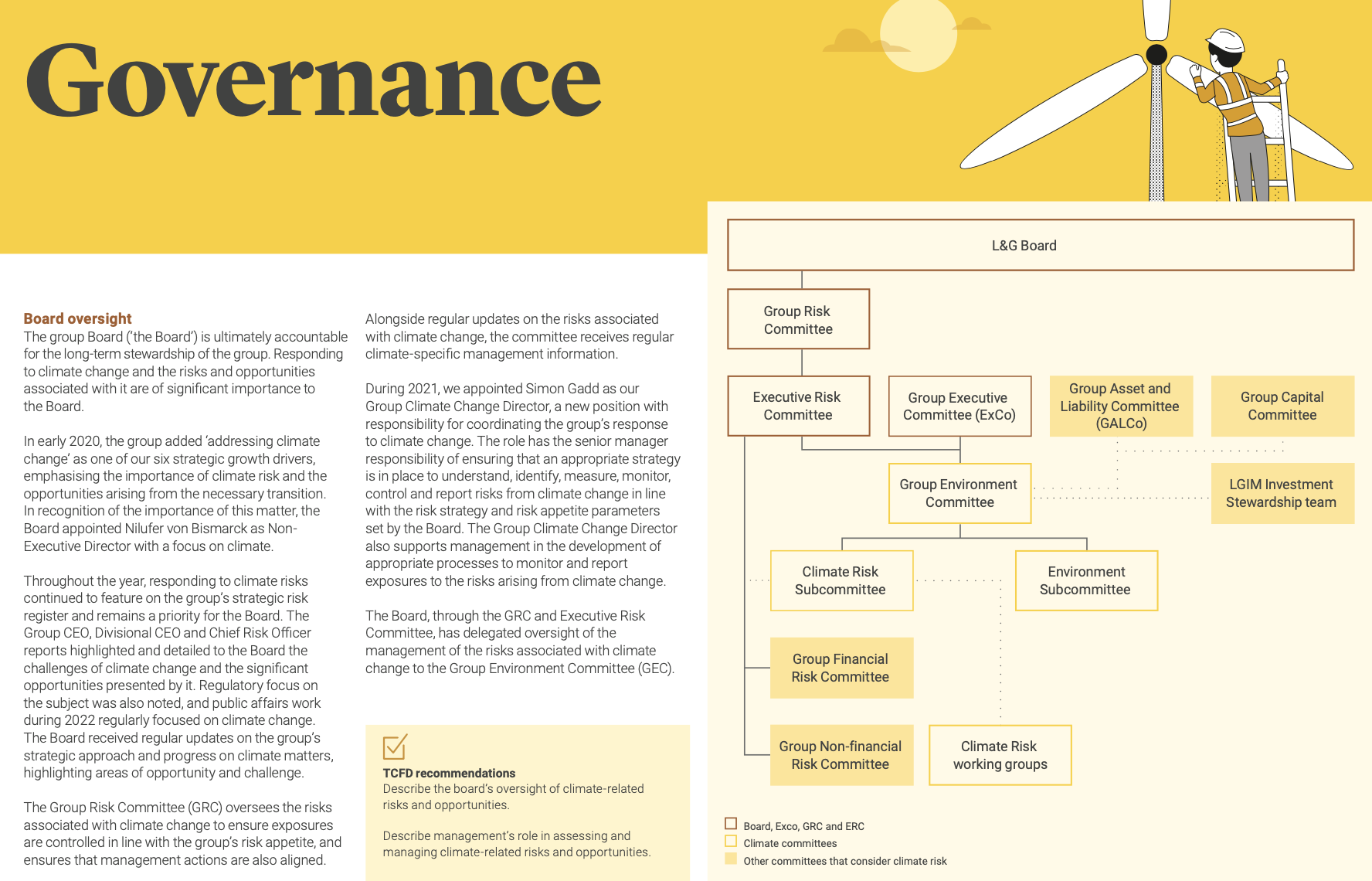

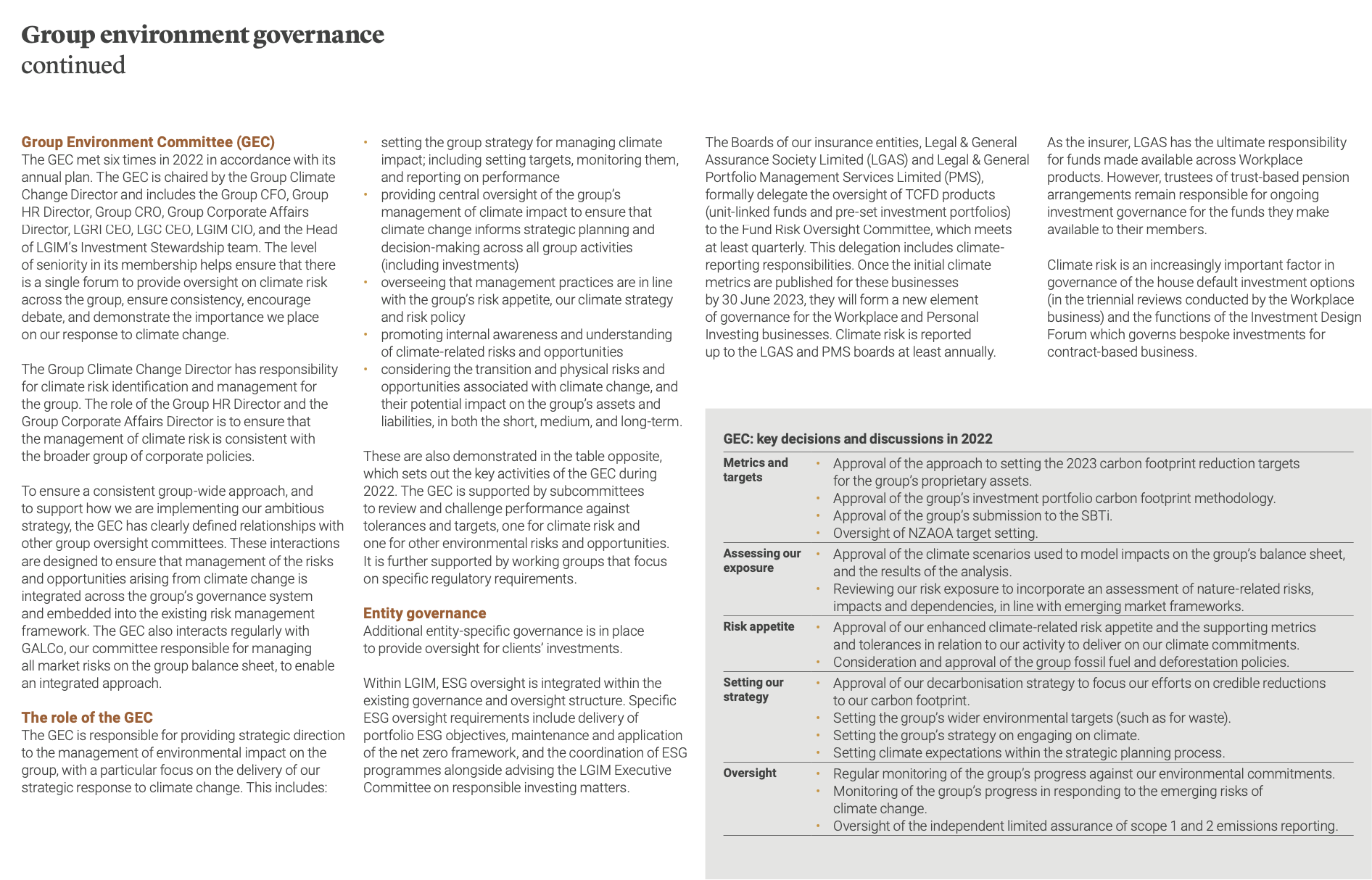

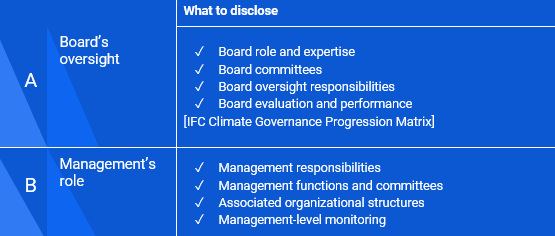

The ISSB and TCFD’s governance pillars both recommends that companies disclose the organization’s governance regarding climate-related risks and opportunities.

What do investors want to know?

- Insight into the governance and risk management context in which financial and operating results are achieved.

- Understand if climate-related issues receive appropriate board and management attention and are considered in decision-making.

