Sustainable development is development that meets the needs of the present without compromising the ability of future generations to meet their own needs.

Sustainability, as applied to companies (corporate sustainability), refers to creating economic value while considering various stakeholders’ interests, including workers, customers, locally affected communities, and the environment. Sustainability considerations include companies’ social and environmental impacts that can affect long-term performance:

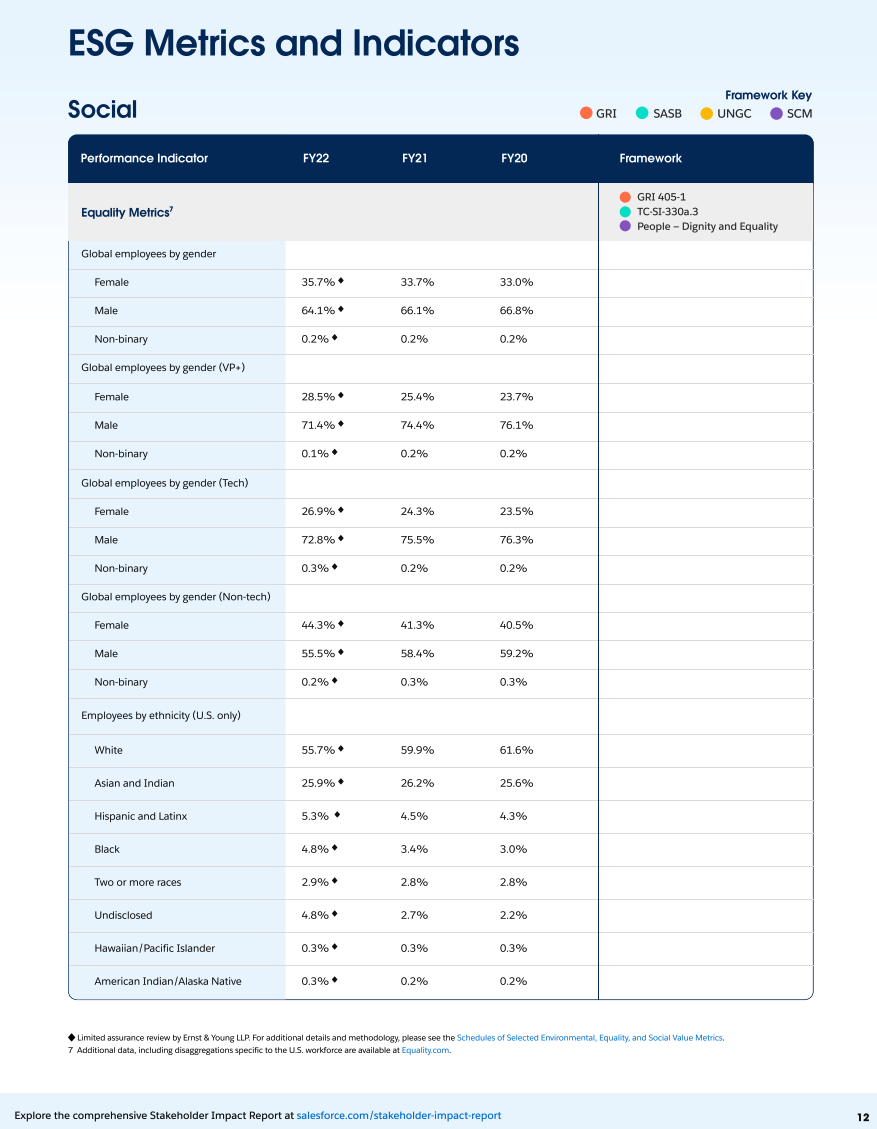

- Social factors include those that affect the well-being of employees, customers, and local communities and that are under the company’s control or influence;

- Environmental factors include the effect of the company’s physical activities on the environment or the natural capital the company uses to operate.

International Sustainability Standards Board (ISSB) Standards and European Sustainability Reporting Standards (ESRS)

ISSB IFRS S1 General Requirements for Disclosure of Sustainability-Related Financial Information

The International Financial Reporting Standards (IFRS) IFRS Sustainability Disclosure Standard describes sustainability as the ability of a company to sustainably maintain and access resources and relationships (such as financial, human, and natural) and manage its dependencies and impacts within its whole business ecosystem over the short, medium, and long terms.

European Union Corporate Sustainability Reporting Directive and European Sustainability Reporting Standards

The Corporate Sustainability Reporting Directive (CSRD) is the European Union’s latest initiative to improve the quality and comparability of corporate sustainability disclosures. The CSRD will affect 50,000 companies in the European Union as of January 1, 2024.

The CSRD uses the term “sustainability matters” to refer to environmental, social (including human rights), and governance factors.

The European Sustainability Reporting Standards (ESRS): ESRS 1 General Requirements Application Requirement 16 (AR 16) in Annex A provides an overview of the sustainability topics, sub-topics and sub-sub-topics (collectively ‘sustainability matters’) covered by topical ESRS such as on climate change, pollution, water and marine resources, biodiversity and ecosystems, own workforce, circular economy, workers in the value chain, affected communities, consumers and business conduct.

According to AR 16 in Annex A when performing its materiality assessment, the company shall consider the provided list of sustainability matters covered in the topical ESRS. If as a result of the materiality assessment a given sustainability matter is assessed to be material, the company shall report according to the corresponding Disclosure Requirements of the relevant topical ESRS.

See the list of sustainability matters on pages 24-26 in the ESRS 1 General Requirements

Why Disclose?

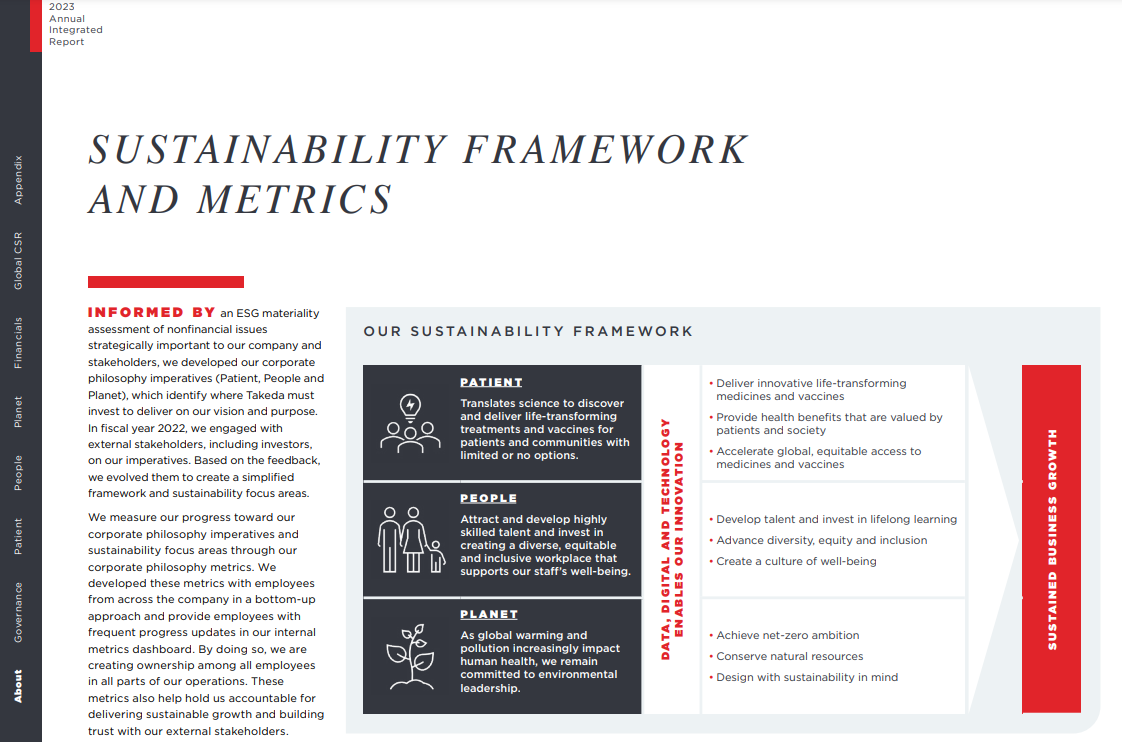

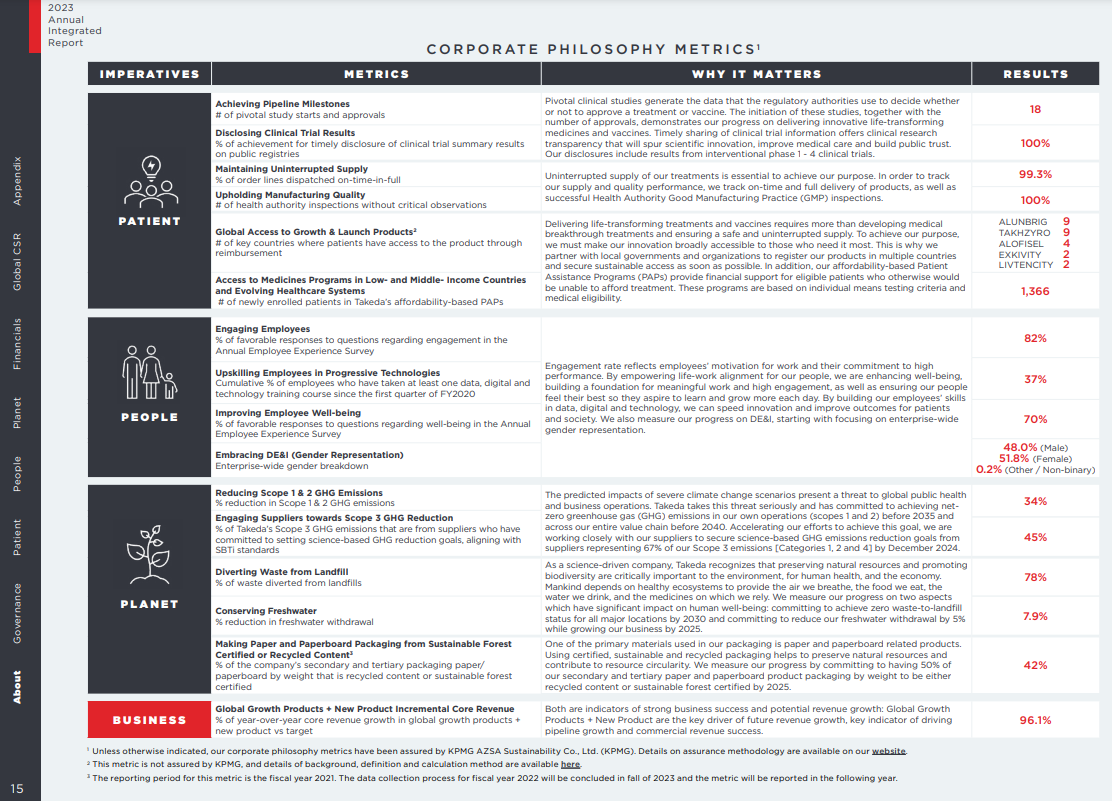

Sustainability issues can be major opportunities and risks for companies and should be an integral aspect of the strategy. Companies should report on the sustainability issues most relevant to their business model, industry, and location and that are most material for long-term value creation across various capitals and stakeholders.

