Financial statements are important for public accountability. Unlike financial key performance indicators, which are unique to the company’s business model and context, financial statements present an account of performance that is standardized according to generally accepted accounting practices and comparable across companies and industries.

The preparation and presentation of financial statements are often strictly regulated at the national level. Typically, countries have additional requirements for large companies listed on stock exchanges. For example, they may require listed companies to prepare financial statements according to nationally accepted accounting principles—a national version of International Financial Reporting Standards (IFRS) in most countries and other internally accepted best practices such as Generally Accepted Accounting Principles (GAAP) in the United States.

The annual report should include an affirmation that the financial statements have been prepared by management and audited by an independent, qualified, and competent auditor. For more information, see on Audit of financial statements.

The International Financial Reporting Standards for Small and Medium-Sized Entities (IFRS for SMEs) is less demanding and tailored to the information needs of lenders, creditors, and other stakeholders of small and medium enterprises, focusing primarily on information about cash flows, liquidity, and solvency. The standard is intended for use by entities that do not have public accountability (e.g. unlisted companies) and publish simplified financial statements.

Reporting on Financial Statements

Financial statements measure two key elements of a company’s performance:

- Financial position (assets, liabilities, and equity);

- Performance (income and cash flow).

Typical annual reports include the following financial statements and related information:

- Statements of income;

- Balance sheet;

- Statement of cash flows;

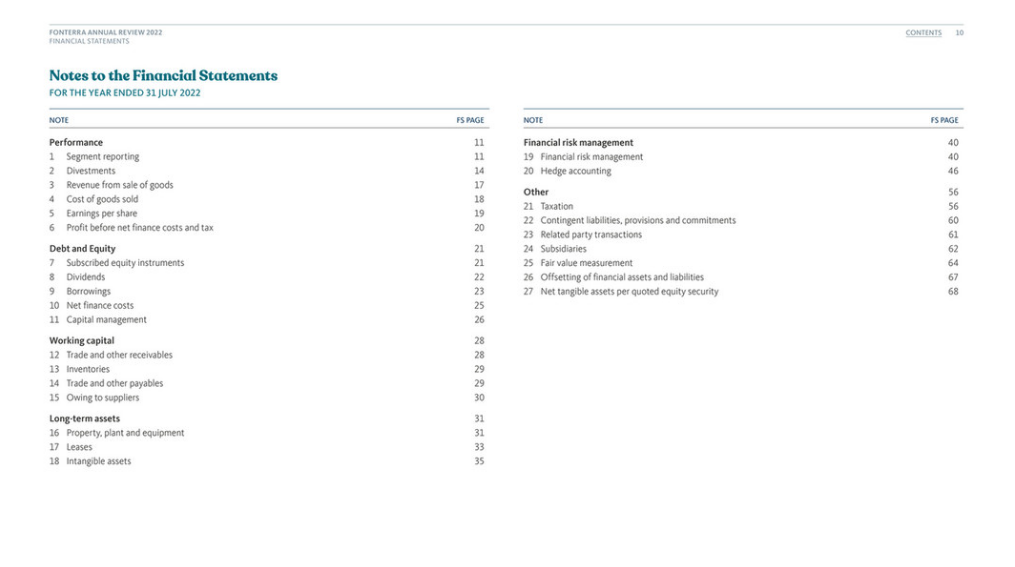

- Notes to financial statements.

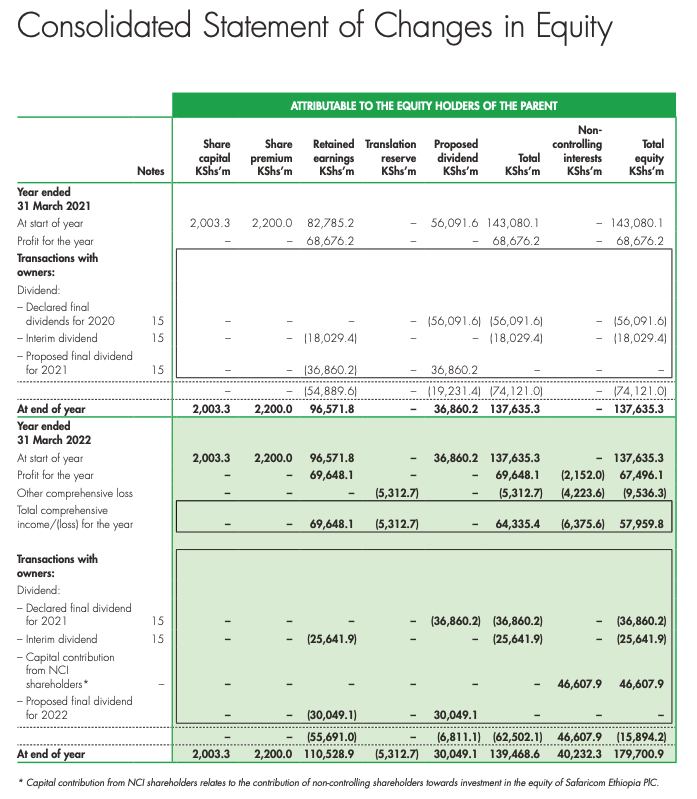

Listed companies may also include a statement of change in stockholders’ equity.