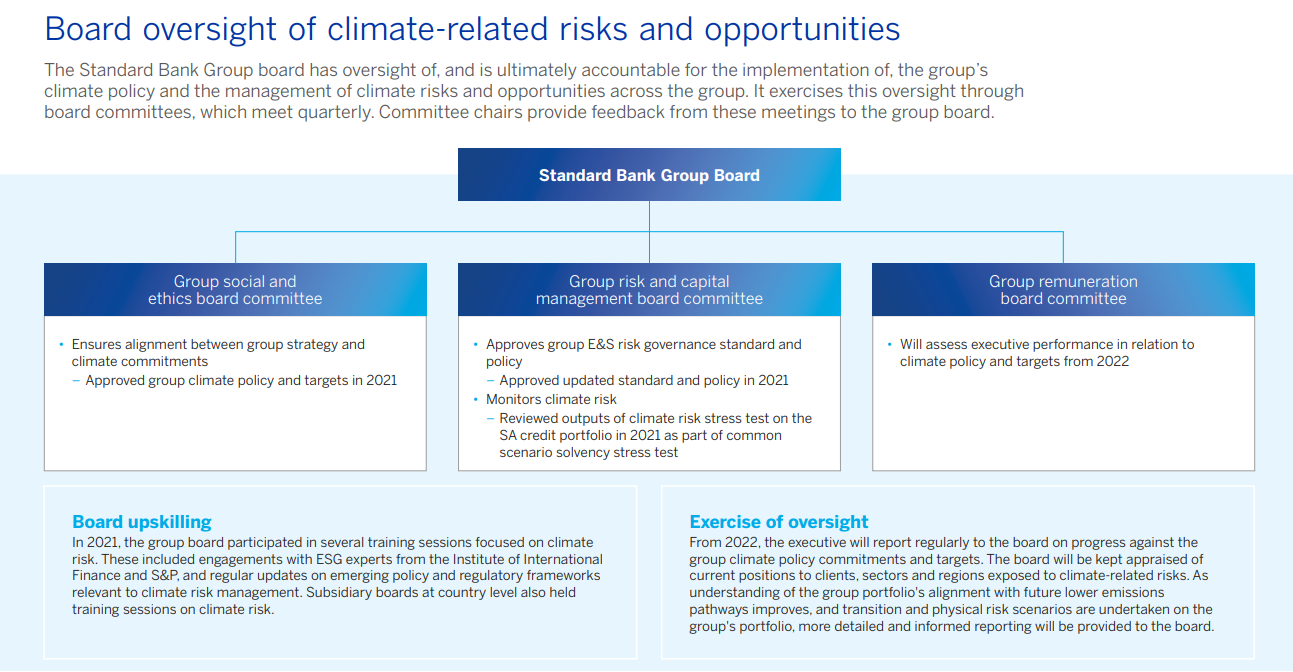

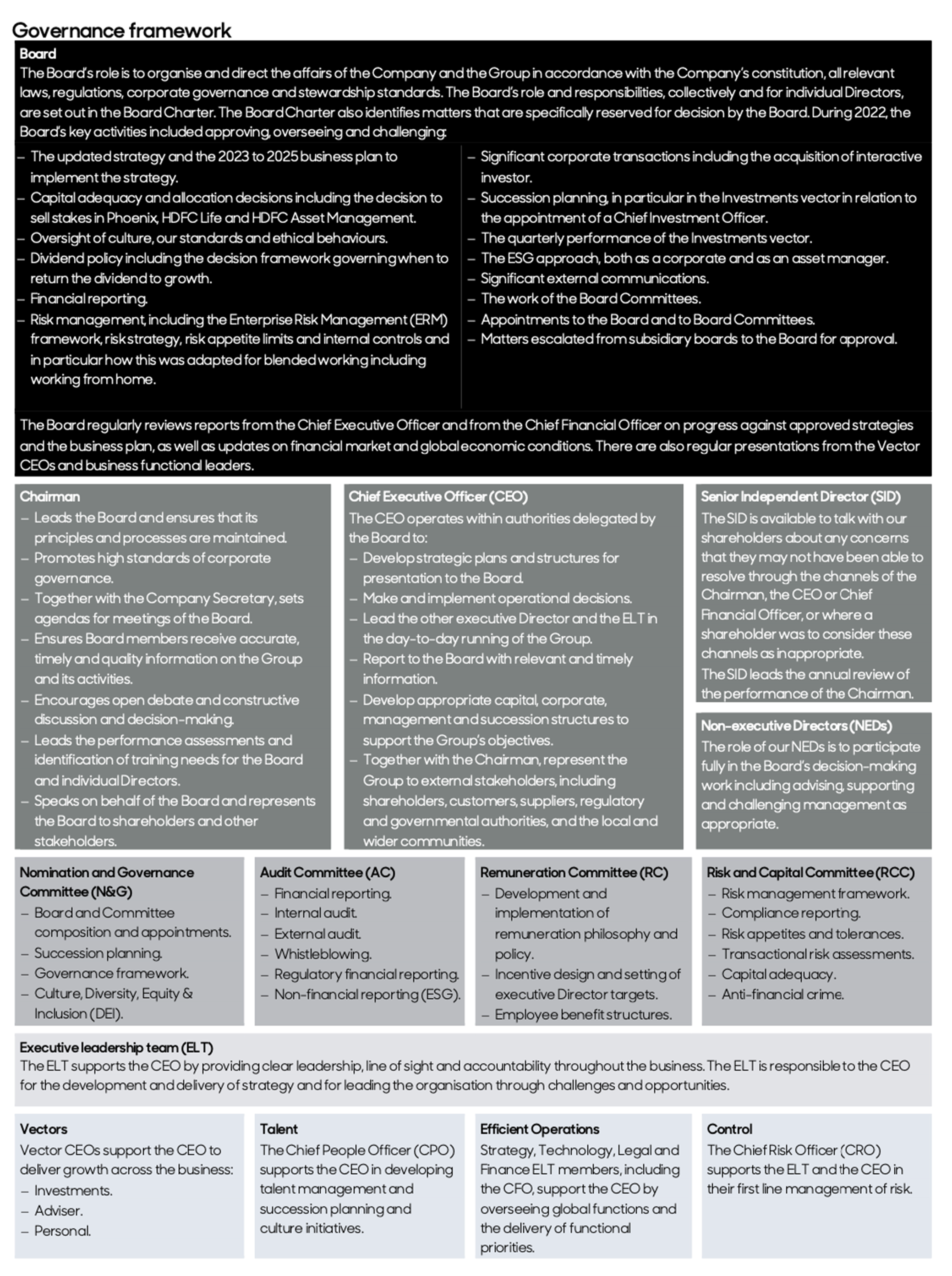

Disclose the role of the board of the organisation in overseeing climate-related issues.

Consider including a discussion of:

- How and how often the board or board committees (such as audit, risk, or other committees) are informed about climate-related issues;

- Whether climate-related issues are considered when reviewing strategy, risk management policies, expenditure, and so on;

- How the board conducts monitoring and oversight of progress against targets for addressing climate-related issues.