Recommended Disclosure?

Describe the management systems in place to manage and monitor the core environmental and social issues (environmental and social management system or ESMS). Describe the method for assessing material sustainability-related risks and opportunities (materiality assessment), how often the assessment is performed, and the roles of management and the board in overseeing the assessment. Include a description of sustainability-related risks and opportunities facing the company and how they affect the company’s business model, strategy, and risk profile.

Environmental and Social Management Systems

Report on the management systems in place to manage and monitor material environmental and social issues. This is consistent with IFC Performance Standard 1: Assessment and Management of Environmental and Social Risks and Impacts, which specifies that companies should adopt a mitigation hierarchy to anticipate and avoid (or minimize where avoidance is not possible) impacts and, where residual impacts remain, compensate for or offset risks and impacts to workers, affected communities, and the environment.

Best Practice Resources

IFC Performance Standard 1: Environmental and Social Management Systems

An environmental and social management system (ESMS) helps companies integrate processes and practices to consistently implement policies to meet business objectives. An ESMS allows companies to anticipate environmental and social risks posed by their business activities and avoid, minimize, and compensate for any impacts. A good management system includes consultation with stakeholders and a way to address complaints from workers and local communities.

See IFC’s Environmental and Social Management System Implementation Handbook on ESMS.

Learn more about IFC’s ESMS Diagnostic Tool to assess the quality of an ESMS and benchmark it against IFC Performance Standard 1 and good market practices.

Visit IFC’s FIRST (Financial Institutions: Resource, Solutions, and Tools) for guidance on understanding and managing environmental and social risks and explore opportunities, and guidance on how to implement an ESMS specifically tailored for financial institutions.

Materiality Assessment

Companies should set a method for assessing material sustainability opportunities and risks and address how often the assessment is performed and the roles of management and the board in overseeing the assessment.

Concepts of Materiality for Sustainability

The evolution of corporate reporting toward integrating sustainability-related risks and opportunities in companies’ core strategy, governance, risk management, and performance brings with it new concepts of materiality to guide companies.

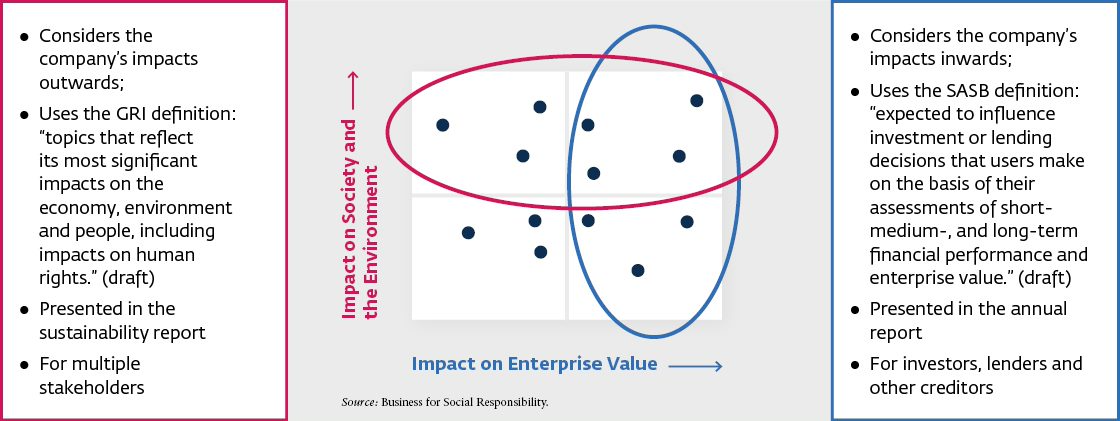

The concept of materiality is often used in corporate financial reporting to disclose information that a reasonable investor would consider important in making informed decisions about the company (IFRS, FASB). Regarding sustainability reporting, the concept was also used to gauge the disclosure of companies’ significant economic, environmental, and social impacts or matters that substantively influence stakeholders’ assessments and decisions, beyond investors (GRI).

Building on these two related concepts, the Integrated Reporting Framework, now part of IFRS, introduced an integrated approach based on long-term value creation. It defines material as the “matters that substantively affect the organization’s ability to create value over the short, medium, and long term,” where value creation is defined with reference to financial, manufactured, intellectual, human, social and relationship, and natural capitals.

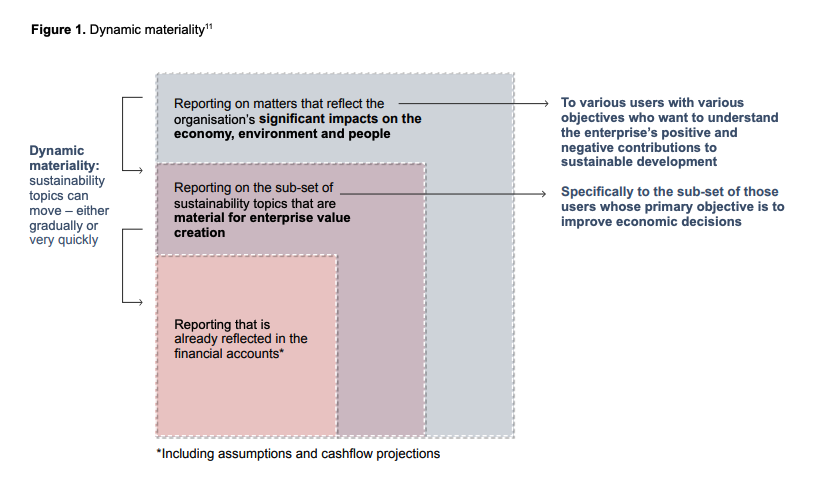

Recently, the concept of dynamic materiality has been introduced to capture these various perspectives on what is material to companies and thus to be disclosed.

Fore more on the understanding of the linkages between dynamic and double materiality check the blog from Donato Calace, Vice President of Accounts and Innovation at Datamaran on Understanding the chaning perspectives of materiality. “Importantly, double materiality and dynamic materiality are interrelated concepts acknowledging different aspects of the same process; while the former describes more accurately how issues can be financially and non-financially material, the latter articulates the dynamics that drive an issue to move along the continuum.”

Your annual report should indicate how the company determines which issues are material considering the company’s strategic plans for future value creation. The materiality lens has expanded beyond financial issues to include all issues that affect value creation or erosion.

It’s important to report on what issues are important to manage and to disclose how the company manages them.

Single Materiality

ISSB IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information adopts the concept of single materiality for sustainability disclosure, defining material sustainability information as that which can reasonably be expected to influence decisions of users users of general purpose financial reporting to assess enterprise value.

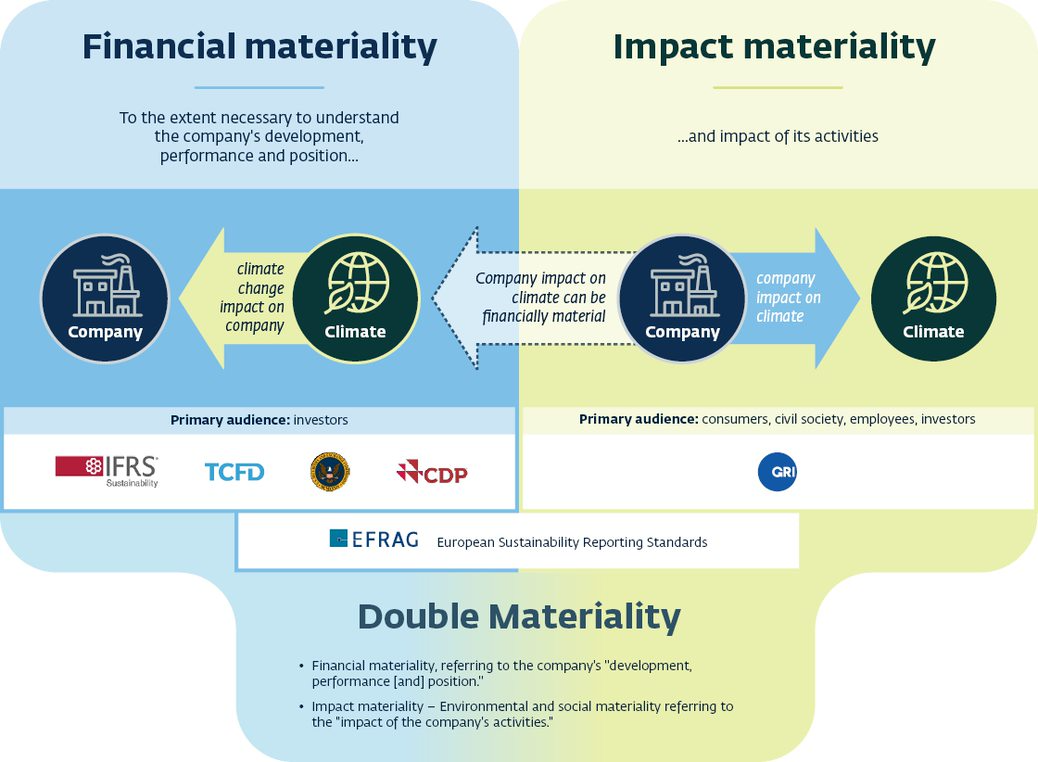

Double Materiality

The EU Commission stated that the Corporate Sustainability Reporting Directive adopted in January 2023 (which replaces the EU Nonfinancial Reporting Directive) has a double materiality perspective:

- Financial materiality, referring to the company’s “development, performance [and] position,” and;

- Impact (formerly environmental and social) materiality, referring to the “impact of the company’s activities.