Financial statements are usually published along with additional information in the notes to financial statements.

IFRS International Accounting Standard 1 (IAS1) Presentation of Financial Statements requires an entity to present a complete set of financial statements at least annually, with comparative amounts for the preceding year (including comparative amounts in the notes).

Climate change is a topic in which stakeholders are increasingly interested because of its potential effect on companies’ business models, cash flows, financial position and financial performance. As such, some climate-related disclosures in the notes to the financial statements may be necessary. More information on the effects of climate-related matters on financial statements is available here.

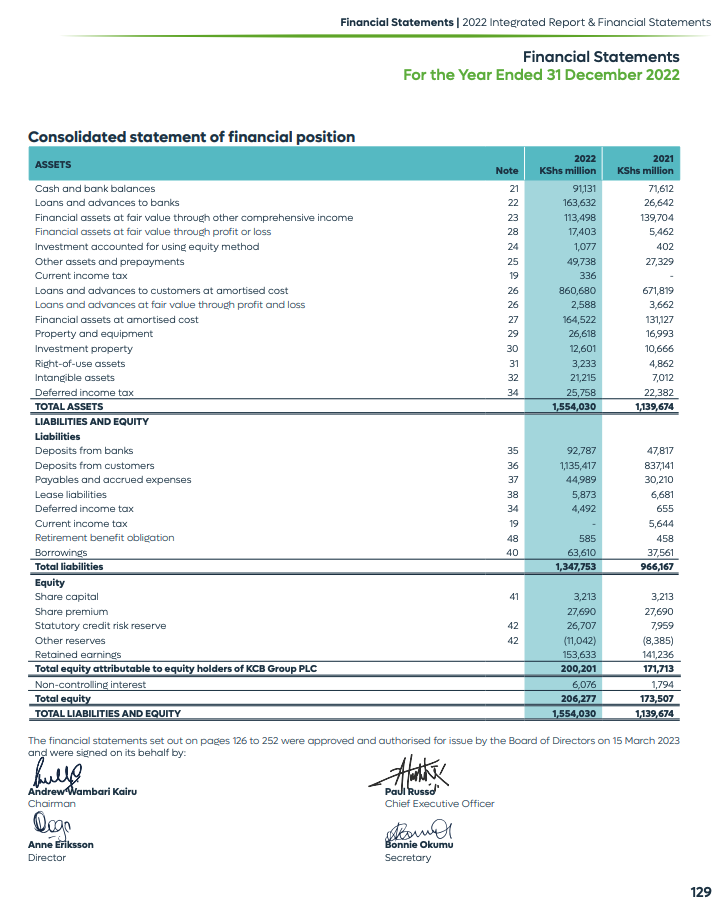

Two financial statements provide information on the company’s financial position: the balance sheet and, for publicly listed companies, the statement of shareholders’ equity with two years of comparable data.

Balance Sheet

- Reports a company's assets, liabilities, and shareholders' equity;

- Basis for computing rates of return and evaluating its capital structure;

- Picture of what a company owns and owes and amounts invested by shareholders.

Statement of Shareholders’ Equity

- Reflects changes in the value of the business to shareholders;

- Picture of how the business is performing, net of all assets and liabilities;

- Depicts how business activities contribute to changes in shareholders' equity.