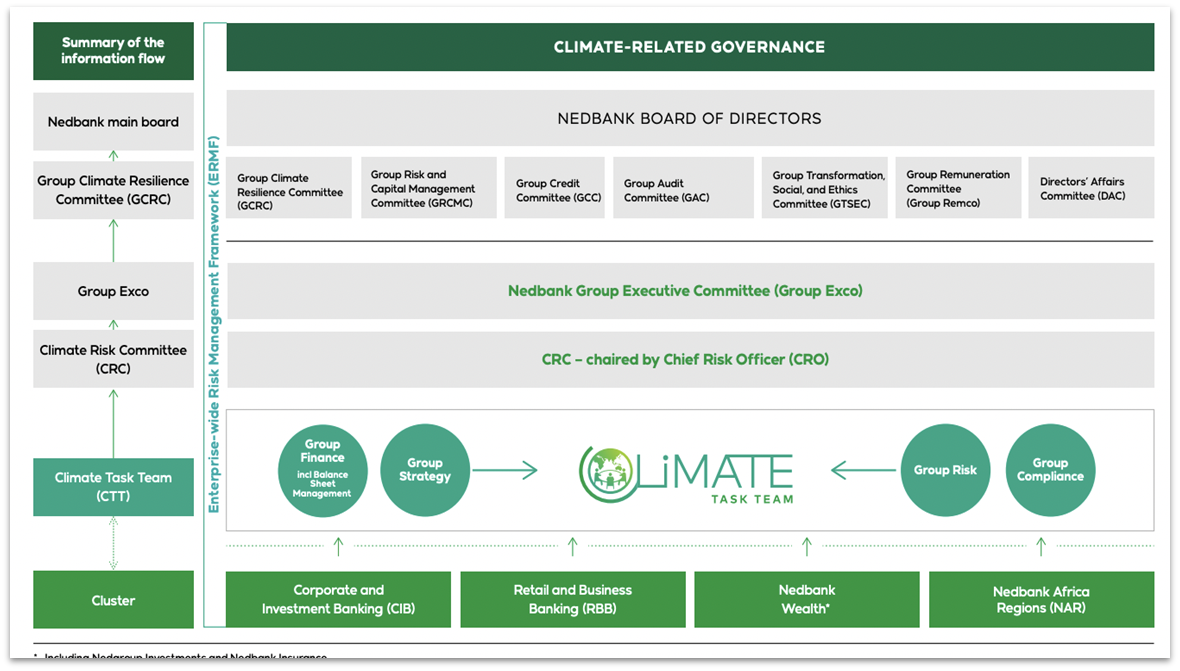

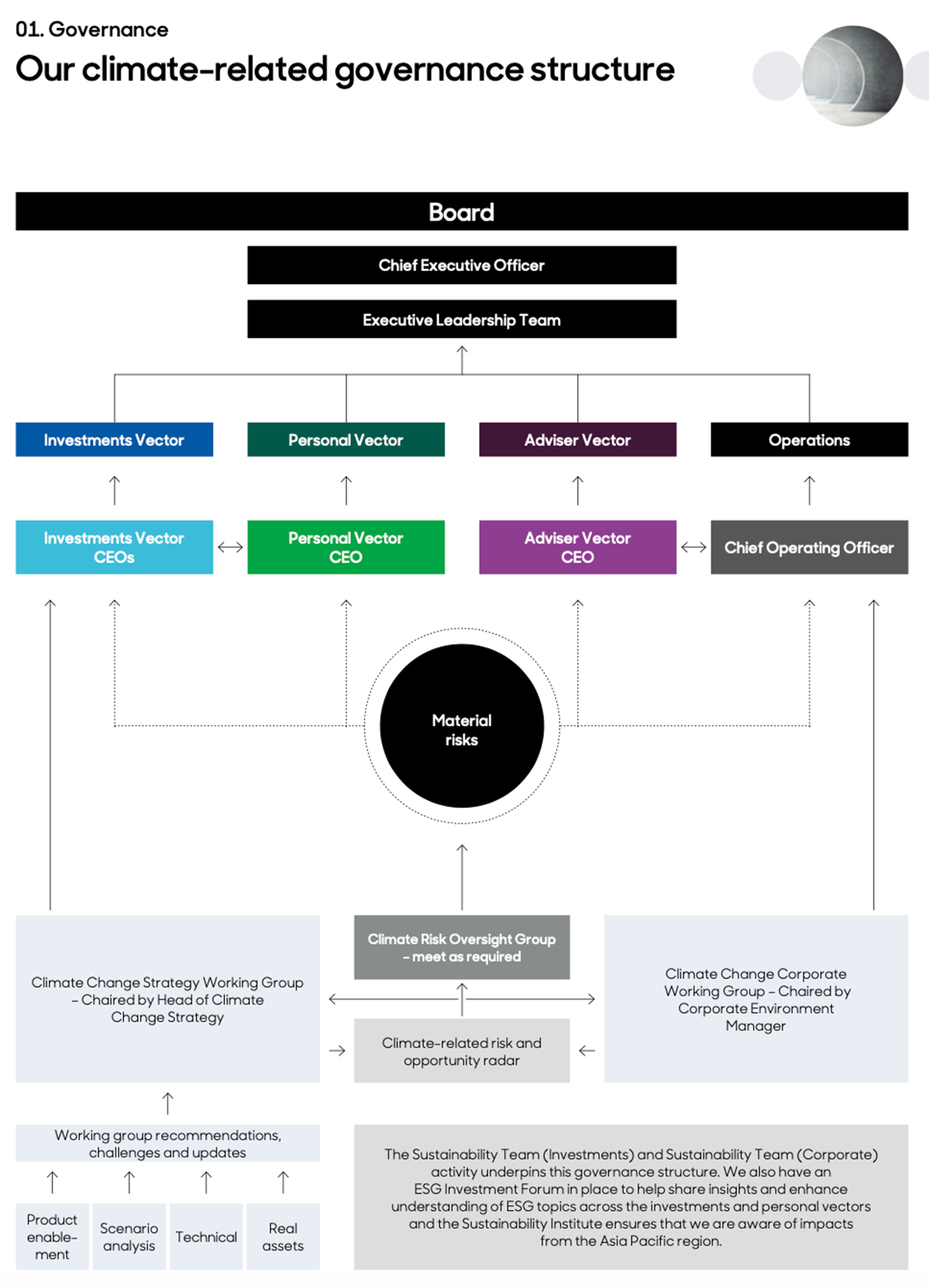

Disclosing the role of management in assessing and managing climate-related issues.

Consider including a discussion of:

- Whether your organisation has assigned climate-related responsibilities to management-level positions or committees;

- Description of the associated organizational structures;

- How the governance body(s)’ or individual(s)’ responsibilities for climate-related risks and opportunities are reflected in the terms of reference;

- Mandates, role descriptions and other related policies applicable to relevant body(s) or individual(s);

- Processes by which management is informed about climate-related issues;

- How management monitors climate-related issues;

For additional resources on TCFD, visit the TCFD Knowledge Hub and the TCFD publications web page.