The [Draft] European Sustainability Reporting Guidelines 1 Double materiality conceptual guidelines for standard-setting para 13 sets that “Double materiality is a concept which provides criteria for determination of whether a sustainability topic or information has to be included in the undertaking’s sustainability report. Double materiality is the union (in mathematical terms, i.e. union of two sets, not intersection) of impact materiality and financial materiality. A sustainability topic or information meets therefore the criteria of double materiality if it is material from the impact perspective or from the financial perspective or from both of these two perspectives.”

- Source: Adapted from the Guidelines on reporting climate-related information, European Commission, 2019, p. 7;

- The concept of double materiality included in the European Sustainability Reporting Standards is based on impact materiality and financial materiality (ESRS 1 para 3.3, pages 7-8).

Dynamic Materiality

In 2020, international nonprofit CDP Worldwide, the Climate Disclosure Standards Board, the Global Reporting Initiative, the International Integrated Reporting Council, and the Sustainability Accounting Standards Board united on a shared vision for corporate reporting that serves distinct but related materiality concepts for sustainability disclosure. The group introduced the concept of dynamic materiality to reflect the fast-evolving nature of sustainability issues, the needs of multiple users, and the impact on company performance.

“Dynamic materiality offers the potential for capturing the evolution of material issues in an environment characterized by rapid change and infuenced by key corporate stakeholders.” (Kuh, Thomas and Shepley, Andre and Bala, Greg and Flowers, Michael, Dynamic Materiality: Measuring What Matters (January 17, 2020). Available at SSRN: https://ssrn.com/abstract=3521035 or http://dx.doi.org/10.2139/ssrn.3521035

Methods for Assessing Materiality

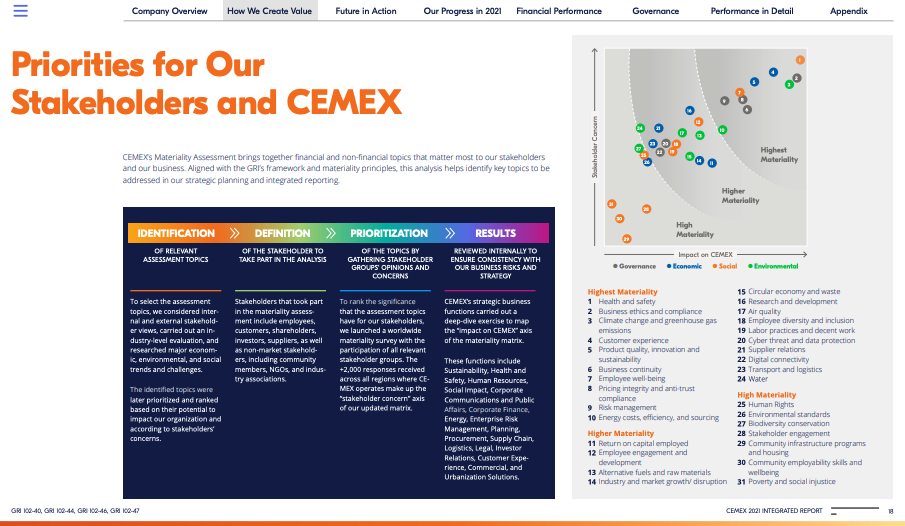

Materiality Matrix

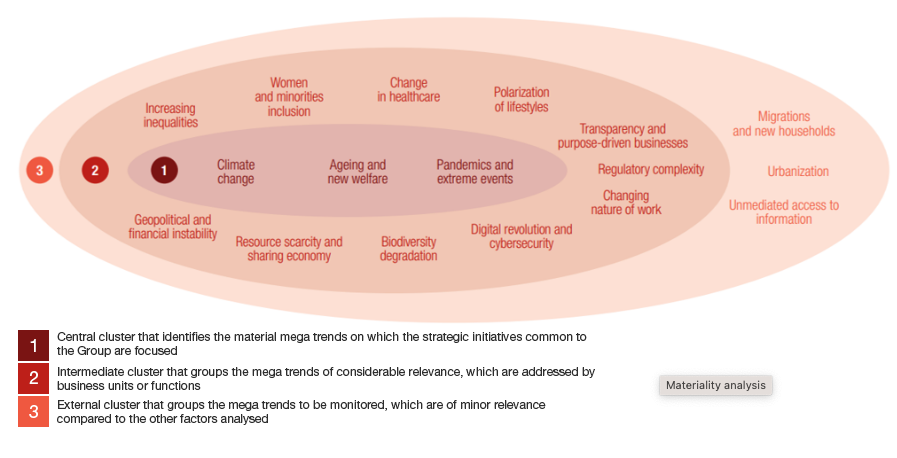

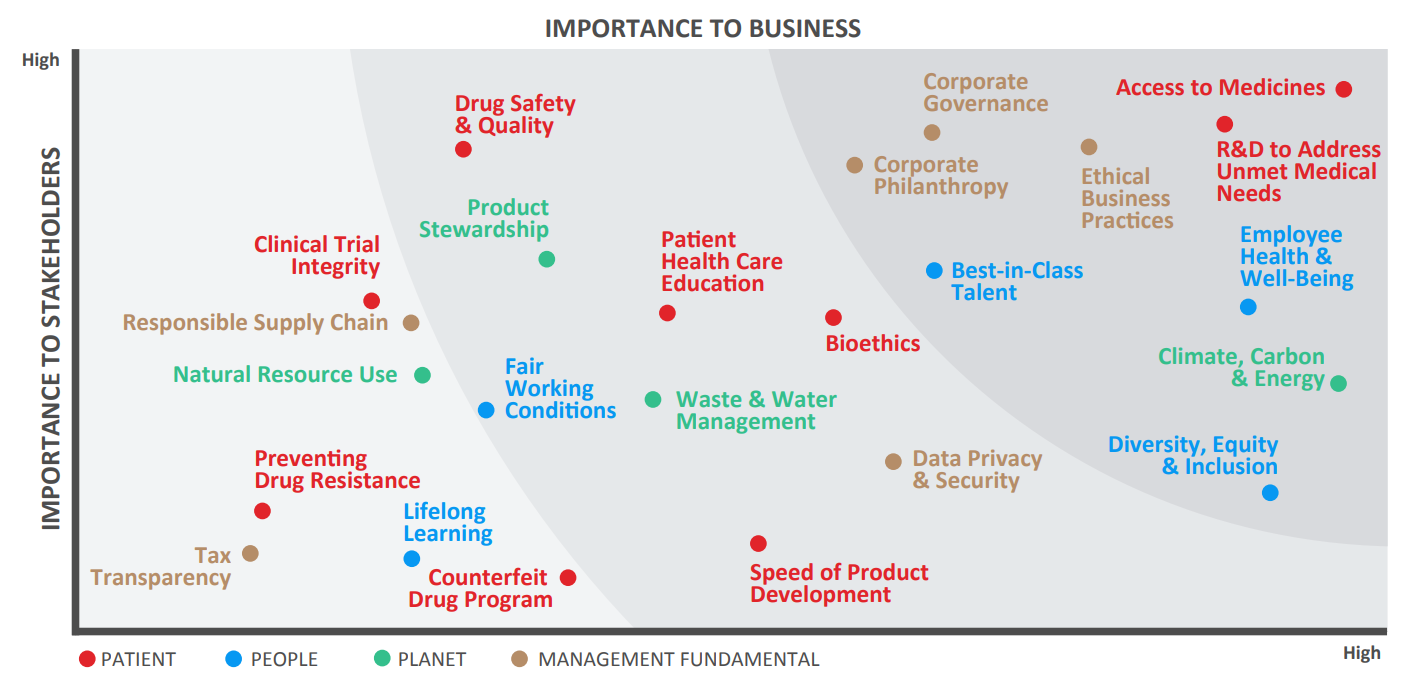

Creating a materiality matrix is a common method for disclosing prioritization of material issues. The matrix ranks the importance of sustainability issues to the company against the perception of its key stakeholders.

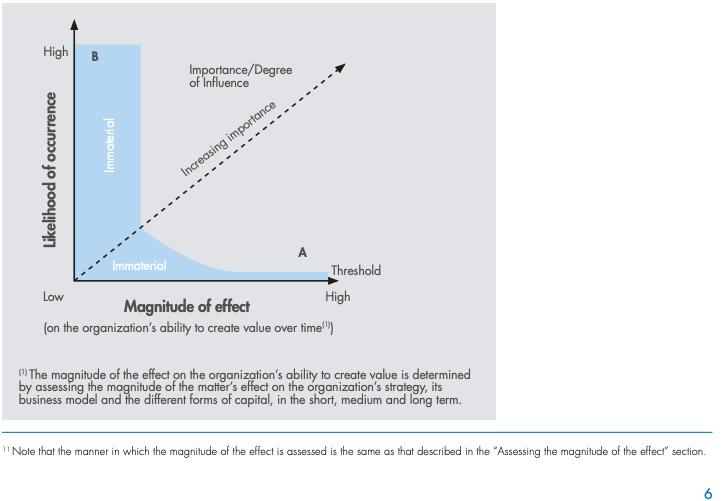

Probability and Magnitude

Another method is to assess the combination of probability and magnitude of impact of sustainability issues to determine if they reach the materiality threshold. Issues that have a greater likelihood of occurring or a greater likelihood of significant impact on either the reporting organization or its stakeholders should be of greater importance.