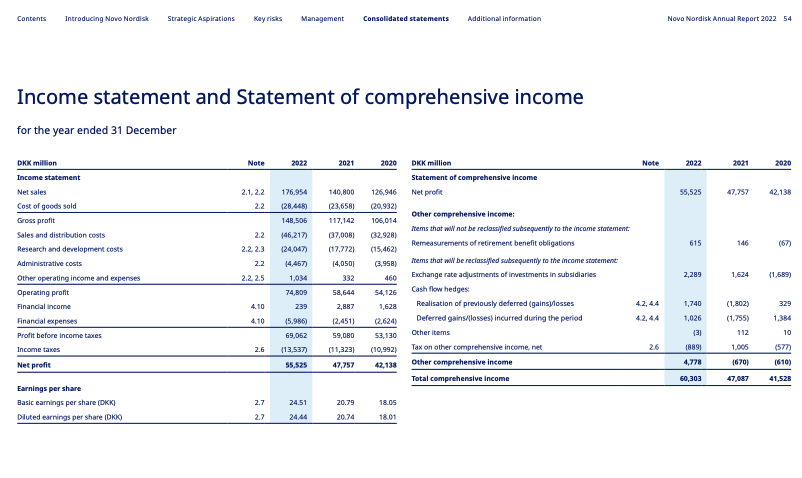

Two financial statements provide information on the company’s financial performance: the income statement and the statement of cash flows.

Income Statement

- Reports the company’s revenues and expenses during the reporting period;

- Provides insights into a company’s operations, the efficiency of its management, and allows to assess performance relative to industry peers.

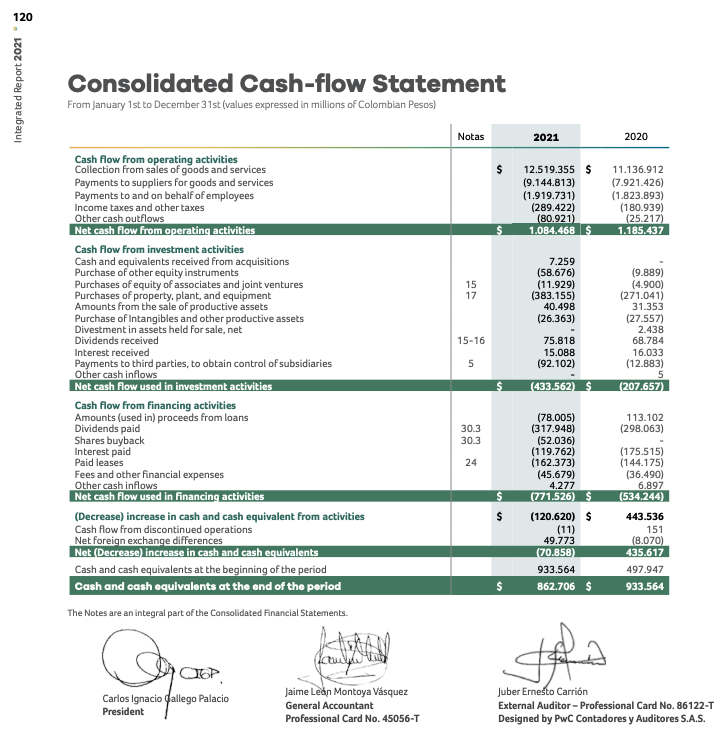

Statement of Cash Flows

- Reports cash inflows from internal operations and external investment;

- Reports cash outflows for business activities and investments;

- Trails cash made by the business in three ways: operations, investment, and financing.

Financial statements are published along with additional information needed to understand and analyze the company’s financial position and results.

Notes to Financial Statements

Financial statements are usually published along with notes to explain accounting policies and assumptions of the company. Notes also provide additional details on the numbers reported in the financial statements to help investors and other users understand and analyze performance. Investors sometimes use the notes to financial statements to evaluate the consistency between the company strategy and its operational and financial management.

IFRS AS1 Presentation of Financial Statements provides that complete set of financial statements comprises notes, including a summary of significant accounting policies and other explanatory information.

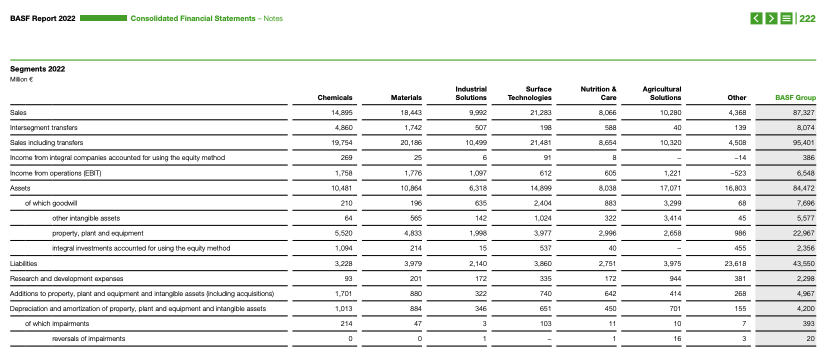

Segment Reporting

Companies should present segment information that corresponds to internal organization and management’s decision-making. Segment reporting in financial statements should correspond with other parts of the reports where business segments are relevant, including business model and environment and performance reporting.