Governance Checklist

Top Tips for Getting Started with Disclosure

- Leverage existing processes and disclosures;

- Connect information;

- Cross-reference within and across reports (annual, sustainability, TCFD);

- Provide clear, concise, and proportional information;

- Clearly define time horizons (short-, medium-, and long-term);

- Start with qualitative reporting, if no data are available;

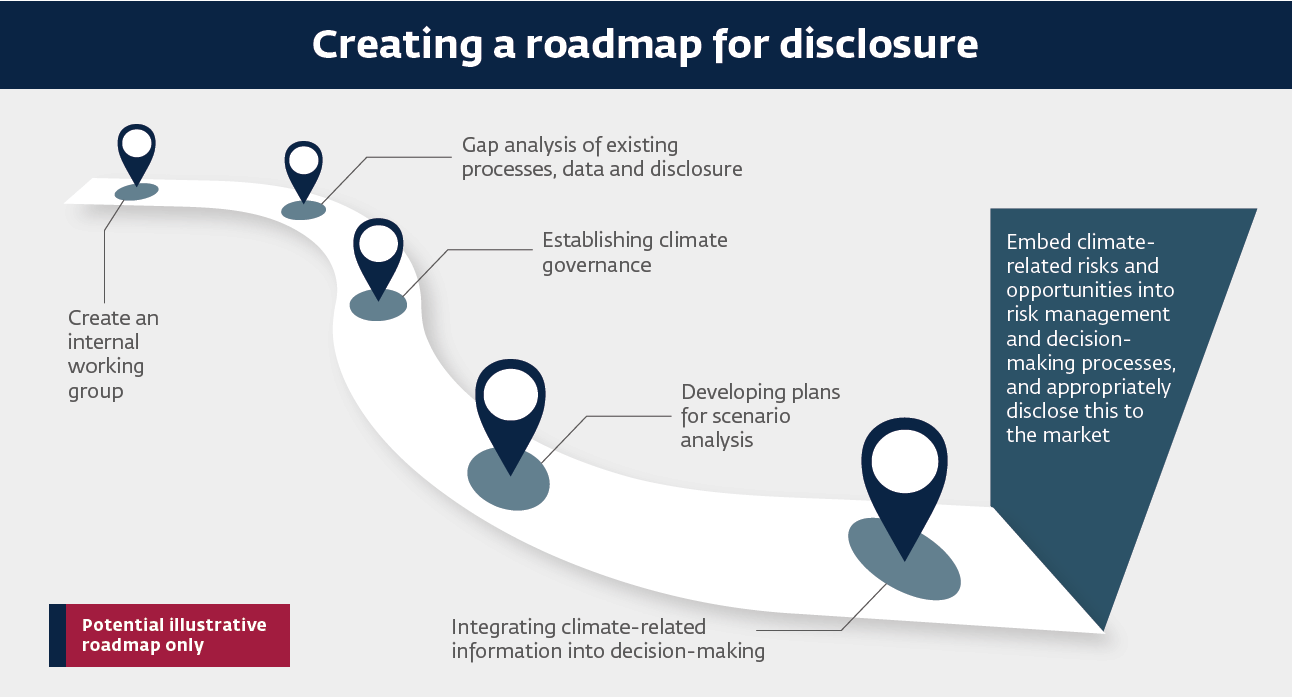

- Create an internal road map for climate-related disclosures;

- Coordinate with different functions and teams that address climate change.

Creating an Internal Road Map for Climate-Related Disclosures

Where to disclose climate-related financial information?

- Disclosure should be provided in the mainstream annual report;

- Intention was not for separate TCFD statements or additional sustainability reporting;

- Integrated into reporting and connected to financial information;

- Subject to the same governance processes and sign-off as the financial report;

- Accessible to investors as primary users.

Climate change is a significant and, in many cases, existential risk for companies. They are facing the unprecedented physical impacts of climate change, which their boards must address, such as extreme weather events disrupting value chains and affecting business infrastructure.

Using the IFC Corporate Governance Methodology, IFC’s climate governance approach guidance and recommended practices were developed to assist boards in appropriately identifying and overseeing climate-related risks and opportunities.

IFC’s main tool in assessing climate governance is the IFC Climate Governance Progression Matrix to evaluate a company’s climate governance practices in each of the six areas of governance, with four levels of achievement (from basic to international best practice):

- Commitment to Environmental, Social, and Corporate Governance: to create a climate mindset and demonstrate leadership;

- Structure and Functioning of the Board of Directors: to create active board engagement on climate change;

- Control Environment: to integrate climate change issues into key internal control systems, the internal audit function, risk governance, and compliance;

- Disclosure and Transparency: to ensure disclosure of climate-related financial information;

- Treatment of Minority Shareholders: to ensure equitable treatment of all stakeholders;

- Governance of Stakeholder Engagement: to involve those affected stakeholders.