-

ISSB IFRS1 General Requirements For Disclosure Of Sustainability-Related Financial Information (Excerpt)

MATERIALITY

17. An entity shall disclose material information about the sustainability-related risks and opportunities that could reasonably be expected to affect the entity’s prospects.

18. In the context of sustainability-related financial disclosures, information is material if omitting, misstating or obscuring that information could reasonably be expected to influence decisions that primary users of general purpose financial reports make on the basis of those reports, which include financial statements and sustainability-related financial disclosures and which provide information about a specific reporting entity.

19. To identify and disclose material information, an entity shall apply paragraphs B13–B37.

Materiality (paragraphs 17–19)–

B13 - Paragraph 17 requires an entity to disclose material information about the sustainability-related risks and opportunities that could reasonably be expected to affect the entity’s prospects. Materiality of information is judged in relation to whether omitting, misstating or obscuring that information could reasonably be expected to influence decisions of primary users of general purpose financial reports, which provide information about a specific reporting entity.

B14 - The decisions of primary users relate to providing resources to the entity and involve decisions about:

- buying, selling or holding equity and debt instruments;

- providing or selling loans and other forms of credit; or

- exercising rights to vote on, or otherwise influence, the entity’s management’s actions that affect the use of the entity’s economic resources.

B15 - The decisions described in paragraph B14 depend on primary users’ expectations about returns, for example, dividends, principal and interest payments or market price increases. Those expectations depend on primary users’ assessment of the amount, timing and uncertainty of future net cash inflows to the entity and on their assessment of stewardship of the entity’s economic resources by the entity’s management and its governing body(s) or individual(s).

B16 - Assessing whether information could reasonably be expected to influence the decisions made by primary users requires consideration of the characteristics of those users and of the entity’s own circumstances.

B17 - Sustainability-related financial disclosures are prepared for primary users who have reasonable knowledge of business and economic activities and who review and analyse information diligently. At times, even well-informed and diligent users may need to seek the aid of an adviser to understand sustainability-related financial information.

B18 - Individual primary users may have different, and sometimes even conflicting, information needs and desires. Information needs of primary users may also evolve over time. Sustainability-related financial disclosures are intended to meet common information needs of primary users.

Identifying material information

B19 - Materiality judgements are specific to an entity. Consequently, this Standard does not specify any thresholds for materiality or predetermine what would be material in a particular situation.

B20 - To identify material information about a sustainability-related risk or opportunity, an entity shall apply, as the starting point, the requirements of the IFRS Sustainability Disclosure Standard that specifically applies to that sustainability-related risk or opportunity. In the absence of an IFRS Sustainability Disclosure Standard that specifically applies to a sustainability-related risk or opportunity, the entity shall apply the requirements on sources of guidance specified in paragraphs 57–58. Those sources specify information, including metrics, that may be relevant to a particular sustainability-related risk or opportunity, to a particular industry or in specified circumstances.

B21 - An entity shall assess whether the information identified in applying paragraph B20, either individually or in combination with other information, is material in the context of the entity’s sustainability-related financial disclosures taken as a whole. In assessing whether information is material, an entity shall consider both quantitative and qualitative factors. For example, an entity might consider the magnitude and the nature of the effect of a sustainability-related risk or opportunity on the entity.

B22 - In some cases, IFRS Sustainability Disclosure Standards require the disclosure of information about possible future events with uncertain outcomes. In judging whether information about such possible future events is material, an entity shall consider:- the potential effects of the events on the amount, timing and uncertainty of the entity’s future cash flows over the short, medium and long term (referred to as ‘the possible outcome’); and

- the range of possible outcomes and the likelihood of the possible outcomes within that range.

B23 - When considering possible outcomes, an entity shall consider all pertinent facts and circumstances. Information about a possible future event is more likely to be judged as being material if the potential effects are significant and the event is likely to occur. However, an entity shall also consider whether information about low-probability and high-impact outcomes might be material either individually or in combination with information about other low-probability and high-impact outcomes. For example, an entity might be exposed to several sustainability-related risks, each of which could cause the same type of disruption—such as disruption to the entity’s supply chain. Information about an individual source of risk might not be material if disruption from that source is highly unlikely to occur. However, information about the aggregate risk—the risk of supply chain disruption from all sources—might be material.

B24 - If a possible future event is expected to affect an entity’s cash flows, but only many years in the future, information about that event is usually less likely to be judged material than information about a possible future event with similar effects that are expected to occur sooner. However, in some circumstances, an item of information could reasonably be expected to influence primary users’ decisions regardless of the magnitude of the potential effects of the future event or the timing of that event. For example, this might happen if information about a particular sustainability-related risk or opportunity is highly scrutinised by primary users of an entity’s general purpose financial reports.

B25 - An entity need not disclose information otherwise required by an IFRS Sustainability Disclosure Standard if the information is not material. This is the case even if the IFRS Sustainability Disclosure Standard contains a list of specific requirements or describes them as minimum requirements.

B26 - An entity shall disclose additional information when compliance with the specifically applicable requirements in an IFRS Sustainability Disclosure Standard is insufficient to enable users of general purpose financial reports to understand the effects of sustainability-related risks and opportunities on the entity’s cash flows, its access to finance and cost of capital over the short, medium and long term.B27 - An entity shall identify its sustainability-related financial disclosures clearly and distinguish them from other information provided by the entity (see paragraph 62). An entity shall not obscure material information. Information is obscured if it is communicated in a way that would have a similar effect for primary users to omitting or misstating that information. Examples of circumstances that might result in material information being obscured include:

- material information is not clearly distinguished from additional information that is not material;

- material information is disclosed in the sustainability-related financial disclosures, but the language used is vague or unclear;

- material information about a sustainability-related risk or opportunity is scattered throughout the sustainability-related financial disclosures;

- items of information that are dissimilar are inappropriately aggregated;

- items of information that are similar are inappropriately disaggregated; and

- the understandability of the sustainability-related financial disclosures is reduced as a result of material information being hidden by immaterial information to the extent that a primary user is unable to determine what information is material.

B28 - An entity shall reassess its materiality judgements at each reporting date to take account of changed circumstances and assumptions. Because of changes in the entity’s individual circumstances, or in the external environment, some types of information included in an entity’s sustainability-related financial disclosures for prior periods might no longer be material. Conversely, some types of information not previously disclosed might become material.

Aggregation and disaggregation

B29 - When an entity applies IFRS Sustainability Disclosure Standards, it shall consider all facts and circumstances and decide how to aggregate and disaggregate information in its sustainability-related financial disclosures. The entity shall not reduce the understandability of its sustainability-related financial disclosures by obscuring material information with immaterial information or by aggregating material items of information that are dissimilar to each other.

B30 - An entity shall not aggregate information if doing so would obscure information that is material. Information shall be aggregated if items of information have shared characteristics and shall not be aggregated if they do not have shared characteristics. The entity might need to disaggregate information about sustainability-related risks and opportunities, for example, by geographical location or in consideration of the geopolitical environment. For example, to ensure that material information is not obscured, an entity might need to disaggregate information about its use of water to distinguish between water drawn from abundant sources and water drawn from water-stressed areas.

Interaction with law or regulation

B31 - Law or regulation might specify requirements for an entity to disclose sustainability-related information in its general purpose financial reports. In such circumstances, the entity is permitted to include in its sustainability-related financial disclosures information to meet legal or regulatory requirements, even if that information is not material. However, such information shall not obscure material information.

B32 - An entity shall disclose material sustainability-related financial information, even if law or regulation permits the entity not to disclose such information.

B33 - An entity need not disclose information otherwise required by an IFRS Sustainability Disclosure Standard if law or regulation prohibits the entity from disclosing that information. If an entity omits material information for that reason, it shall identify the type of information not disclosed and explain the source of the restriction.

Commercially sensitive information

B34 - If an entity determines that information about a sustainability-related opportunity is commercially sensitive in the limited circumstances described in paragraph B35, the entity is permitted to omit that information from its sustainability-related financial disclosures. Such an omission is permitted even if information is otherwise required by an IFRS Sustainability Disclosure Standard and the information is material.

B35 - An entity qualifies for the exemption specified in paragraph B34 if, and only if:

- information about the sustainability-related opportunity is not already publicly available;

- disclosure of that information could reasonably be expected to prejudice seriously the economic benefits the entity would otherwise be able to realise in pursuing the opportunity; and

- the entity has determined that it is impossible to disclose that information in a manner—for example, at an aggregated level—that would enable the entity to meet the objectives of the disclosure requirements without prejudicing seriously the economic benefits the entity would otherwise be able to realise in pursuing the opportunity.

B36 - If an entity elects to use the exemption specified in paragraph B34, the entity shall, for each item of information omitted:

- disclose the fact that it has used the exemption; and

- reassess, at each reporting date, whether the information qualifies for the exemption.

B37 - An entity is prohibited from using the exemption specified in paragraph B34 in relation to a sustainability-related risk or as a basis for broad non-disclosure of sustainability-related financial information.

Source: ISSB IFRS S1 General Requirement for Disclosure of Sustainability-Related Financial Information.

-

European Sustainability Reporting Standards ESRS1 – General Requirements (Excerpt)

3.2 Material matters and materiality of information

25. Performing a materiality assessment (see sections 3.4 Impact materiality and 3.5 Financial materiality) is necessary for the undertaking to identify the material impacts, risks and opportunities to be reported.

26. Materiality assessment is the starting point for sustainability reporting under ESRS. IRO-1 in section 4.1 of ESRS 2, includes general disclosure requirements about the undertaking’s process to identify impacts, risks and opportunities and assess their materiality. SBM-3 of ESRS 2 provides general disclosure requirements on the material impacts, risks and opportunities resulting from the undertaking’s materiality assessment.

27. The Application Requirements in Appendix A of this Standard include a list of sustainability matters covered in topical ESRS, categorised by topics, sub-topics and sub-sub-topics, to support the materiality assessment. Appendix E Flowchart for determining disclosures to be included of this Standard provides an illustration of the materiality assessment described in this section.

28. A sustainability matter is “material” when it meets the criteria defined for impact materiality (see section 3.4 of this Standard) or financial materiality (see section 3.5 of this Standard), or both.

29. Irrespective of the outcome of its materiality assessment, the undertaking shall always disclose the information required by: ESRS 2 General Disclosures (i.e. all the Disclosure Requirements and data points specified in ESRS 2) and the Disclosure Requirements 6 (including their datapoints) in topical ESRS related to the Disclosure Requirement IRO-1 Description of the process to identify and assess material impacts, risks and opportunities, as listed in ESRS 2 Appendix C Disclosure/Application Requirements in topical ESRS that are applicable jointly with ESRS 2 General Disclosures.

30. When the undertaking concludes that a sustainability matter is material as a result of its materiality assessment, on which ESRS 2 IRO-1, IRO-2 and SBM-3 set disclosure requirements, it shall: (a) disclose information according to the Disclosure Requirements (including Application Requirements) related to that specific sustainability matter in the corresponding topical and sector-specific ESRS; and (b) disclose additional entity-specific disclosures (see paragraph 11 and AR 1 to AR 5 of this Standard) when the material sustainability matter is not covered by an ESRS or is covered with insufficient granularity.

31. The applicable information prescribed within a Disclosure Requirement, including its datapoints, or an entity-specific disclosure, shall be disclosed when the undertaking assesses, as part of its assessment of material information, that the information is relevant from one or more of the following perspectives: (a) the significance of the information in relation to the matter it purports to depict or explain; or (b) the capacity of such information to meet the users’ decision-making needs, including the needs of primary users of general-purpose financial reporting described in paragraph 48 and/or the needs of users whose principal interest is in information about the undertaking’s impacts.

32. If the undertaking concludes that climate change is not material and therefore omits all disclosure requirements in ESRS E1 Climate change, it shall disclose a detailed explanation of the conclusions of its materiality assessment with regard to climate change (see ESRS 2 IRO-2 Disclosure Requirements in ESRS covered by the undertaking’s sustainability statement), including a forward-looking analysis of the conditions that could lead the undertaking to conclude that climate change is material in the future. If the undertaking concludes that a topic other than climate change is not material and therefore it omits all the Disclosure Requirements in the corresponding topical ESRS, it may briefly explain the conclusions of its materiality assessment for that topic.

33. When disclosing information on policies, actions and targets in relation to a sustainability matter that has been assessed to be material, the undertaking shall include the information prescribed by all the Disclosure Requirements and datapoints in the topical and sector-specific ESRS related to that matter and in the corresponding Minimum Disclosure Requirement on policies, actions, and targets required under ESRS 2. If the undertaking cannot disclose the information prescribed by either the Disclosure Requirements and datapoints in the topical or sector-specific ESRS, or the Minimum Disclosure Requirements in ESRS 2 on policies, actions and targets, because it has not adopted the respective policies, implemented the respective actions or set the respective targets, it shall disclose this to be the case and it may report a timeframe in which it aims to have these in place.

34. When disclosing information on metrics for a material sustainability matter according to the Metrics and Targets section of the relevant topical ESRS, the undertaking: (a) shall include the information prescribed by a Disclosure Requirement if it assesses such information to be material; and (b) may omit the information prescribed by a datapoint of a Disclosure Requirement if it assesses such information to be not material and concludes that such information is not needed to meet the objective of the Disclosure Requirement.

35. If the undertaking omits the information prescribed by a datapoint that derives from other EU legislation listed in Appendix B of ESRS 2, it shall explicitly state that the information in question is “not material”. 7

36. The undertaking shall establish how it applies criteria, including appropriate thresholds, to determine: (a) the information it discloses on metrics for a material sustainability matter according to the Metrics and Targets section of the relevant topical ESRS, in accordance with paragraph 34; and (b) the information to be disclosed as entity-specific disclosures. 3.3 Double materiality

37. Double materiality has two dimensions, namely: impact materiality and financial materiality. Unless specified otherwise, the terms “material” and “materiality” are used throughout ESRS to refer to double materiality.

38. Impact materiality and financial materiality assessments are inter-related and the interdependencies between these two dimensions shall be considered. In general, the starting point is the assessment of impacts, although there may also be material risks and opportunities that are not related to the undertaking’s impacts. A sustainability impact may be financially material from inception or become financially material, when it could reasonably be expected to affect the undertaking’s financial position, financial performance, cash flows, its access to finance or cost of capital over the short-, medium- or long-term. Impacts are captured by the impact materiality perspective irrespective of whether or not they are financially material.

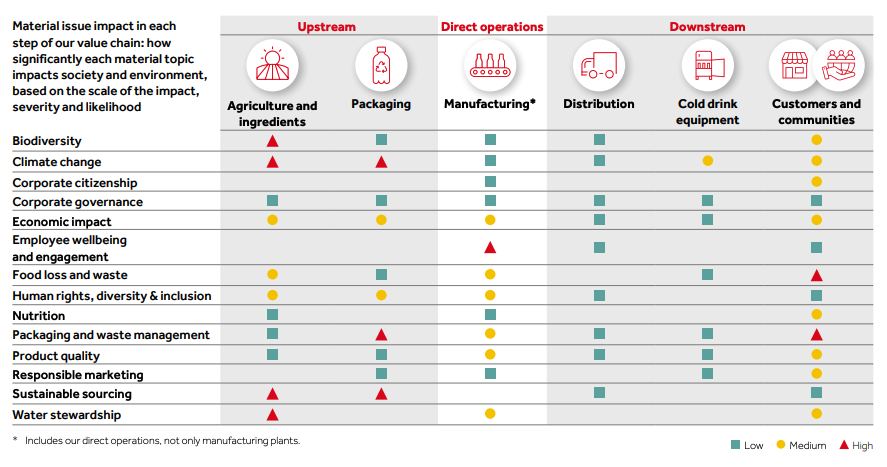

39. In identifying and assessing the impacts, risks and opportunities in the undertaking’s value chain to determine their materiality, the undertaking shall focus on areas where impacts, risks and opportunities are deemed likely to arise, based on the nature of the activities, business relationships, geographies or other factors concerned.

40. The undertaking shall consider how it is affected by its dependencies on the availability of natural, human and social resources at appropriate prices and quality, irrespective of its potential impacts on those resources.

41. An undertaking’s principal impacts, risks and opportunities are understood to be the same as the material impacts, risks and opportunities identified under the double materiality principle and therefore reported on in its sustainability statement.

42. The undertaking shall apply the criteria set under sections 3.4 and 3.5 in this Standard, using appropriate quantitative and/or qualitative thresholds. Appropriate thresholds are necessary to determine which impacts, risks and opportunities are identified and addressed by the undertaking as material and to determine which sustainability matters are material for reporting purposes. Some existing standards and frameworks use the term "most significant impacts” when referring to the threshold used to identify the impacts that are described in ESRS as "material impacts." 3.4 Impact materiality

43. A sustainability matter is material from an impact perspective when it pertains to the undertaking’s material actual or potential, positive or negative impacts on people or the environment over the short-, medium- or long-term. Impacts include those connected with the undertaking’s own operations and upstream and downstream value chain, including through its products and services, as well as through its business relationships. Business relationships include those in the undertaking’s upstream and downstream value chain and are not limited to direct contractual relationships.

44. In this context, impacts on people or the environment include impacts in relation to environmental, social and governance matters.

45. The materiality assessment of a negative impact is informed by the due diligence process defined in the international instruments of the UN Guiding Principles on Business and Human Rights and the OECD Guidelines for Multinational Enterprises. For actual negative impacts, 8 materiality is based on the severity of the impact, while for potential negative impacts it is based on the severity and likelihood of the impact. Severity is based on the following factors: (a) the scale; (b) scope; and (c) irremediable character of the impact. In the case of a potential negative human rights impact, the severity of the impact takes precedence over its likelihood.

46. For positive impacts, materiality is based on: (a) the scale and scope of the impact for actual impacts; and (b) the scale, scope and likelihood of the impact for potential impacts. 3.5 Financial materiality

47. The scope of financial materiality for sustainability reporting is an expansion of the scope of materiality used in the process of determining which information should be included in the undertaking’s financial statements.

48. The financial materiality assessment corresponds to the identification of information that is considered material for primary users of general-purpose financial reports in making decisions relating to providing resources to the entity. In particular, information is considered material for primary users of general-purpose financial reports if omitting, misstating or obscuring that information could reasonably be expected to influence decisions that they make on the basis of the undertaking’s sustainability statement.

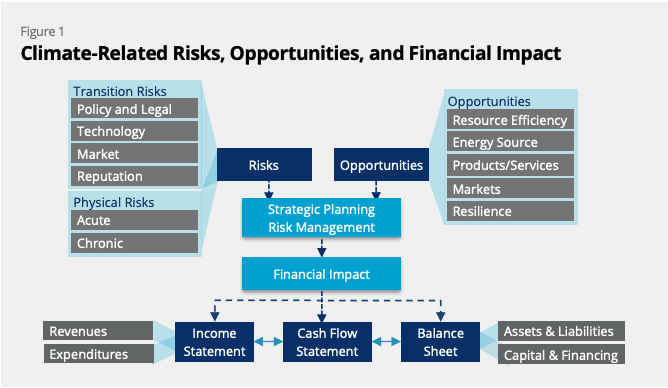

49. A sustainability matter is material from a financial perspective if it triggers or could reasonably be expected to trigger material financial effects on the undertaking. This is the case when a sustainability matter generates risks or opportunities that have a material influence, or could reasonably be expected to have a material influence, on the undertaking’s development, financial position, financial performance, cash flows, access to finance or cost of capital over the short-, medium- or long-term. Risks and opportunities may derive from past events or future events. The financial materiality of a sustainability matter is not constrained to matters that are within the control of the undertaking but includes information on material risks and opportunities attributable to business relationships beyond the scope of consolidation used in the preparation of financial statements.