![Tip Sheet: Climate Governance: Equipping Boards to Mitigate Climate Risks and Seize Climate Opportunities [Link]](/sites/default/files/inline-images/Climate%20Governance%20-%20%20Equipping%20Boards%20to%20Mitigate%20Climate%20Risks%20and%20Seize%20Climate%20Opportunities.png)

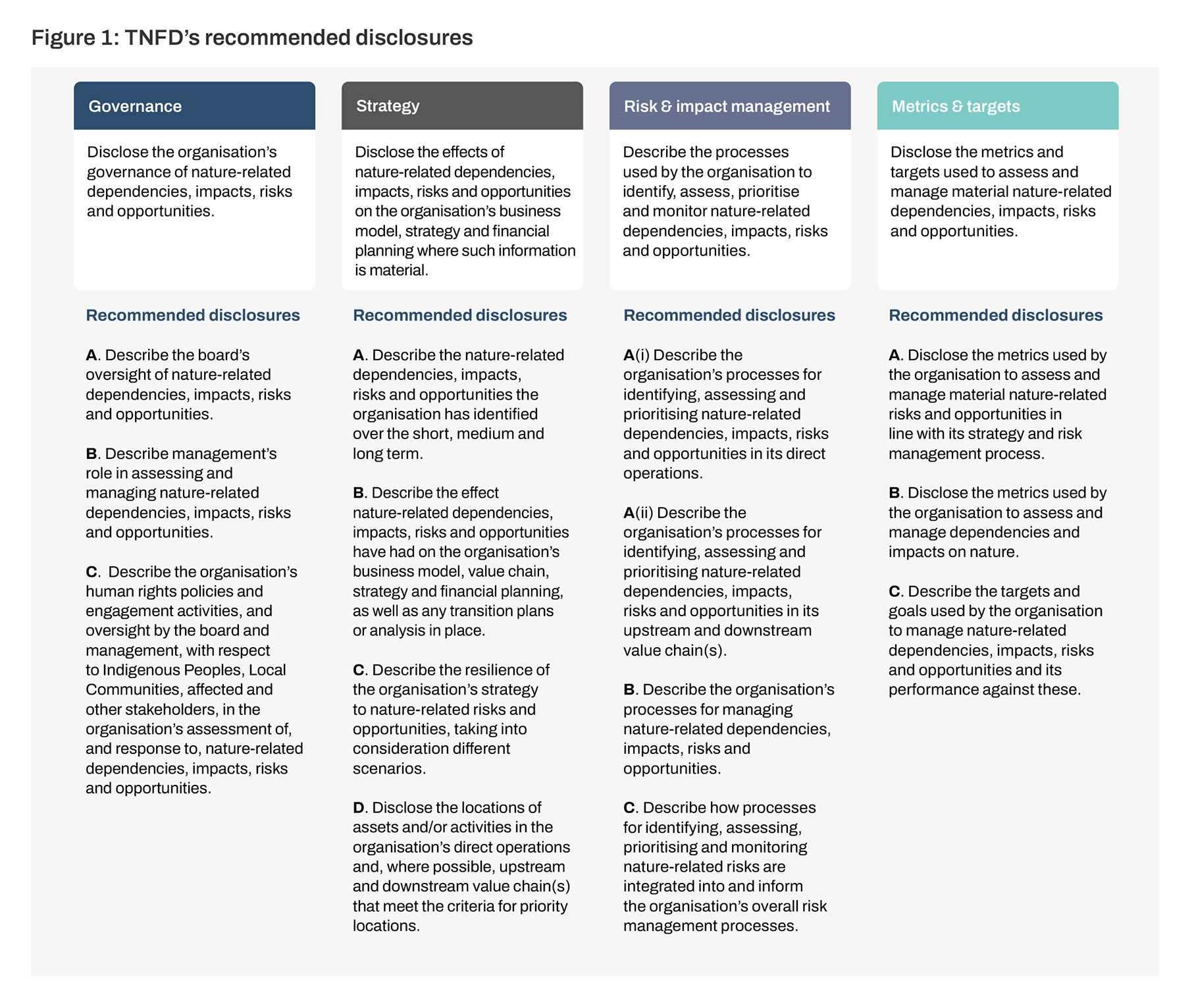

In recent years, momentum and efforts have grown to develop globally harmonized sustainability reporting standards. These efforts resulted in the development of the IFRS Sustainability Disclosure Standards, a global baseline for sustainability disclosures and the European Sustainability Reporting Standards. Both disclosure standards have topic-specific standards for reporting of climate-related information: IFRS S2 Climate-Related Disclosures and ESRS E1 Climate Change. The Taskforce on Nature-related Financial Disclosures (TNFD) released in March 2023 the fourth version of its beta framework for the disclosure of nature-related information.