50. Dependencies on natural, human and social resources can be sources of financial risks or opportunities. Dependencies may trigger effects in two possible ways: (a) they may influence the undertaking’s ability to continue to use or obtain the resources needed in its business processes, as well as the quality and pricing of those resources; and (b) they may affect the undertaking’s ability to rely on relationships needed in its business processes on acceptable terms.

51. The materiality of risks and opportunities is assessed based on a combination of the likelihood of occurrence and the potential magnitude of the financial effects. 3.6 Material impacts or risks arising from actions to address sustainability matters

52. The undertaking’s materiality assessment may lead to the identification of situations in which its actions to address certain impacts or risks, or to benefit from certain opportunities in relation to a sustainability matter, might have material negative impacts or cause material risks in relation to one or more other sustainability matters. For example: (a) an action plan to decarbonise production that involves abandoning certain products 9 might have material negative impacts on the undertaking’s own workforce and result in material risks due to redundancy payments; or (b) an action plan of an automotive supplier to focus on the supply of e-vehicles might lead to stranded assets for the production of supply parts for conventional vehicles.

53. In such situations, the undertaking shall: (a) disclose the existence of material negative impacts or material risks together with the actions that generate them, with a cross-reference to the topic to which the impacts or risks relate; and (b) provide a description of how the material negative impacts or material risks are addressed under the topic to which they relate.

Source: European Sustainability Reporting Standards: ESRS 1 General Requirements.

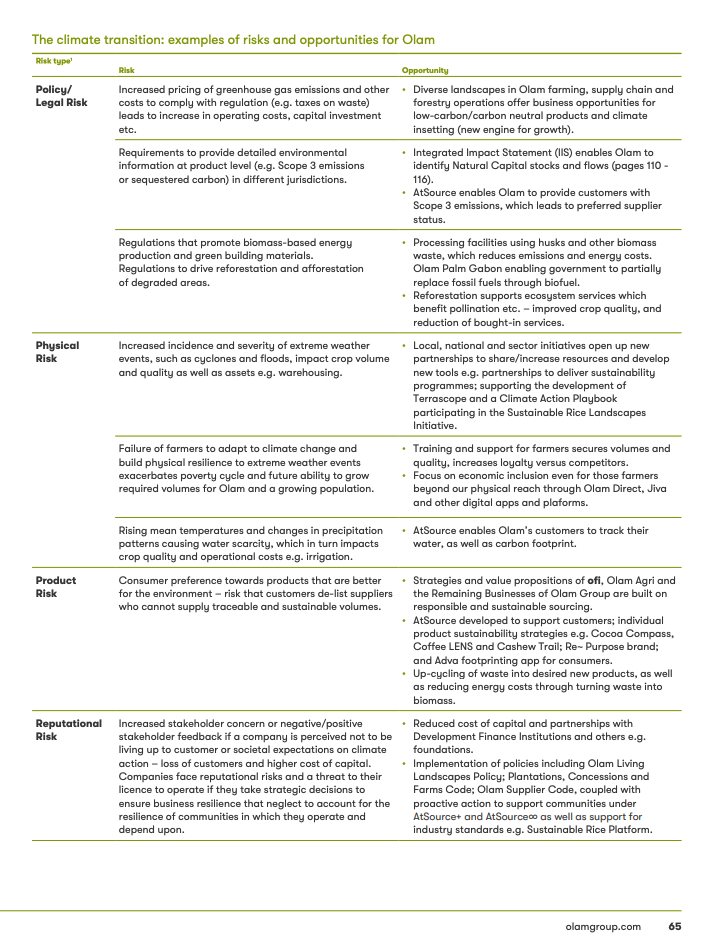

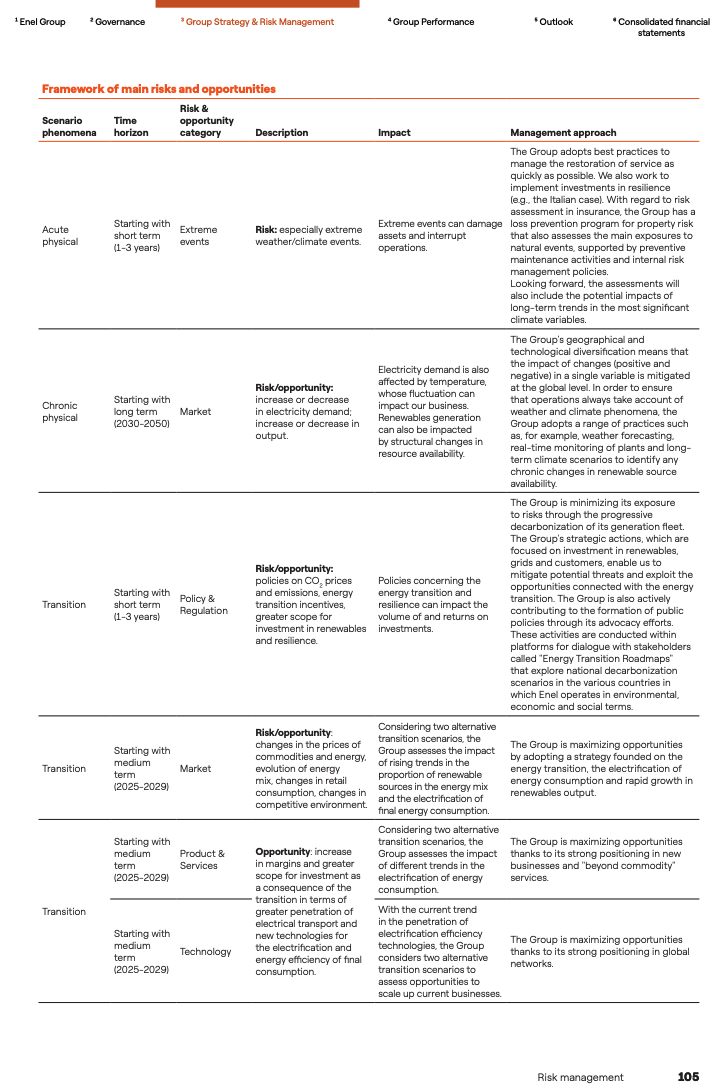

List the key sustainability opportunities and risks facing the company, and describe how they specifically affect the company’s business model, strategy, and risk profile.

Key sustainability issues to manage and monitor include material environmental and social issues and extraneous issues such as the impact of climate change on the business and on society, the impact of products and services, and the business’s contribution to sustainable development.

Social issues relate to the well-being of employees, customers, and local communities, and in this context, they are under the company’s control or influence. Social issues include the fair treatment of workers, health and safety of workers and consumers, access to and affordability of basic services, economic impact on local communities, and conditions of relocation and livelihood restoration for resettled communities.

Environmental issues include the effect of the company’s physical activities on the environment, such as greenhouse gas emissions, air pollution, and waste. They also include the responsible use of natural resources in operations and production (water, energy, minerals) and the effect on other users of these resources.

Summary of Environmental and Social Issues

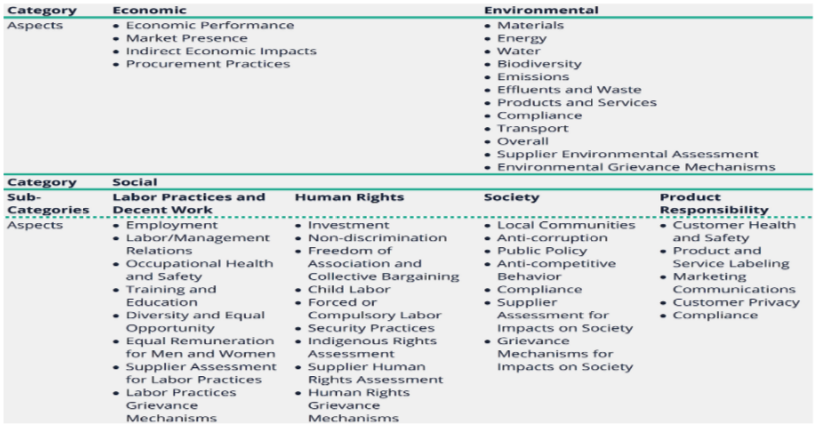

The Global Reporting Initiative (GRI) provides a list of environmental and social issues to include in sustainability reports, based on their materiality.

-

EUROPEAN SUSTAINABILITY REPORTING STANDARDS – TOPICAL STANDARDS (ENVIRONMENTAL, SOCIAL AND GOVERNANCE STANDARDS)

There are three categories of the European Sustainability Reporting Standards (ESRS):

- (a) cross-cutting standards;

- (b) topical standards (Environmental, Social and Governance standards); and

- (c) sector-specific standards.

Cross-cutting standards and topical standards are sector-agnostic, meaning that they apply to all undertakings regardless of which sector or sectors the undertaking operates in.

The European Sustainability Reporting Standards include 10 topical standards focused on environmental, social and governance matters.

Governance matters

Business conduct - the role and expertise of the administrative, management and supervisory bodies related to business conduct.

- Corporate culture and business conduct policies;

- Management of relationships with suppliers;

- Prevention and detection of corruption or bribery.

Source: European Sustainability Reporting Standards

These core environmental and social issues generally apply to all or most companies and industries, but they apply differently depending on the industry and context.

Some of the core issues (environmental and social management in the supply chain, forced and child labor,health and safety) are more likely to apply in specific industries such as agribusiness.

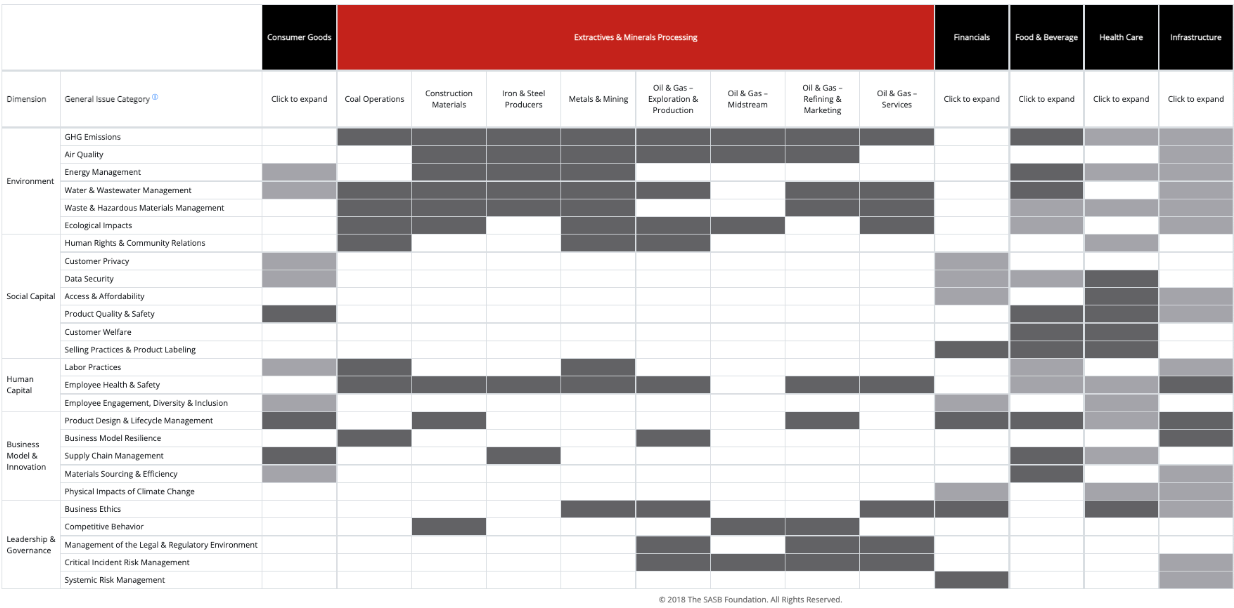

The Sustainability Accounting Standards Board, now part of IFRS Foundation produces a set of industry-specific standards for disclosure of sustainability information. The following materiality map provides a general overview of how sustainability topics apply in broad economic sectors.

Materiality Map

Source: Sustainability Accounting Standards Board (SASB STANDARDS).

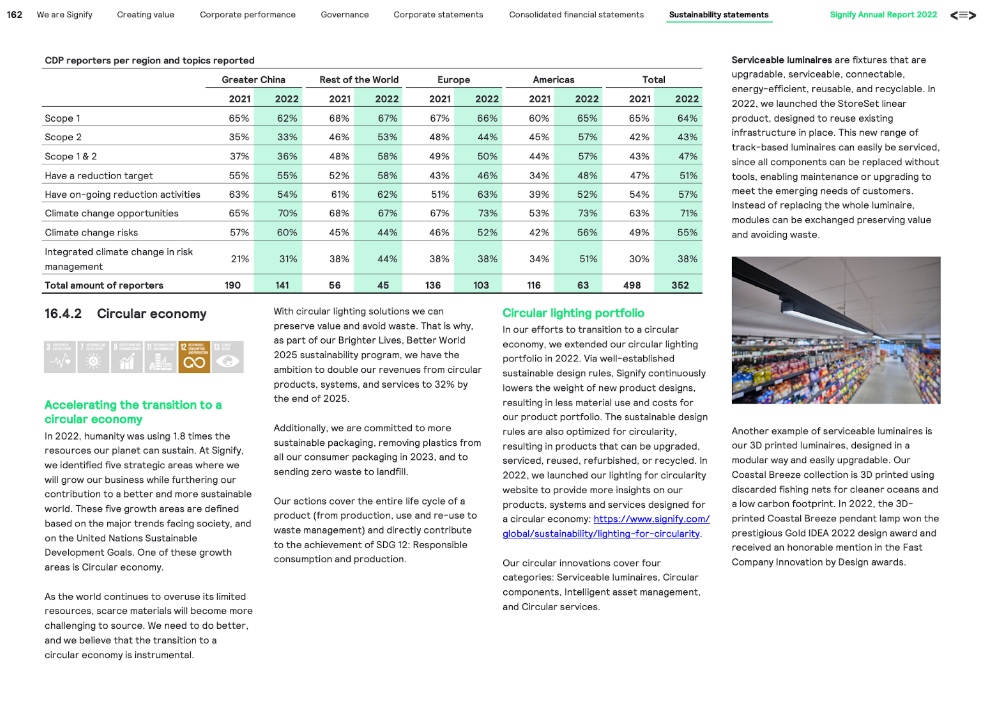

Sustainability issues for products and services typically include consumption-related environmental and social impacts, such as product safety, energy efficiency, and pollution during use. They also include issues arising from the impact of products at the end of their useful life. Together, these issues are sometimes referred to as use-phase, life-cycle, or end-of-life impact.

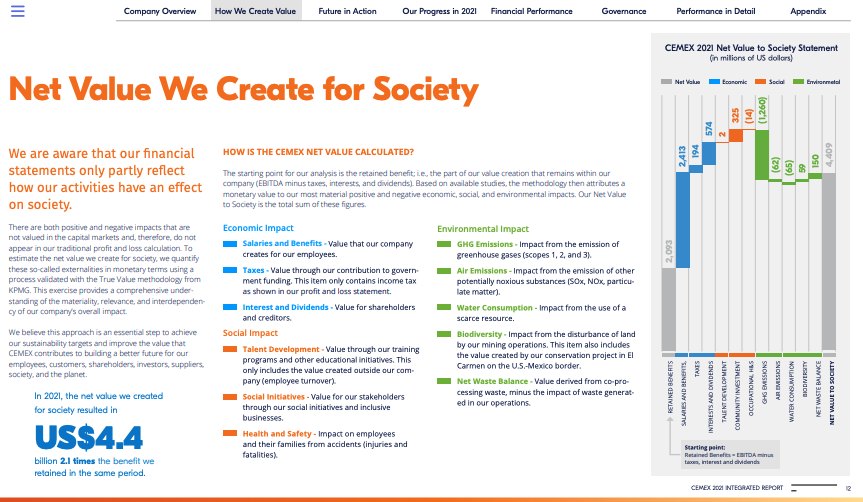

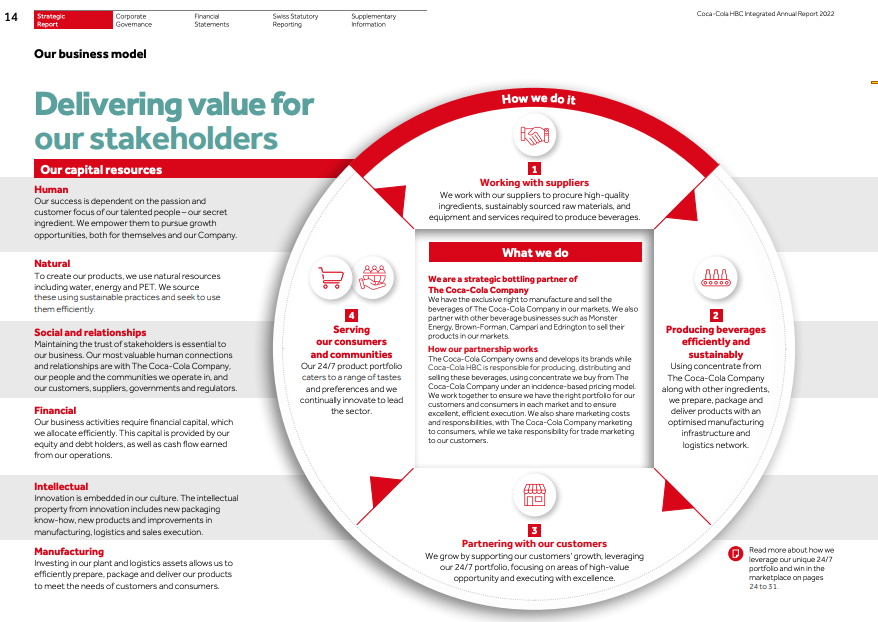

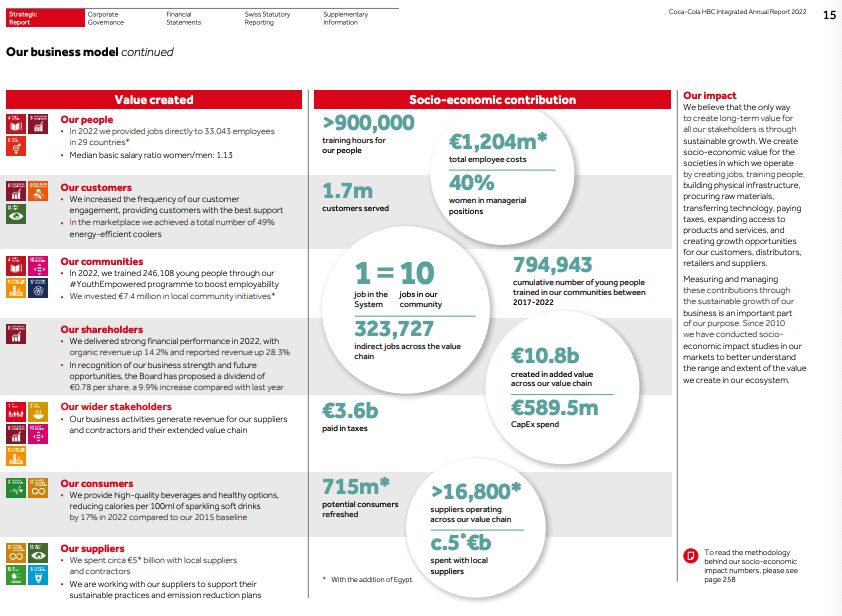

The private sector is an important contributor to economic and social progress, especially when companies manage their environmental and social impact. Including a company’s contribution to economic and social development in the annual report can provide a balanced view of the company’s overall contribution to society. It can also provide context for its sustainability impact and reinforce public confidence in the company and its social license to operate.