International Sustainability Standards Board

ISSB IFRRS S2 Climate-Related Disclosures includes disclosure on governance as one of the four pillars for climate-related financial disclosure (governance, strategy, risk management, and metrics and targets). The publication should be read in conjunction with ISSB IFRS S1 General Requirements for Disclosure of Sustainability-Related Financial Information.

-

ISSB IFRS S2 Climate-Related Disclosures

Governance

5. The objective of climate-related financial disclosures on governance is to enable users of general purpose financial reports to understand the governance processes, controls and procedures an entity uses to monitor, manage and oversee climate-related risks and opportunities.

6. To achieve this objective, an entity shall disclose information about:

(a) the governance body(s) (which can include a board, committee or equivalent body charged with governance) or individual(s) responsible for oversight of climate-related risks and opportunities. Specifically, the entity shall identify that body(s) or individual(s) and disclose information about:

(i) how responsibilities for climate-related risks and opportunities are reflected in the terms of reference, mandates, role descriptions and other related policies applicable to that body(s) or individual(s);

(ii) how the body(s) or individual(s) determines whether appropriate skills and competencies are available or will be developed to oversee strategies designed to respond to climate-related risks and opportunities;

(iii) how and how often the body(s) or individual(s) is informed about climate-related risks and opportunities;

(iv) how the body(s) or individual(s) takes into account climate-related risks and opportunities when overseeing the entity’s strategy, its decisions on major transactions and its risk management processes and related policies, including whether the body(s) or individual(s) has considered trade-offs associated with those risks and opportunities; and

(v) how the body(s) or individual(s) oversees the setting of targets related to climate-related risks and opportunities, and monitors progress towards those targets (see paragraphs 33–36), including whether and how related performance metrics are included in remuneration policies (see paragraph 29(g)).(b) management’s role in the governance processes, controls and procedures used to monitor, manage and oversee climate-related risks and opportunities, including information about:

(i) whether the role is delegated to a specific management-level position or management-level committee and how oversight is exercised over that position or committee; and

(ii) whether management uses controls and procedures to support the oversight of climate-related risks and opportunities and, if so, how these controls and procedures are integrated with other internal functions.7. In preparing disclosures to fulfil the requirements in paragraph 6, an entity shall avoid unnecessary duplication in accordance with IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information (IFRS S1) (see paragraph B42(b) of IFRS S1). For example, although an entity shall provide the information required by paragraph 6, if oversight of sustainability-related risks and opportunities is managed on an integrated basis, the entity would avoid duplication by providing integrated governance disclosures instead of separate disclosures for each sustainability-related risk and opportunity.

The European Sustainability Reporting Standards has topic-specific standards on climate change, which includes disclosure on governance as one of the four pillars for climate-related disclosure (Governance, Strategy, Impact, Risk and Opportunity Management, and Metrics and Targets). It should be implemented in conjunction with the general disclosures required in the cross-cutting ESRS 2 General Disclosures.

-

European Sustainability Reporting Standards, ESRS E1 – Climate Change

ESRS 2 General disclosures

12. The requirements of this section should be read and applied in conjunction with the disclosures required by ESRS 2 on Chapter 2 Governance, Chapter 3 Strategy and Chapter 4 Impact, risk and opportunity management. The resulting disclosures shall be presented in the sustainability statement alongside the disclosures required by ESRS 2, except for ESRS 2 SBM-3 Material impacts, risks and opportunities and their interaction with strategy and business model, for which the undertaking may, in accordance with ESRS2 paragraph 46, present the disclosures alongside the other disclosures required in this topical standard.

Governance Disclosure requirement related to ESRS 2 GOV-3 Integration of sustainability-related performance in incentive schemes

13. The undertaking shall disclose whether and how climate-related considerations are factored into the remuneration of members of the administrative, management and supervisory bodies, including if their performance has been assessed against the GHG emission reduction targets reported under Disclosure Requirement E1-4 and the percentage of the remuneration recognised in the current period that is linked to climate related considerations, with an explanation of what the climate considerations are.

Source: European Sustainability Reporting Standards: ESRS E1 Climate Change

Nature loss poses both risks and opportunities for business, now and in the future. More than half of the world’s economic output – US$44tn of economic value generation – is moderately or highly dependent on nature. The Taskforce on Nature-related Financial Disclosures (TNFD) was announced in July 2020 to develop and deliver a risk management and disclosure framework for organizations to report and act on evolving nature-related risks, with the ultimate aim of supporting a shift in global financial flows away from nature-negative outcomes and toward nature-positive outcomes. In September 2023, TNFD launched the final Recommendations of the Taskforce on Nature-related Financial Disclosures , aligned with TCFD’s four-pillar structure.