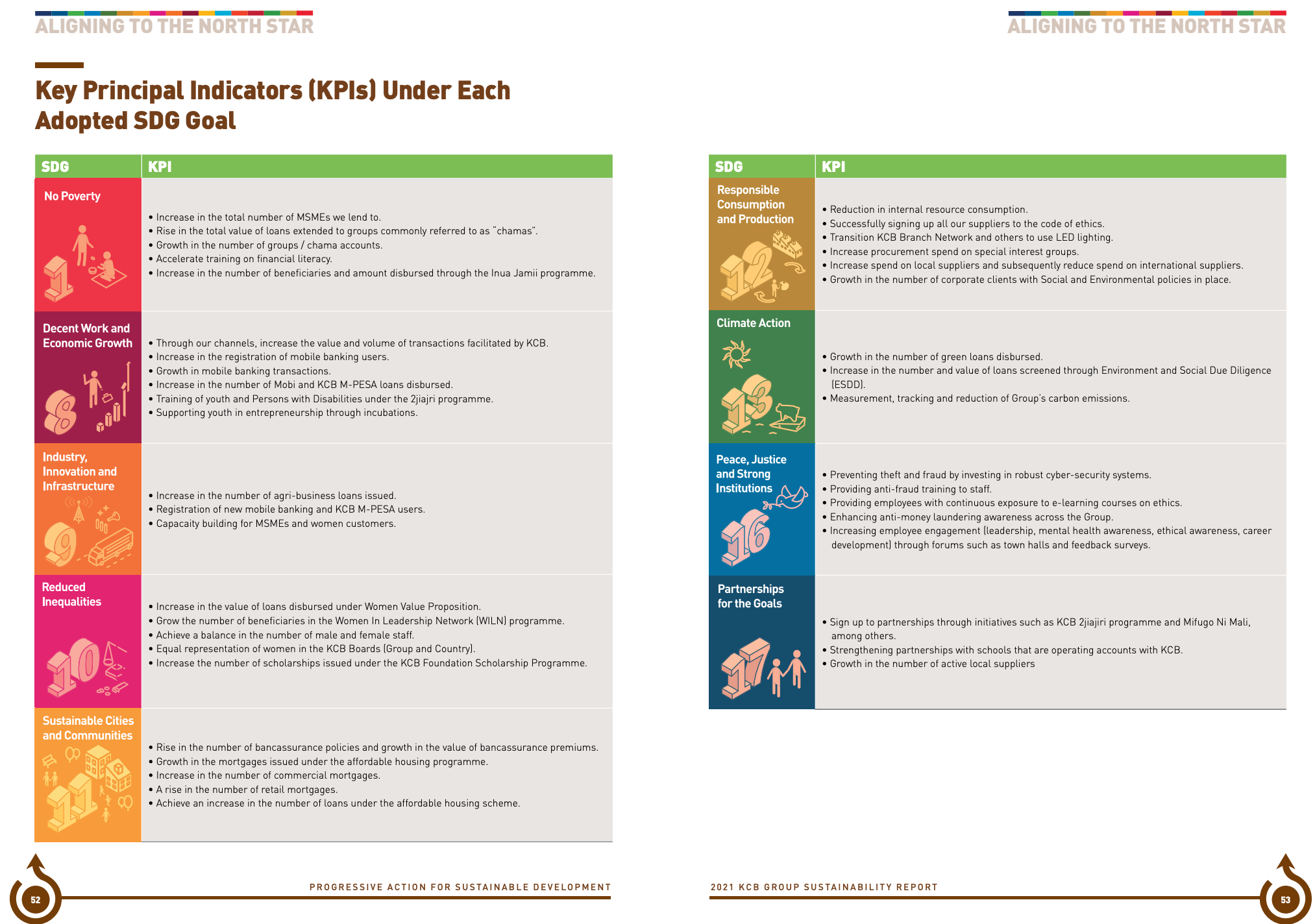

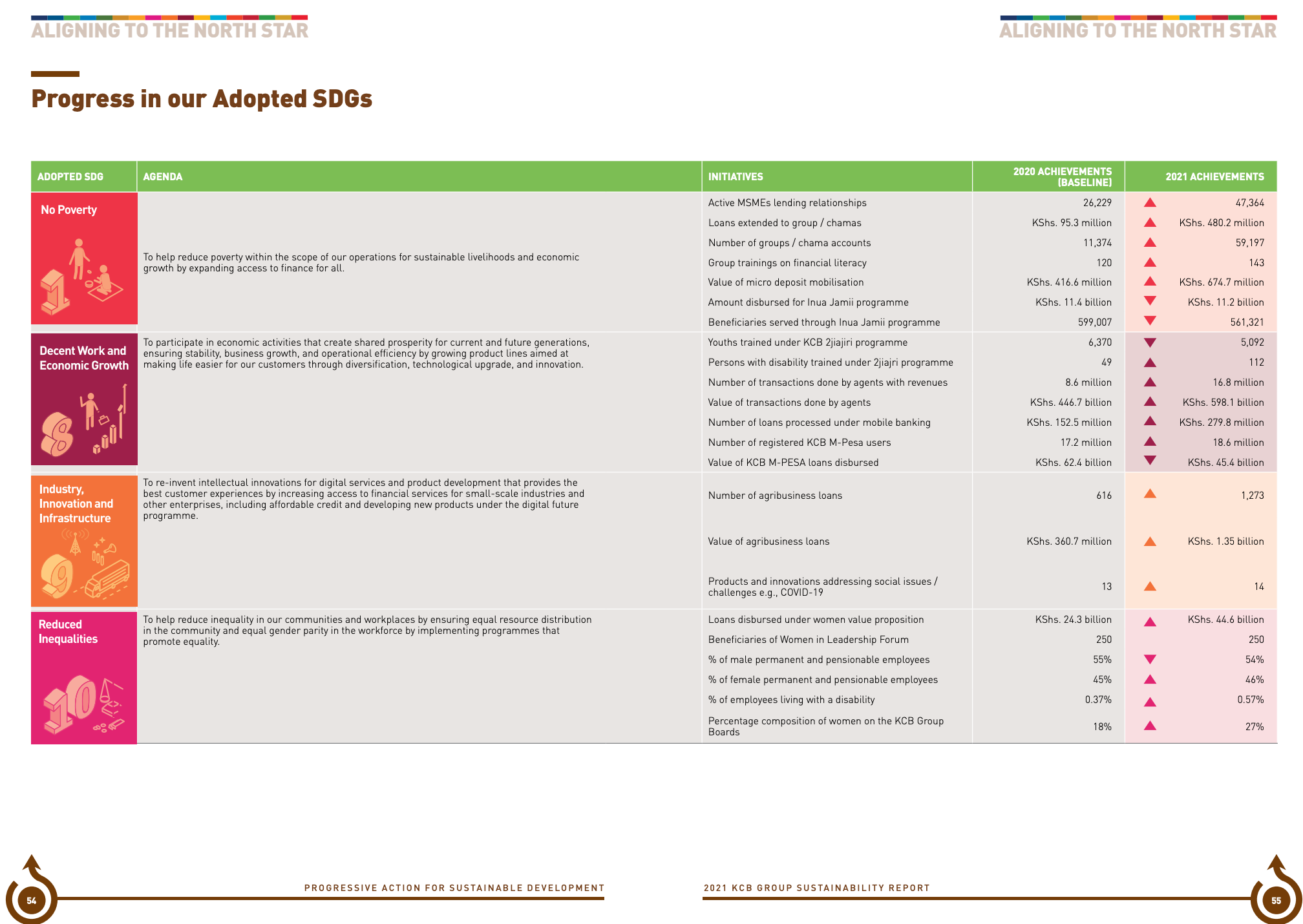

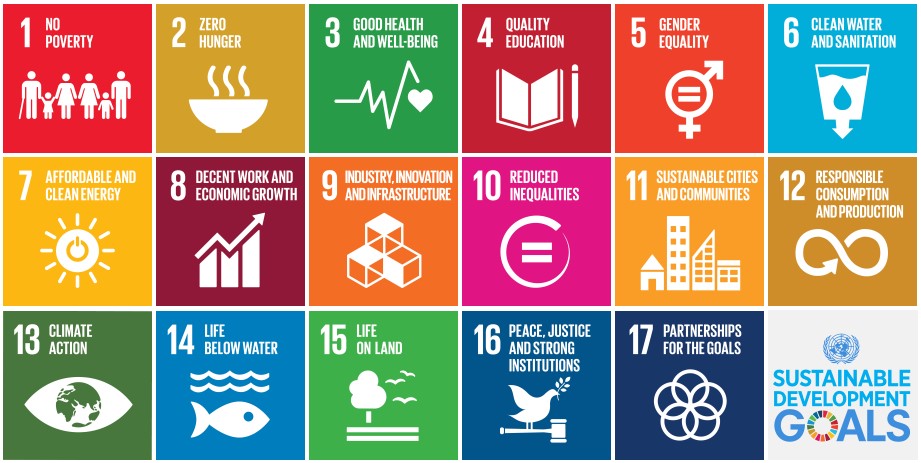

Companies can show their contribution to sustainable development by linking company-level sustainability strategy and risk to the SDGs, the set of 17 universal goals issued by UN member states to frame their economic development and sustainability agendas between 2015 and 2030.

Source: United Nations

See Performance section for a selection of SDGs, targets, and indicators relevant for business, including positive business contribution to the SDGs and mitigation of negative impact. Link: SDG Goals, Targets and Indicators Relevant for Business.